Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dickinson Company has $11,920,000 million in assets. Currently half of these assets are financed with long term debt at 9.6 percent and half with common

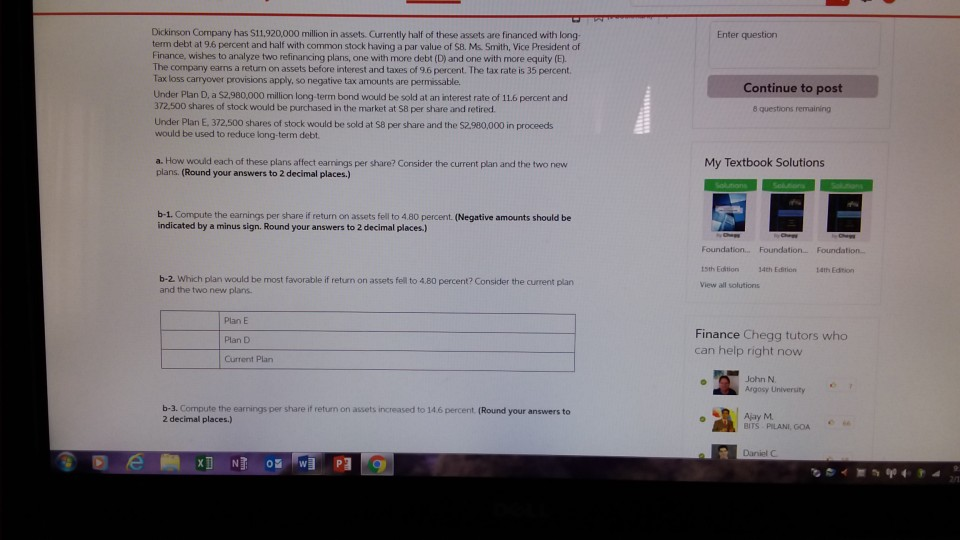

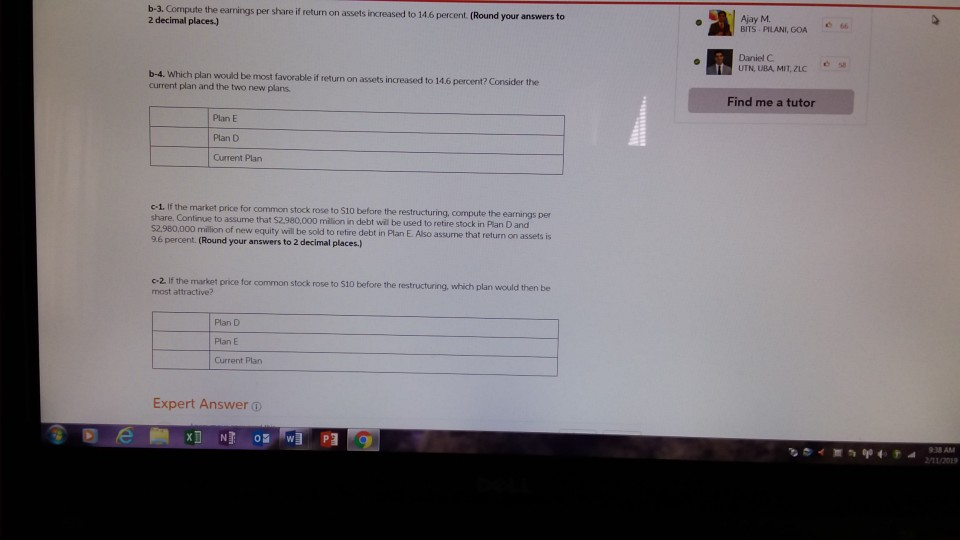

Dickinson Company has $11,920,000 million in assets. Currently half of these assets are financed with long term debt at 9.6 percent and half with common stock having a par value of S8. Ms Smith, Vice President of Finance, wishes to analyze two refinancing plans, one with more debt (D) and one with more equity (E) The company earns a retum on assets before interest and taxes of 9.6 percent. The tax rate is 35 percent Tax loss carryover provisions apply, so negative tax amounts are permissable. Under Plan D, a $2.980,000 million long-term bond would be sold at an interest rate of 116 percent and 372,500 shares of stock would be purchased in the market at S8 per share and retired Enter question Continue to post 8 questions remaining Under Plan E, 372,500 shares of stock would be sold at S8 per share and the $2.980,000 in proceeds would be used to reduce long-term debt. a. How would each of these plans affect earnings per share? Consider the current plan and the two new plans. (Round your answers to 2 decimal places.) My Textbook Solutions b-1. Compute the earnings per share if return on assets fell to 4.80 percent. (Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) 15th Edtion 14th Edrion 14th Edtion b-2. Which plan would be most favorable if return on assets fell to 4.80 percent? Consider the current plan and the two new plans View all solutions Plan E Plan D Current Plan Finance Chegg tutors who can help right now John N Argosy University b-3. Compute the earnings per share if return on assets increased to 14.6 percent (Round your answers to 2 decimal places.) Ajay M BITS PLAN, GOA b-3. Compute the eanings per sha 2 decimal places.) re if return on assets increased to 14.6 percent. (Round your answers to BITS PILANI, GOA Daniel C UTN, UBA, MIT ZLC b-4. Which plan would current plan and the two new plans be most favorable if return on assets increased to 14.6 percent? Consider the Find me a tutor Plan E Plan D Current Plarn c-1. If the market price for common stock rose to S10 before the restructuring, compute share. Continue to assume that $2.980,000 million in debt wil be used to retire stock in Plan D and million of new equity will be sold to retire debt in Plan E Also assume that return on assets is 9.6 percent. (Round your answers to 2 decimal places) c-2 if the market price for common stock rose to 510 before the restructuring, which plan would then be Plan D Plan E Current Plan Expert Answer o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started