Answered step by step

Verified Expert Solution

Question

1 Approved Answer

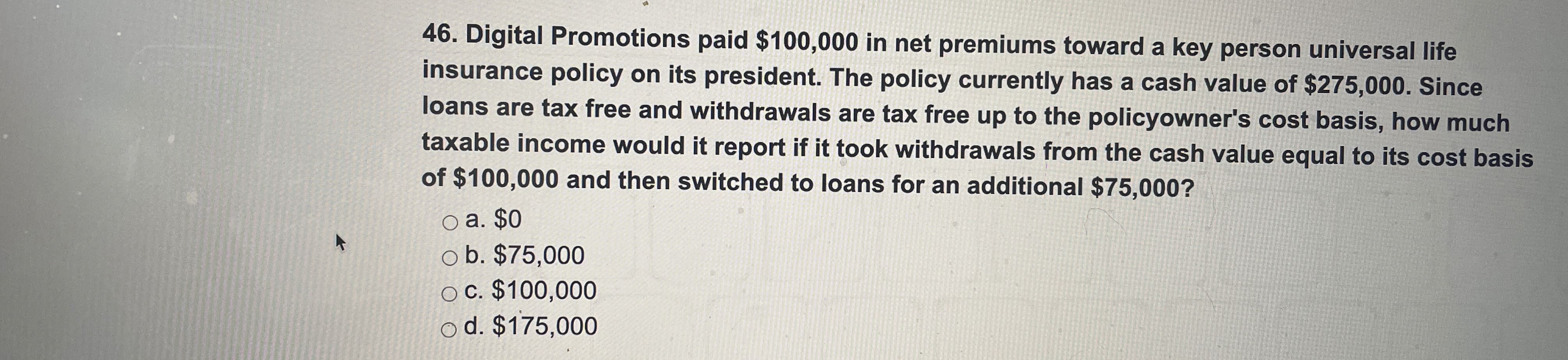

Digital Promotions paid $ 1 0 0 , 0 0 0 in net premiums toward a key person universal life insurance policy on its president.

Digital Promotions paid $ in net premiums toward a key person universal life insurance policy on its president. The policy currently has a cash value of $ Since loans are tax free and withdrawals are tax free up to the policyowner's cost basis, how much taxable income would it report if it took withdrawals from the cash value equal to its cost basis of $ and then switched to loans for an additional $

a $

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started