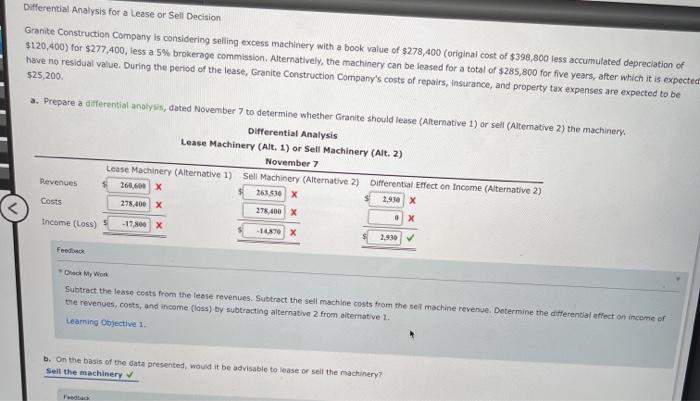

Differential Analysis for a Lease or Sell Decision Granite Construction Company is considering selling excess machinery with a book value of $278,400 (original cost of $398,800 less accumulated depreciation of $120,400) for $277.400, less a 5% brokerage commission, Alternatively, the machinery can be leased for a total of $285,800 for five years, after which it is expected have no residual value. During the period of the lease, Granite Construction Company's costs of repairs, insurance, and property tax expenses are expected to be $25,200 a. Prepare a differential analysis, dated November 7 to determine whether Granite should lease (Alternative 1) or sell (Alternative 2) the machinery Differential Analysis Lease Machinery (Alt. 1) or Sell Machinery (Alt. 2) November 7 Lease Machinery (Alternative 1) Sell Machinery (Alternative 2) Differential Effect on Income (Alternative 2) 260,600X 263.530 X 2,930 X Costs 278.400 x 278.400x OX Income (Loss -1700 X - 1470 X 2.930 Revenues Feedback Oh My Won Subtract the lease costs from the lease revenues. Subtract the sell machine costs from the set machine revenue. Determine the differential effect on income of the revenues, costs, and income (los) by subtracting alternative 2 from alternative 1. Learning Objective 1. 1. On the basis of the data presented, would it be advisable to ease or sell the machinery? Sell the machinery Differential Analysis for a Lease or Sell Decision Granite Construction Company is considering selling excess machinery with a book value of $278,400 (original cost of $398,800 less accumulated depreciation of $120,400) for $277.400, less a 5% brokerage commission, Alternatively, the machinery can be leased for a total of $285,800 for five years, after which it is expected have no residual value. During the period of the lease, Granite Construction Company's costs of repairs, insurance, and property tax expenses are expected to be $25,200 a. Prepare a differential analysis, dated November 7 to determine whether Granite should lease (Alternative 1) or sell (Alternative 2) the machinery Differential Analysis Lease Machinery (Alt. 1) or Sell Machinery (Alt. 2) November 7 Lease Machinery (Alternative 1) Sell Machinery (Alternative 2) Differential Effect on Income (Alternative 2) 260,600X 263.530 X 2,930 X Costs 278.400 x 278.400x OX Income (Loss -1700 X - 1470 X 2.930 Revenues Feedback Oh My Won Subtract the lease costs from the lease revenues. Subtract the sell machine costs from the set machine revenue. Determine the differential effect on income of the revenues, costs, and income (los) by subtracting alternative 2 from alternative 1. Learning Objective 1. 1. On the basis of the data presented, would it be advisable to ease or sell the machinery? Sell the machinery