Question

Did I fill out this question correctly? If not, can you please fix the mistakes? Thank you!!! Stock pricing with uneven dividend growth rate The

Did I fill out this question correctly? If not, can you please fix the mistakes? Thank you!!!

Stock pricing with uneven dividend growth rate

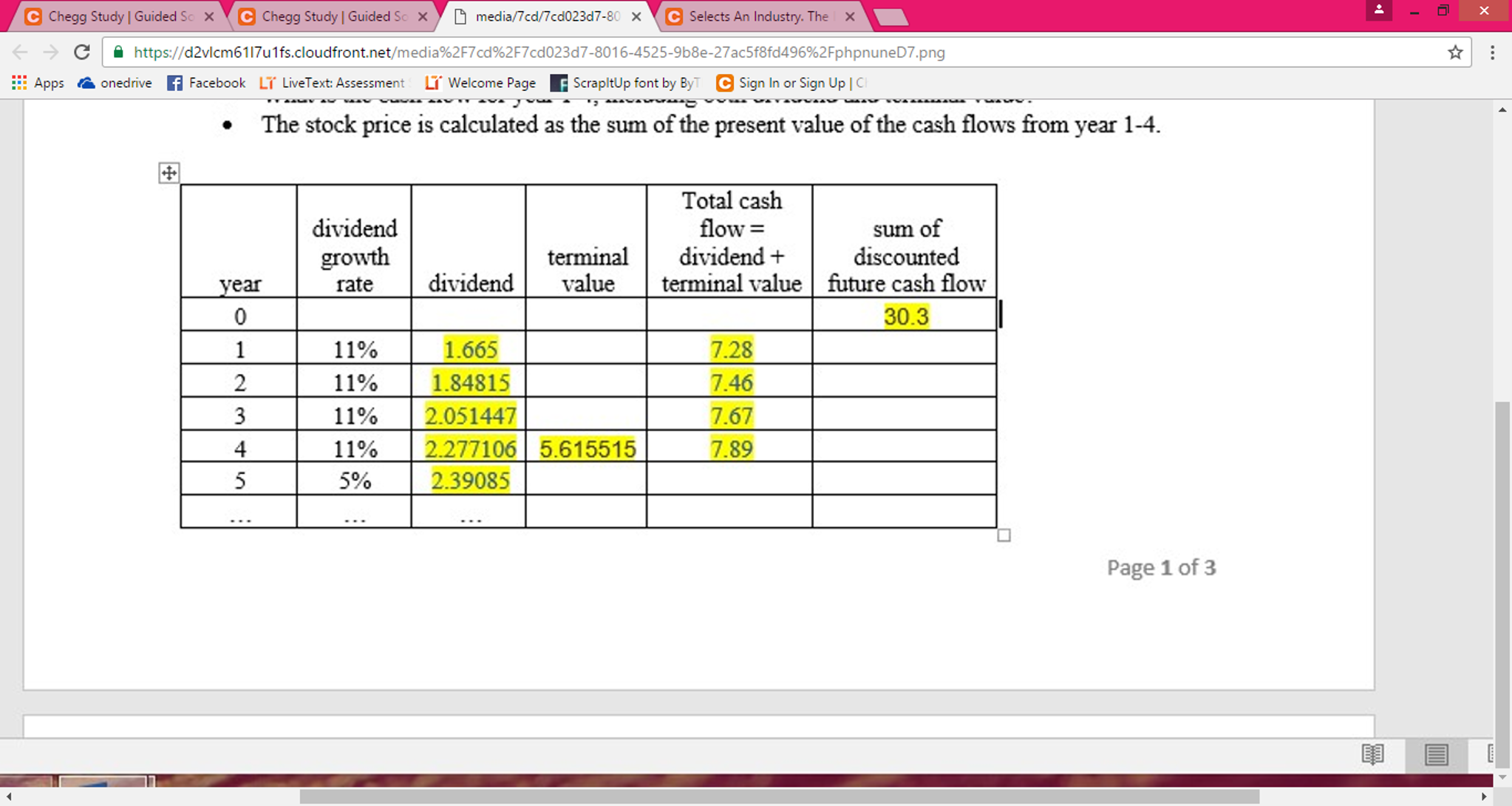

The Seneca Maintenance Company currently (that is, as of year 0) pays a common stock dividend of $1.5 per share. Dividend are expected to grow at a rate of 11% per year for the next 4 years and then continue growing thereafter at a rate of 5% per year. What is the current value of a share of Seneca common stock to an investor who require a 14% rate of return?

Hint:

Calculate the cash flow of the stock for year 1-4, and the terminal value at the end of year 4.

What is the cash flow for year 1-4, including both dividend and terminal value?

The stock price is calculated as the sum of the present value of the cash flows from year 1-4.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started