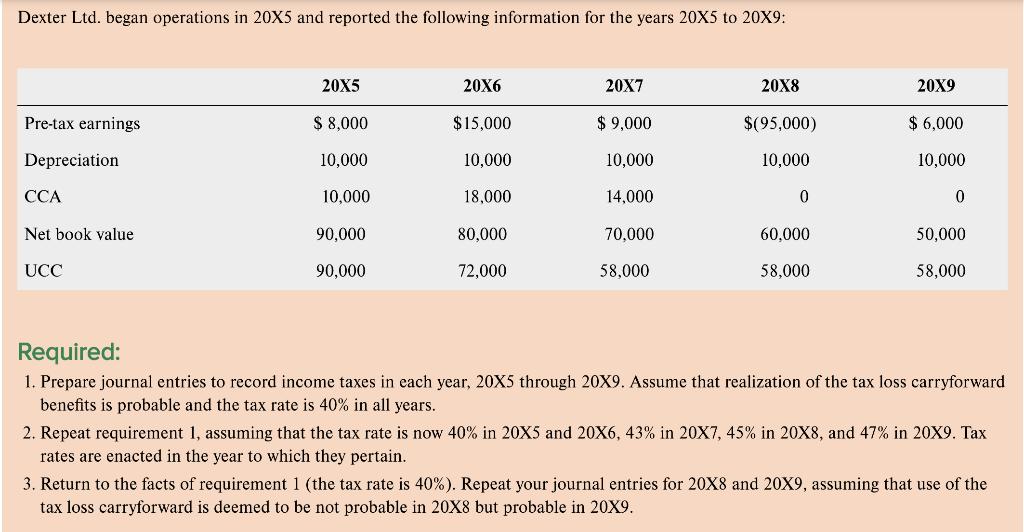

Dexter Ltd. began operations in 20X5 and reported the following information for the years 20X5 to 20X9: Pre-tax earnings Depreciation CCA Net book value

Dexter Ltd. began operations in 20X5 and reported the following information for the years 20X5 to 20X9: Pre-tax earnings Depreciation CCA Net book value UCC 20X5 $ 8,000 10,000 10,000 90,000 90,000 20X6 $15,000 10,000 18,000 80,000 72,000 20X7 $ 9,000 10,000 14,000 70,000 58,000 20X8 $(95,000) 10,000 0 60,000 58,000 20X9 $ 6,000 10,000 0 50,000 58,000 Required: 1. Prepare journal entries to record income taxes in each year, 20X5 through 20X9. Assume that realization of the tax loss carryforward benefits is probable and the tax rate is 40% in all years. 2. Repeat requirement 1, assuming that the tax rate is now 40% in 20X5 and 20X6, 43% in 20X7, 45% in 20X8, and 47% in 20X9. Tax rates are enacted in the year to which they pertain. 3. Return to the facts of requirement 1 (the tax rate is 40%). Repeat your journal entries for 20X8 and 20X9, assuming that use of the tax loss carryforward is deemed to be not probable in 20X8 but probable in 20X9.

Step by Step Solution

3.54 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

2018 Continued Deferred Pax asset alc to Pr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started