Question

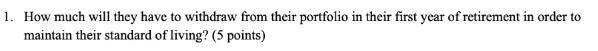

1. How much will they have to withdraw from their portfolio in their first year of retirement in order to maintain their standard of

![]()

![]()

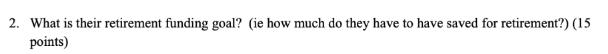

1. How much will they have to withdraw from their portfolio in their first year of retirement in order to maintain their standard of living? (5 points) 2. What is their retirement funding goal? (ie how much do they have to have saved for retirement?) (15 points) 3. How much will they have to save from their net paycheck per year to reach this goal if they start today? For questions 1-3, assume the client invests using a tax-free account. Current Income WRR Social Security Current Age Years to Fund Retirement Age Starting Balance Investment Return Inflation Avg Income Tax Rate Avg Investment Tax Rate $117,000 55.0% $48,000 41 15 71 $2,000 7.70% 4.17% 30.00% 9.00%

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 117000 55 64350 64350 48000 16350 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Stats Data And Models

Authors: Richard D. De Veaux, Paul D. Velleman, David E. Bock

4th Edition

321986490, 978-0321989970, 032198997X, 978-0321986498

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App