Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Digitalis is a technology company that makes high-end computer processors. Their newest processor, the luteA, is going to be sold directly to the public.

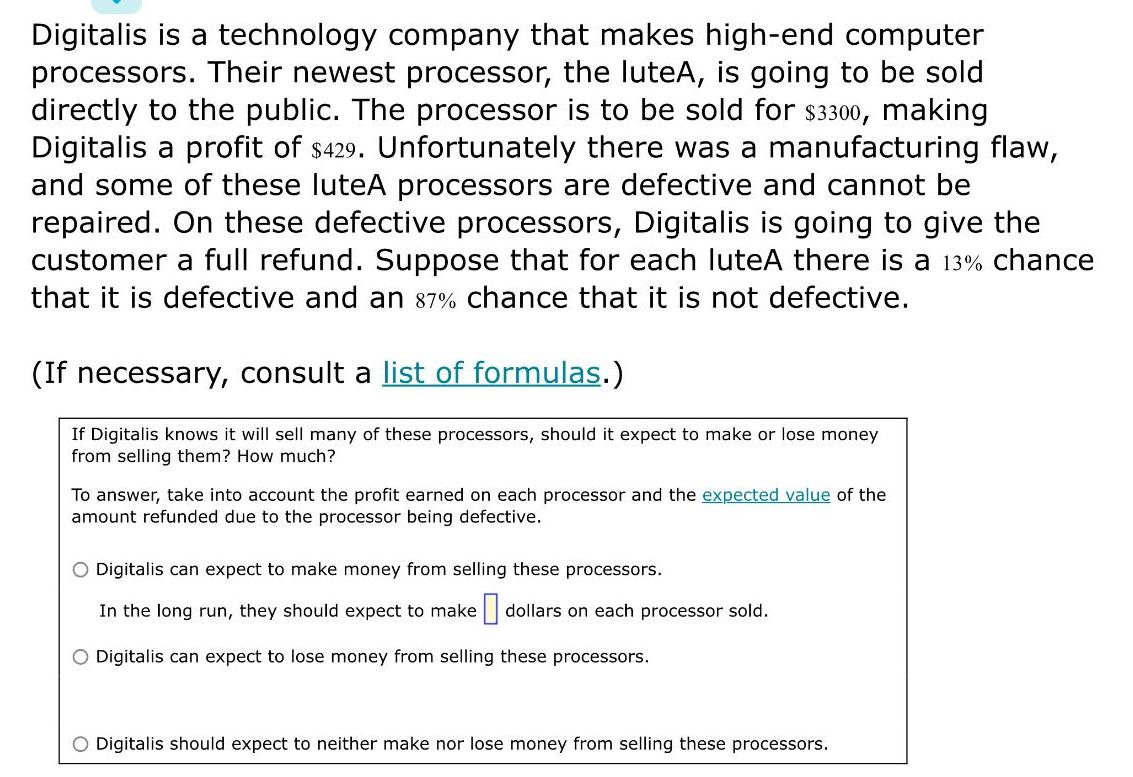

Digitalis is a technology company that makes high-end computer processors. Their newest processor, the luteA, is going to be sold directly to the public. The processor is to be sold for $3300, making Digitalis a profit of $429. Unfortunately there was a manufacturing flaw, and some of these luteA processors are defective and cannot be repaired. On these defective processors, Digitalis is going to give the customer a full refund. Suppose that for each luteA there is a 13% chance that it is defective and an 87% chance that it is not defective. (If necessary, consult a list of formulas.) If Digitalis knows it will sell many of these processors, should it expect to make or lose money from selling them? How much? To answer, take into account the profit earned on each processor and the expected value of the amount refunded due to the processor being defective. O Digitalis can expect to make money from selling these processors. In the long run, they should expect to make dollars on each processor sold. Digitalis can expect to lose money from selling these processors. Digitalis should expect to neither make nor lose money from selling these processors.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started