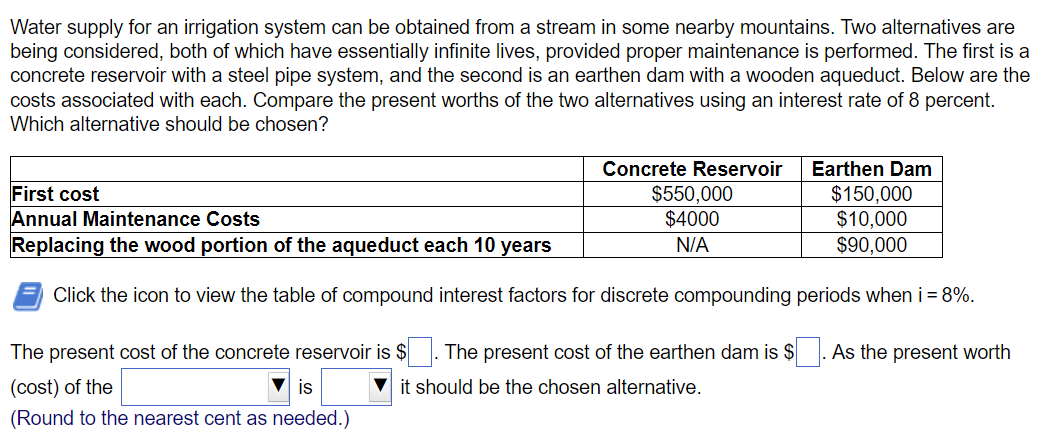

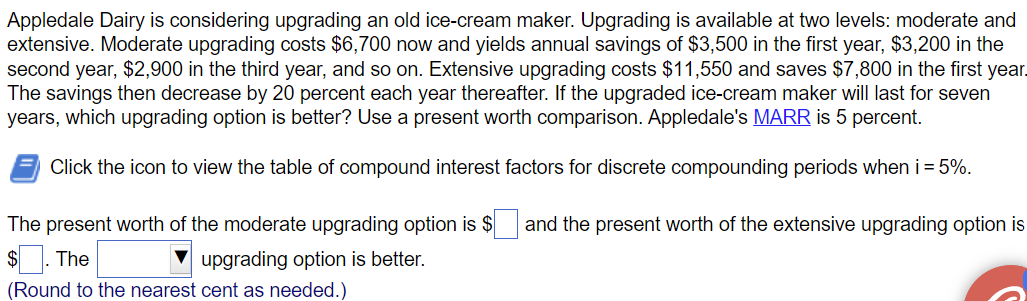

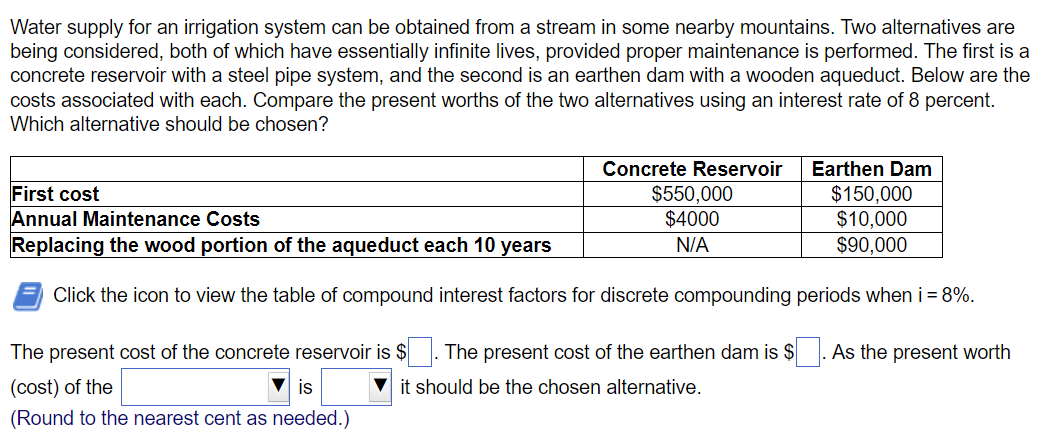

Diana usually uses a four-year payback period to determine if a project is acceptable. A recent project with uniform yearly savings over a nine-year life had a payback period of almost exactly four years, so Diana decided to find the project's present worth to help determine if the project was truly justifiable. However, the calculation did not help either since the present worth was exactly zero. What interest rate was Diana using to calculate the present worth? The project has no salvage value at the end of its nine-year life. Use the linear interpolation method when i=0.20 and 0.25. The interest rate Diana was using is percent. (Round to one decimal place as needed.) Appledale Dairy is considering upgrading an old ice-cream maker. Upgrading is available at two levels: moderate and extensive. Moderate upgrading costs $6,700 now and yields annual savings of $3,500 in the first year, $3,200 in the second year, $2,900 in the third year, and so on. Extensive upgrading costs $11,550 and saves $7,800 in the first year The savings then decrease by 20 percent each year thereafter. If the upgraded ice-cream maker will last for seven years, which upgrading option is better? Use a present worth comparison. Appledale's MARR is 5 percent. Click the icon to view the table of compound interest factors for discrete compounding periods when i=5%. The present worth of the moderate upgrading option is $ and the present worth of the extensive upgrading option is $ The upgrading option is better. (Round to the nearest cent as needed.) Water supply for an irrigation system can be obtained from a stream in some nearby mountains. Two alternatives are being considered, both of which have essentially infinite lives, provided proper maintenance is performed. The first is a concrete reservoir with a steel pipe system, and the second is an earthen dam with a wooden aqueduct. Below are the costs associated with each. Compare the present worths of the two alternatives using an interest rate of 8 percent. Which alternative should be chosen? Click the icon to view the table of compound interest factors for discrete compounding periods when i=8%. The present cost of the concrete reservoir is $. The present cost of the earthen dam is $. As the present worth (cost) of the is it should be the chosen alternative. (Round to the nearest cent as needed.)