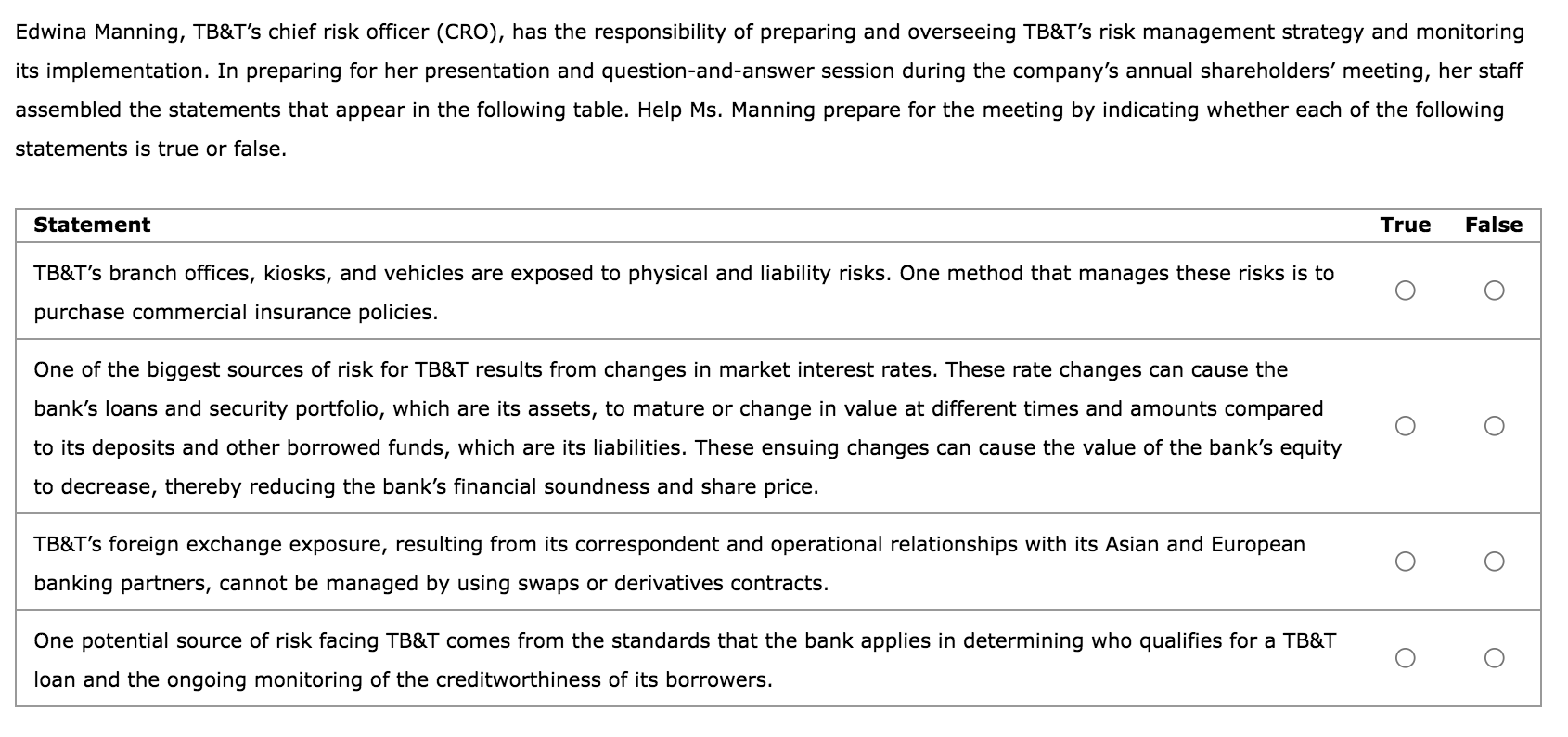

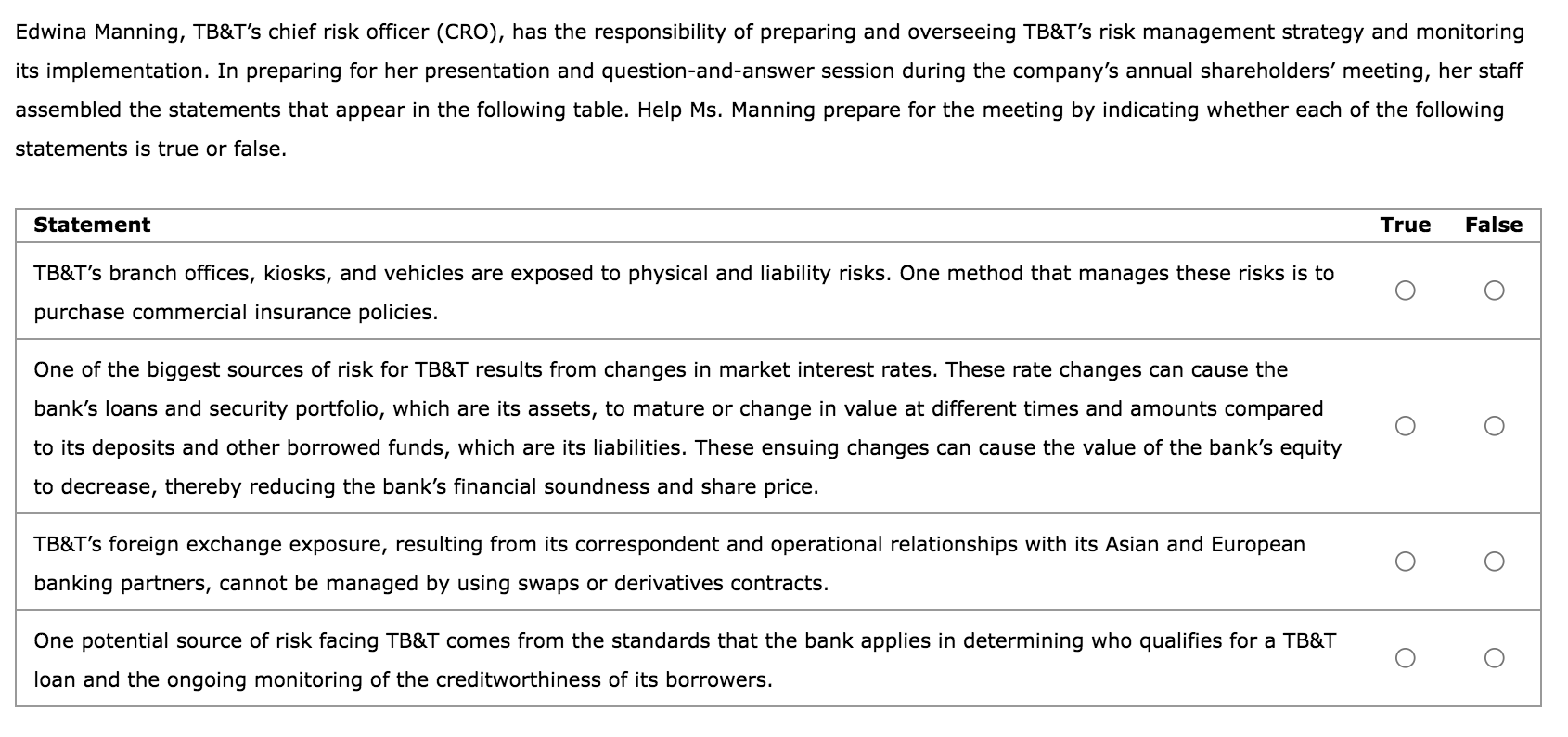

Different companies have different risk exposures, and their risk management approach is customized to the type of risk the company is exposed to. Consider the case of Trident Bank & Trust. Trident Bank & Trust (TB&T) is a large financial institution whose deposits and loans are received and made across seven states in the western United States. With deposits in excess of $1.5 billion, 1,258 branch offices, and 1,769 kiosks in shopping malls and grocery stores in the United States, along with correspondent and operational relationships with all the top-20 Asian and European banks, TB&T is considered to be one of the strongest financial institutions in the western United States. Edwina Manning, TB&T's chief risk officer (CRO), has the responsibility of preparing and overseeing TB&T's risk management strategy and monitoring its implementation. In preparing for her presentation and question-and-answer session during the company's annual shareholders' meeting, her staff assembled the statements that appear in the following table. Help Ms. Manning prepare for the meeting by indicating whether each of the following statements is true or false. Edwina Manning, TB&T's chief risk officer (CRO), has the responsibility of preparing and overseeing TB&T's risk management strategy and monitoring its implementation. In preparing for her presentation and question-and-answer session during the company's annual shareholders' meeting, her staff assembled the statements that appear in the following table. Help Ms. Manning prepare for the meeting by indicating whether each of the following statements is true or false. Statement True False TB&T's branch offices, kiosks, and vehicles are exposed to physical and liability risks. One method that manages these risks is to purchase commercial insurance policies. One of the biggest sources of risk for TB&T results from changes in market interest rates. These rate changes can cause the bank's loans and security portfolio, which are its assets, to mature or change in value at different times and amounts compared to its deposits and other borrowed funds, which are its liabilities. These ensuing changes can cause the value of the bank's equity to decrease, thereby reducing the bank's financial soundness and share price. O O TB&T's foreign exchange exposure, resulting from its correspondent and operational relationships with its Asian and European banking partners, cannot be managed by using swaps or derivatives contracts. One potential source of risk facing TB&T comes from the standards that the bank applies in determining who qualifies for a TB&T loan and the ongoing monitoring of the creditworthiness of its borrowers