Answered step by step

Verified Expert Solution

Question

1 Approved Answer

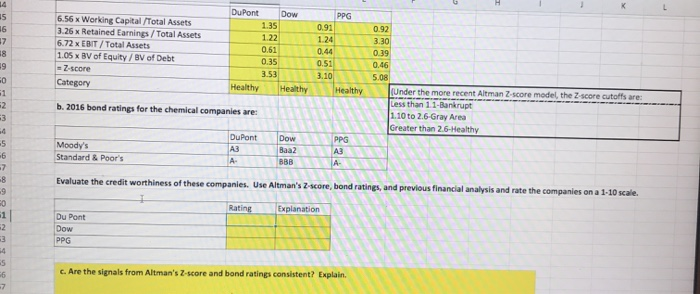

didnt really say, im assuming 1 equals low credit risk and 10 means high credit risk DuPont Dow PG P 0.91 0.92 6.56 x Working

didnt really say, im assuming 1 equals low credit risk and 10 means high credit risk

DuPont Dow PG P 0.91 0.92 6.56 x Working Capital Total Assets 3.26 x Retained Earnings/Total Assets 6.72x EBIT/Total Assets 1.05 x BV of Equity / BV of Debt Z-score Category 0.46 99 " N 0.35 3.53 Healthy Healthy b. 2016 bond ratings for the chemical companies are: Under the more recent Altman 2 score model, the Z-score cutoffs less than 11. Bankrupt 1.10 to 2.6-Gray Area Greater than 26-Healthy DuPont A3 Moody's Standard & Poor's Dow Baa2 BB PPG A 3 A A Evaluate the credit worthiness of these companies. Use Altman's Z-score, analysis and rate the companies on a 1-10 scale Explanation OM Du Pont Dow DPG c. Are the signals from Altman's Z-score and bond ratings consistent? Explain DuPont Dow PG P 0.91 0.92 6.56 x Working Capital Total Assets 3.26 x Retained Earnings/Total Assets 6.72x EBIT/Total Assets 1.05 x BV of Equity / BV of Debt Z-score Category 0.46 99 " N 0.35 3.53 Healthy Healthy b. 2016 bond ratings for the chemical companies are: Under the more recent Altman 2 score model, the Z-score cutoffs less than 11. Bankrupt 1.10 to 2.6-Gray Area Greater than 26-Healthy DuPont A3 Moody's Standard & Poor's Dow Baa2 BB PPG A 3 A A Evaluate the credit worthiness of these companies. Use Altman's Z-score, analysis and rate the companies on a 1-10 scale Explanation OM Du Pont Dow DPG c. Are the signals from Altman's Z-score and bond ratings consistent? Explain Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started