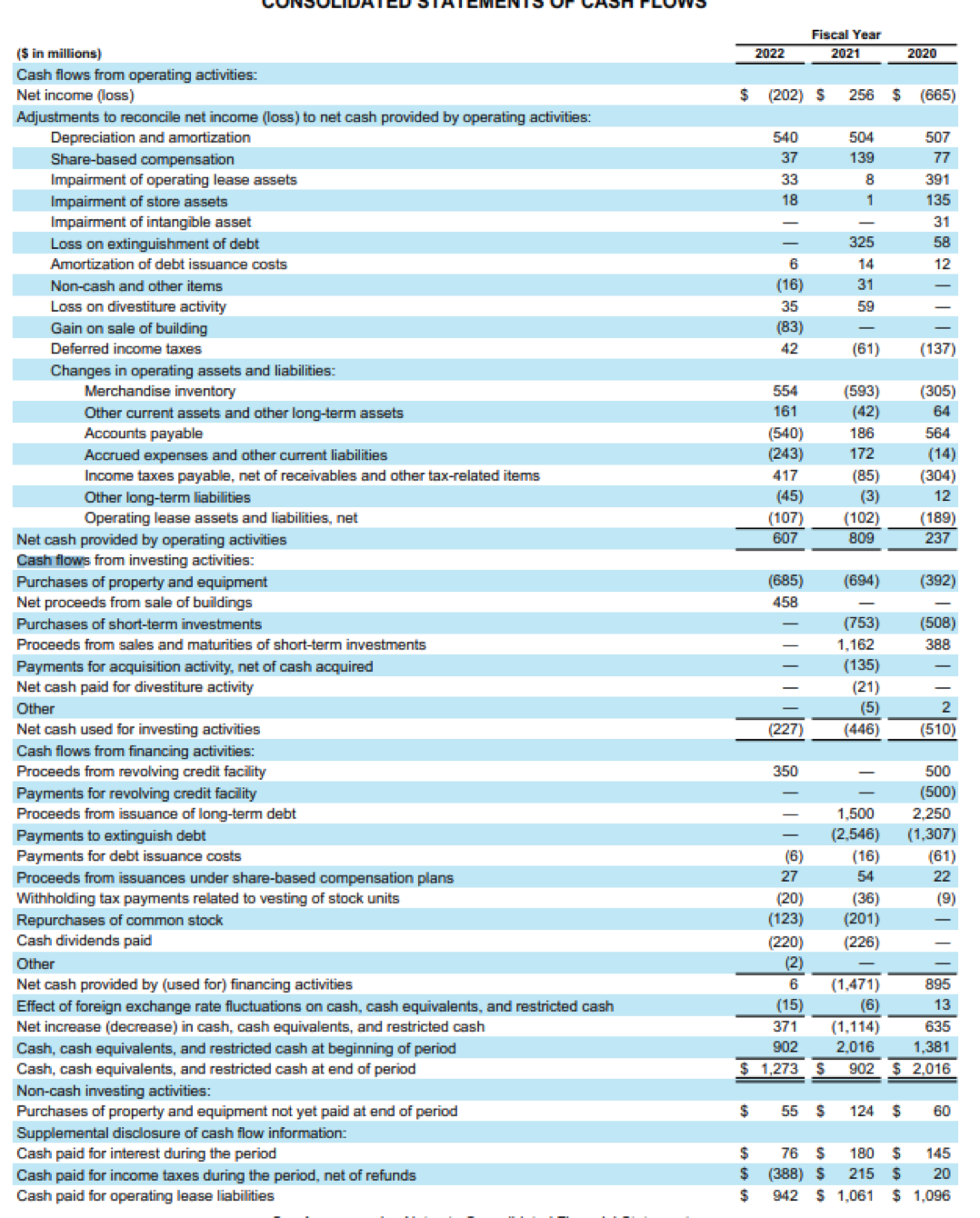

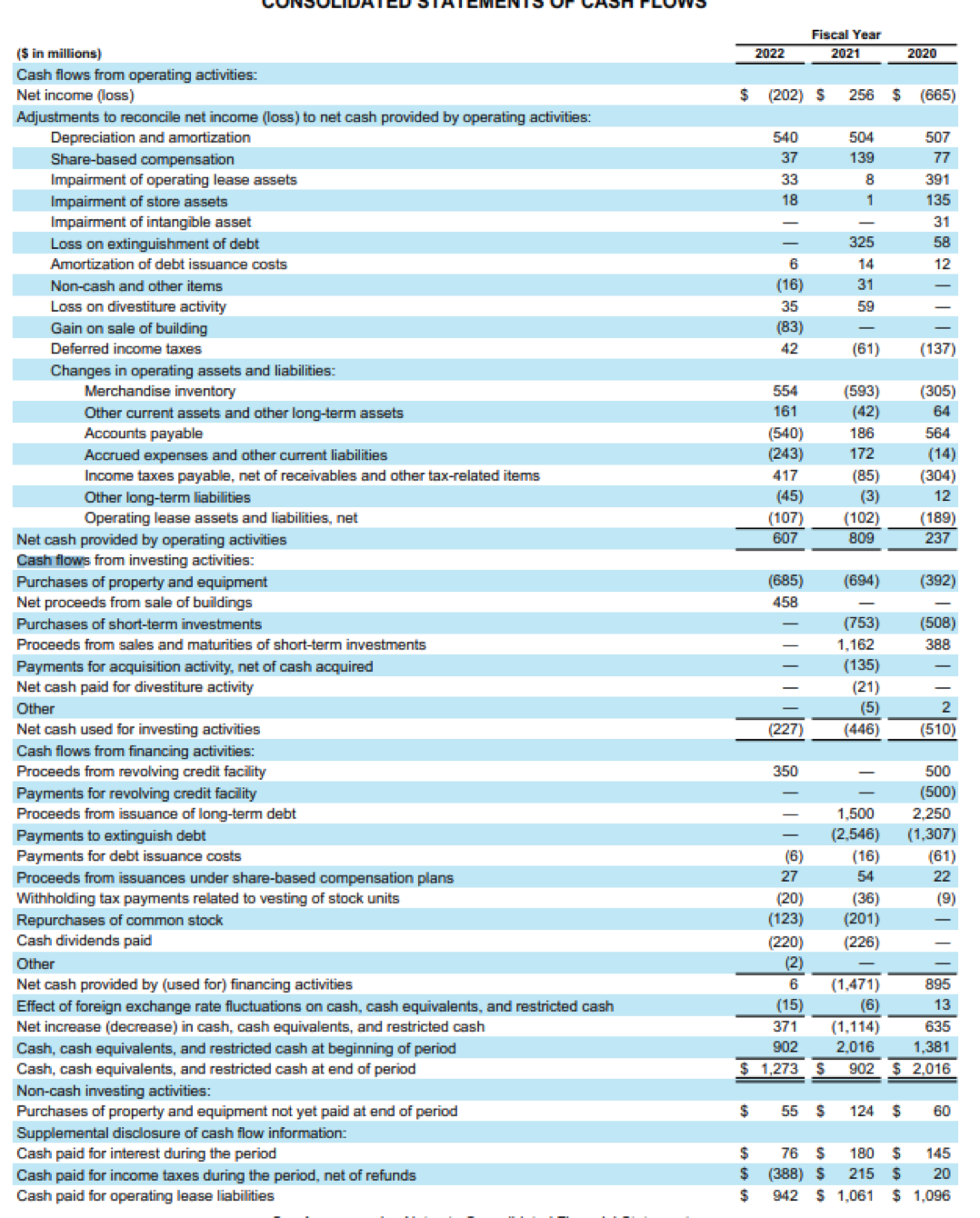

- Did the company use the direct method or the indirect method of disclosing cash flows?

- Comment on the relationship between cash flows from operations and net income for the year of the statement and the previous year.

- What were the most significant sources of cash from operating activities during the period covered by the statement? What percentage of total cash inflows do these sources represent? Answer the same question for the previous period.

- Was the cash from operations more than or less than dividends during the period covered by the statement and the previous period?

- What were the firm's major investing activities during the period covered by the statement and the previous period? Were cash flows from operations more or less than cash flows from investing activities for the company in question?

- What were the most significant cash flows from financing activities during the year of the statement and the previous year?

- Review the management discussion and analysis sections of the financial statements to determine if any additional information is available concerning the company's investment or financing strategy.

\begin{tabular}{|c|c|c|c|c|} \hline \multirow{2}{*}{ (\$ in millions) } & \multicolumn{4}{|c|}{ Fiscal Year } \\ \hline & 2022 & 2021 & \multicolumn{2}{|r|}{2020} \\ \hline \multicolumn{5}{|l|}{ Cash flows from operating activities: } \\ \hline Net income (loss) & $(202) & 256 & $ & (665) \\ \hline \multicolumn{5}{|l|}{ Adjustments to reconcile net income (loss) to net cash provided by operating activities: } \\ \hline Depreciation and amortization & 540 & 504 & & 507 \\ \hline Share-based compensation & 37 & 139 & & 77 \\ \hline Impairment of operating lease assets & 33 & 8 & & 391 \\ \hline Impairment of store assets & 18 & 1 & & 135 \\ \hline Impairment of intangible asset & - & - & & 31 \\ \hline Loss on extinguishment of debt & - & 325 & & 58 \\ \hline Amortization of debt issuance costs & 6 & 14 & & 12 \\ \hline Non-cash and other items & (16) & 31 & & - \\ \hline Loss on divestiture activity & 35 & 59 & & - \\ \hline Gain on sale of building & (83) & - & & - \\ \hline Deferred income taxes & 42 & (61) & & (137) \\ \hline \multicolumn{5}{|l|}{ Changes in operating assets and liabilities: } \\ \hline Merchandise inventory & 554 & (593) & & (305) \\ \hline Other current assets and other long-term assets & 161 & (42) & & 64 \\ \hline Accounts payable & (540) & 186 & & 564 \\ \hline Accrued expenses and other current liabilities & (243) & 172 & & (14) \\ \hline Income taxes payable, net of receivables and other tax-related items & 417 & (85) & & (304) \\ \hline Other long-term liabilities & (45) & (3) & & 12 \\ \hline Operating lease assets and liabilities, net & (107) & (102) & & (189) \\ \hline Net cash provided by operating activities & 607 & 809 & & 237 \\ \hline \multicolumn{5}{|l|}{ Cash flows from investing activities: } \\ \hline Purchases of property and equipment & (685) & (694) & & (392) \\ \hline Net proceeds from sale of buildings & 458 & - & & - \\ \hline Purchases of short-term investments & - & (753) & & (508) \\ \hline Proceeds from sales and maturities of short-term investments & - & 1,162 & & 388 \\ \hline Payments for acquisition activity, net of cash acquired & - & (135) & & - \\ \hline Net cash paid for divestiture activity & - & (21) & & - \\ \hline Other & - & (5) & & 2 \\ \hline Net cash used for investing activities & (227) & (446) & & (510) \\ \hline \multicolumn{5}{|l|}{ Cash flows from financing activities: } \\ \hline Proceeds from revolving credit facility & 350 & - & & 500 \\ \hline Payments for revolving credit facility & - & - & & (500) \\ \hline Proceeds from issuance of long-term debt & - & 1,500 & & 2,250 \\ \hline Payments to extinguish debt & - & (2,546) & & (1,307) \\ \hline Payments for debt issuance costs & (6) & (16) & & (61) \\ \hline Proceeds from issuances under share-based compensation plans & 27 & 54 & & 22 \\ \hline Withholding tax payments related to vesting of stock units & (20) & (36) & & (9) \\ \hline Repurchases of common stock & (123) & (201) & & - \\ \hline Cash dividends paid & (220) & (226) & & - \\ \hline Other & (2) & - & & - \\ \hline Net cash provided by (used for) financing activities & 6 & (1,471) & & 895 \\ \hline Effect of foreign exchange rate fluctuations on cash, cash equivalents, and restricted cash & (15) & (6) & & 13 \\ \hline Net increase (decrease) in cash, cash equivalents, and restricted cash & 371 & (1,114) & & 635 \\ \hline Cash, cash equivalents, and restricted cash at beginning of period & 902 & 2,016 & & 1,381 \\ \hline Cash, cash equivalents, and restricted cash at end of period & $1,273 & 902 & $ & 2,016 \\ \hline \multicolumn{5}{|l|}{ Non-cash investing activities: } \\ \hline Purchases of property and equipment not yet paid at end of period & 55 & 124 & $ & 60 \\ \hline \multicolumn{5}{|l|}{ Supplemental disclosure of cash flow information: } \\ \hline Cash paid for interest during the period & 76 & 180 & $ & 145 \\ \hline Cash paid for income taxes during the period, net of refunds & $(388) & 215 & $ & 20 \\ \hline Cash paid for operating lease liabilities & 942 & \$ 1,061 & $ & 1,096 \\ \hline \end{tabular}