Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dickson has budgeted to produce 10,000 units of its single product in a period. It operates a standard costing system. The following information has

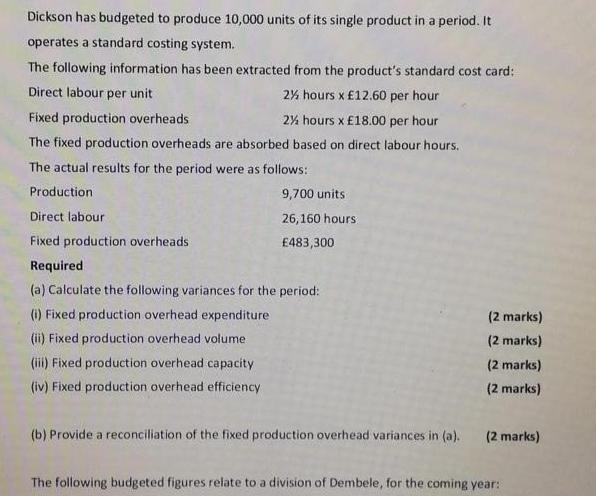

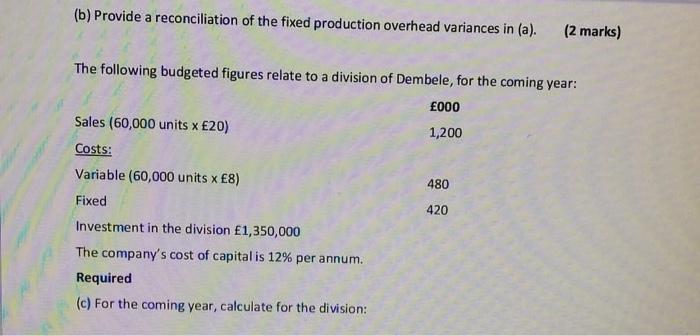

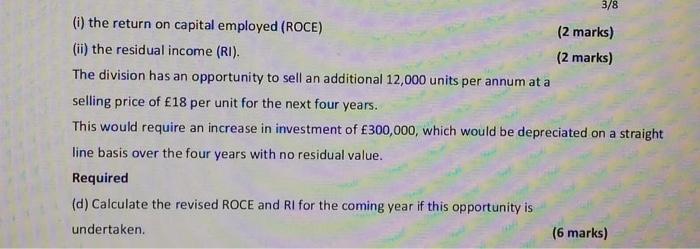

Dickson has budgeted to produce 10,000 units of its single product in a period. It operates a standard costing system. The following information has been extracted from the product's standard cost card: Direct labour per unit 2% hours x 12.60 per hour Fixed production overheads 2% hours x 18.00 per hour The fixed production overheads are absorbed based on direct labour hours, The actual results for the period were as follows: Production 9,700 units Direct labour 26,160 hours Fixed production overheads 483,300 Required (a) Calculate the following variances for the period: (i) Fixed production overhead expenditure (2 marks) (ii) Fixed production overhead volume (2 marks) (iii) Fixed production overhead capacity (2 marks) (iv) Fixed production overhead efficiency (2 marks) (b) Provide a reconciliation of the fixed production overhead variances in (a). (2 marks) The following budgeted figures relate to a division of Dembele, for the coming year: (b) Provide a reconciliation of the fixed production overhead variances in (a). (2 marks) The following budgeted figures relate to a division of Dembele, for the coming year: 00 Sales (60,000 units x 20) 1,200 Costs: Variable (60,000 units x 8) 480 Fixed 420 Investment in the division 1,350,000 The company's cost of capital is 12% per annum. Required (c) For the coming year, calculate for the division: 3/8 (i) the return on capital employed (ROCE) (2 marks) (ii) the residual income (RI). (2 marks) The division has an opportunity to sell an additional 12,000 units per annum at a selling price of 18 per unit for the next four years. This would require an increase in investment of 300,000, which would be depreciated on a straight line basis over the four years with no residual value. Required (d) Calculate the revised ROCE and RI for the coming year if this opportunity is undertaken. (6 marks)

Step by Step Solution

★★★★★

3.50 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Answer to a Answer to a i Calculation of Fixed Production Overhead Expenditure Budgeted Fixed Overhead 450000 working note 1 Actual Fixed Overhead 483300 Budgeted Fixed Overhead Actual Fixed Overhead ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6360c76fe2c0b_234900.pdf

180 KBs PDF File

6360c76fe2c0b_234900.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started