Question

Differential Analysis for Machine Replacement Proposal Franklin Printing Company is considering replacing a machine that has been used in its factory for four years. Relevant

Differential Analysis for Machine Replacement Proposal

Franklin Printing Company is considering replacing a machine that has been used in its factory for four years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follows:

| Old Machine | |

| Cost of machine, 10-year life | $108,900 |

| Annual depreciation (straight-line) | 10,890 |

| Annual manufacturing costs, excluding depreciation | 38,500 |

| Annual nonmanufacturing operating expenses | 12,900 |

| Annual revenue | 94,800 |

| Current estimated selling price of the machine | 35,900 |

| New Machine | |

| Cost of machine, six-year life | $135,600 |

| Annual depreciation (straight-line) | 22,600 |

| Estimated annual manufacturing costs, exclusive of depreciation | 17,900 |

Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase of the new machine

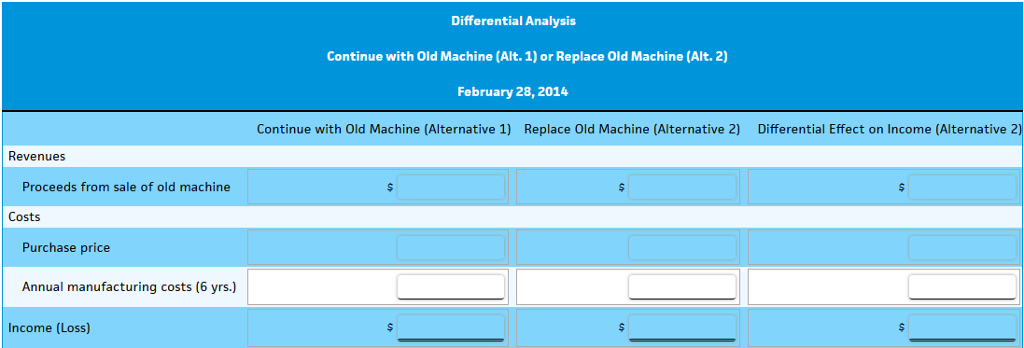

1. Prepare a differential analysis as of February 28, 2014, comparing operations using the present machine (Alternative 1) with operations using the new machine (Alternative 2). The analysis should indicate the total differential income that would result over the six-year period if the new machine is acquired. If an amount is zero, enter zero "0".

2. What other factors should be considered before a final decision is reached?

a) Are there any improvements in the quality of work turned out by the new machine?

b) What opportunities are available for the use of the funds required to purchase the new machine?

c) Are there any improvements in the quality of work turned out by the new machine and what opportunities are available for the use of the funds required to purchase the new machine?

d) What affect would this decision have on employee morale?

e) None of these choices is correct.

Differential Analysis Continue with Old Machine (Alt. 1) or Replace Old Machine (Alt.2) February 28, 2014 Continue with Old Machine (Alternative 1) Replace Old Machine (Alternative 2) Differential Effect on Income (Alternative 2) Revenues Proceeds from sale of old machine Costs Purchase price Annual manufacturing costs (6 yrs.) Income (Loss)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started