Answered step by step

Verified Expert Solution

Question

1 Approved Answer

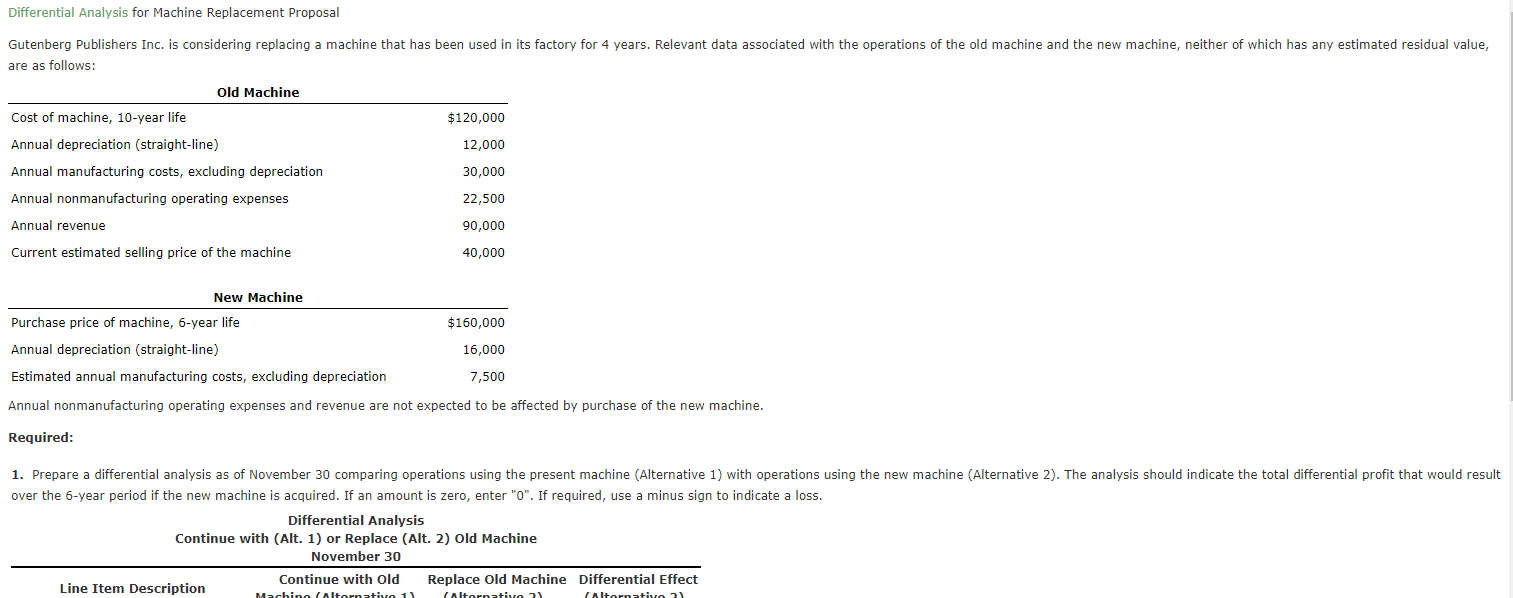

Differential Analysis for Machine Replacement Proposal are as follows: Old Machine Cost of machine, 10 -year life Annual depreciation (straight-line) Annual manufacturing costs, excluding depreciation

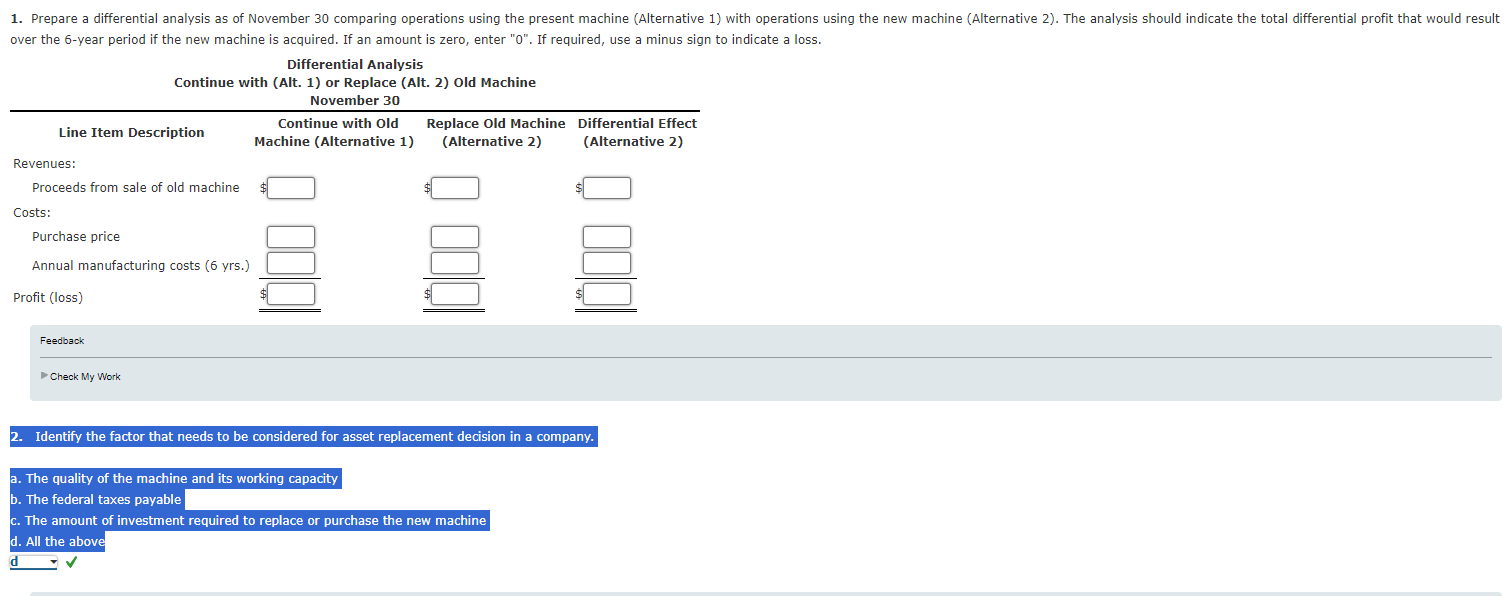

Differential Analysis for Machine Replacement Proposal are as follows: Old Machine Cost of machine, 10 -year life Annual depreciation (straight-line) Annual manufacturing costs, excluding depreciation Annual nonmanufacturing operating expenses Annual revenue Current estimated selling price of the machine New Machine Purchase price of machine, 6-year life Annual depreciation (straight-line) Estimated annual manufacturing costs, excluding depreciation $120,000 12,000 30,000 22,500 90,000 40,000 Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase of the new machine. Required: over the 6-year period if the new machine is acquired. If an amount is zero, enter " 0 ". If required, use a minus sign to indicate a loss. Differential Analysis Continue with (Alt. 1) or Replace (Alt. 2) Old Machine November 30 Line Item Description Continue with Old Replace Old Machine Differential Effect over the 6-year period if the new machine is acquired. If an amount is zero, enter " 0 ". If required, use a minus sign to indicate a loss. Differential Analysis Continue with (Alt. 1) or Replace (Alt. 2) Old Machine November 30 Line Item Description Revenues: Proceeds from sale of old machine s Costs: Purchase price Annual manufacturing costs ( 6 yrs.) Profit (loss) Feedback Check My Work 2. Identify the factor that needs to be considered for asset replacement decision in a company. a. The quality of the machine and its working capacity b. The federal taxes payable The amount of investment required to replace or purchase the new machine d. All the above

Differential Analysis for Machine Replacement Proposal are as follows: Old Machine Cost of machine, 10 -year life Annual depreciation (straight-line) Annual manufacturing costs, excluding depreciation Annual nonmanufacturing operating expenses Annual revenue Current estimated selling price of the machine New Machine Purchase price of machine, 6-year life Annual depreciation (straight-line) Estimated annual manufacturing costs, excluding depreciation $120,000 12,000 30,000 22,500 90,000 40,000 Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase of the new machine. Required: over the 6-year period if the new machine is acquired. If an amount is zero, enter " 0 ". If required, use a minus sign to indicate a loss. Differential Analysis Continue with (Alt. 1) or Replace (Alt. 2) Old Machine November 30 Line Item Description Continue with Old Replace Old Machine Differential Effect over the 6-year period if the new machine is acquired. If an amount is zero, enter " 0 ". If required, use a minus sign to indicate a loss. Differential Analysis Continue with (Alt. 1) or Replace (Alt. 2) Old Machine November 30 Line Item Description Revenues: Proceeds from sale of old machine s Costs: Purchase price Annual manufacturing costs ( 6 yrs.) Profit (loss) Feedback Check My Work 2. Identify the factor that needs to be considered for asset replacement decision in a company. a. The quality of the machine and its working capacity b. The federal taxes payable The amount of investment required to replace or purchase the new machine d. All the above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started