Answered step by step

Verified Expert Solution

Question

1 Approved Answer

did you even go to school what does your responce even mean? maybe you should take an english class. how do you not know how

did you even go to school what does your responce even mean? maybe you should take an english class. how do you not know how to prepare consolidated financials? im definitely not missing any information. this is ridiculous.

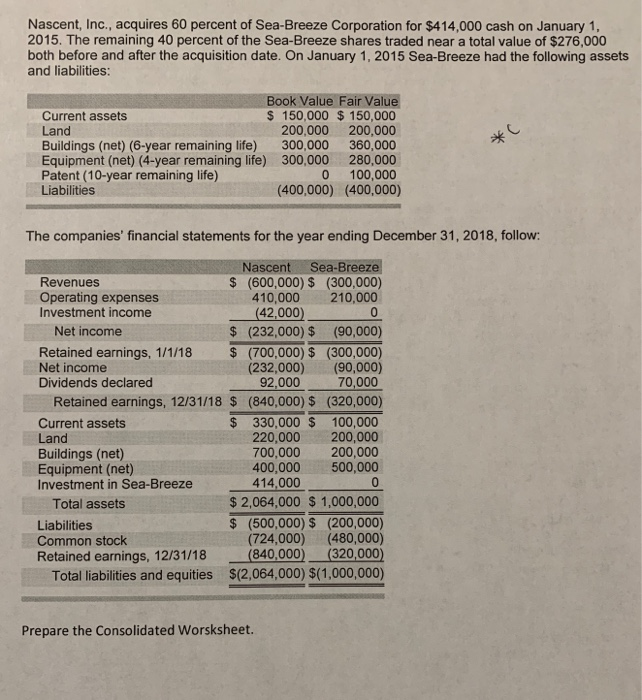

Nascent, Inc., acquires 60 percent of Sea-Breeze Corporation for $414,000 cash on January 1, 2015. The remaining 40 percent of the Sea-Breeze shares traded near a total value of $276,000 both before and after the acquisition date. On January 1, 2015 Sea-Breeze had the following assets and liabilities: Book Value Fair Value Current assets $ 150,000 $ 150,000 Land 200,000 200,000 Buildings (net) (6-year remaining life) 300,000 360,000 Equipment (net) (4-year remaining life) 300,000 280,000 Patent (10-year remaining life) 0 100,000 Liabilities (400,000) (400,000) The companies' financial statements for the year ending December 31, 2018, follow: Nascent Sea-Breeze Revenues $ (600,000) $ (300,000) Operating expenses 410,000 210,000 Investment income (42,000) Net income $ (232,000) $ (90,000) Retained earnings, 1/1/18 $ (700,000) $ (300,000) Net income (232,000) (90,000) Dividends declared 92,000 70,000 Retained earnings, 12/31/18 $ (840,000) $ (320,000) Current assets $ 330,000 $ 100,000 Land 220,000 200,000 Buildings (net) 700,000 200,000 Equipment (net) 400,000 500,000 Investment in Sea-Breeze 414,000 Total assets $ 2,064,000 $ 1,000,000 Liabilities $ (500,000) $ (200,000) Common stock (724,000) (480,000) Retained earnings, 12/31/18 (840,000)_(320,000) Total liabilities and equities $(2,064,000) $(1,000,000) Prepare the Consolidated Worsksheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started