Answered step by step

Verified Expert Solution

Question

1 Approved Answer

did i do these 2 questions correctly give me an answer so i can understand thank you (7) Which of the following statements is correct?

did i do these 2 questions correctly give me an answer so i can understand thank you

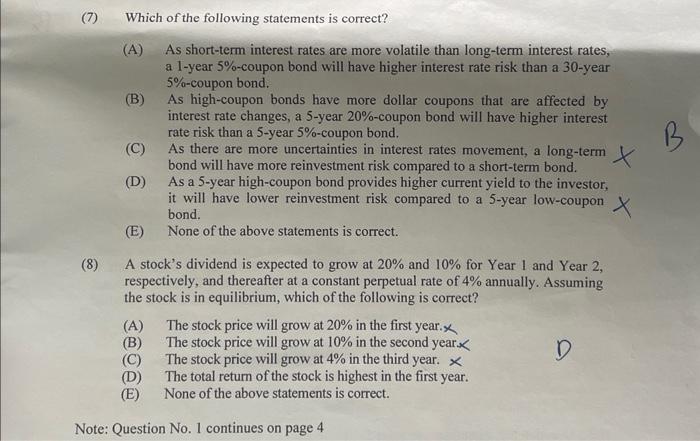

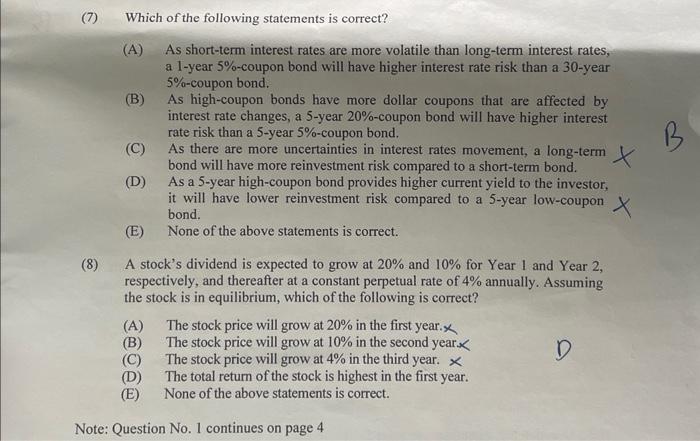

(7) Which of the following statements is correct? (A) As short-term interest rates are more volatile than long-term interest rates, a 1 -year 5%-coupon bond will have higher interest rate risk than a 30 -year 5%-coupon bond. (B) As high-coupon bonds have more dollar coupons that are affected by interest rate changes, a 5 -year 20%-coupon bond will have higher interest rate risk than a 5-year 5%-coupon bond. (C) As there are more uncertainties in interest rates movement, a long-term bond will have more reinvestment risk compared to a short-term bond. (D) As a 5-year high-coupon bond provides higher current yield to the investor, it will have lower reinvestment risk compared to a 5 -year low-coupon bond. (E) None of the above statements is correct. (8) A stock's dividend is expected to grow at 20% and 10% for Year 1 and Year 2 , respectively, and thereafter at a constant perpetual rate of 4% annually. Assuming the stock is in equilibrium, which of the following is correct? (A) The stock price will grow at 20% in the first year. x (B) The stock price will grow at 10% in the second year. (C) The stock price will grow at 4% in the third year. x (D) The total retum of the stock is highest in the first year. (E) None of the above statements is correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started