Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Diana is 5 0 years old and works for Trimark as a sales manager. She has worked for this employer for 2 2 years and

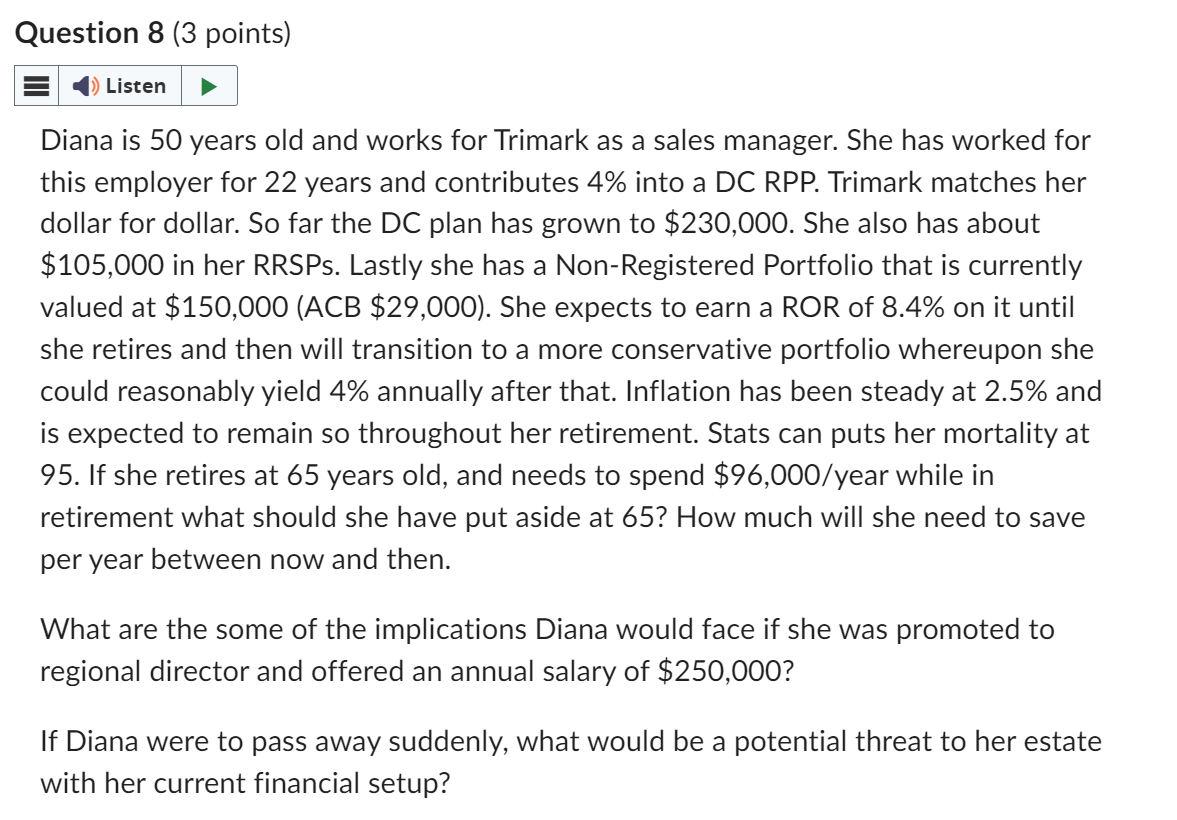

Diana is years old and works for Trimark as a sales manager. She has worked for

this employer for years and contributes into a DC RPP Trimark matches her

dollar for dollar. So far the DC plan has grown to $ She also has about

$ in her RRSPs Lastly she has a NonRegistered Portfolio that is currently

valued at $ACB $ She expects to earn a ROR of on it until

she retires and then will transition to a more conservative portfolio whereupon she

could reasonably yield annually after that. Inflation has been steady at and

is expected to remain so throughout her retirement. Stats can puts her mortality at

If she retires at years old, and needs to spend $year while in

retirement what should she have put aside at How much will she need to save

per year between now and then.

What are the some of the implications Diana would face if she was promoted to

regional director and offered an annual salary of $

If Diana were to pass away suddenly, what would be a potential threat to her estate

with her current financial setup?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started