Answered step by step

Verified Expert Solution

Question

1 Approved Answer

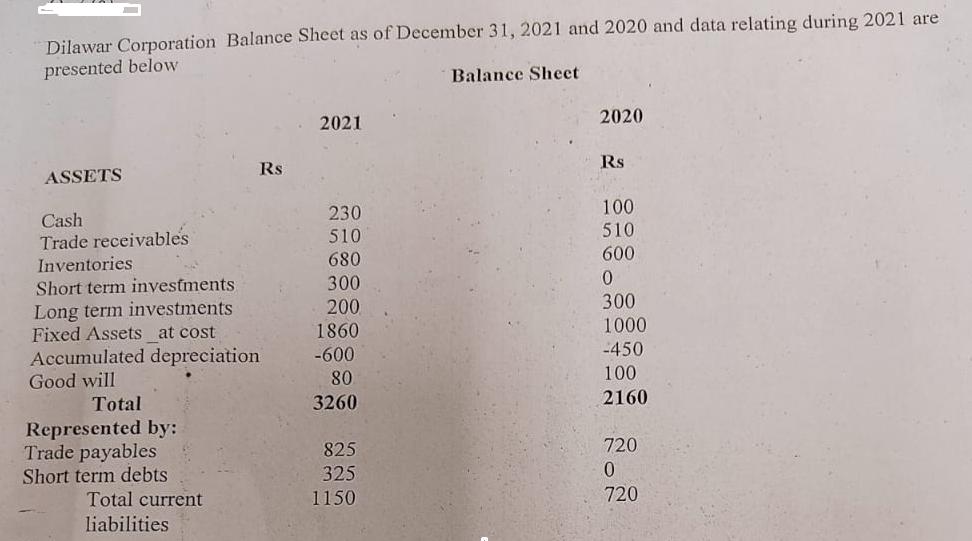

Dilawar Corporation Balance Sheet as of December 31, 2021 and 2020 and data relating during 2021 are presented below Balance Sheet ASSETS Cash Trade

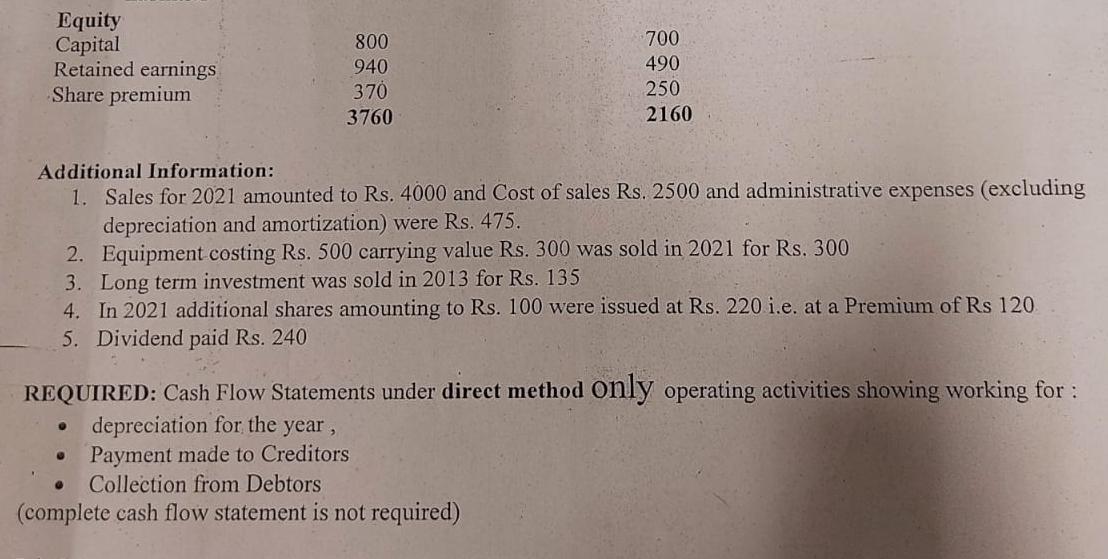

Dilawar Corporation Balance Sheet as of December 31, 2021 and 2020 and data relating during 2021 are presented below Balance Sheet ASSETS Cash Trade receivables Inventories Short term investments Long term investments Fixed Assets at cost Accumulated depreciation Good will Total Represented by: Trade payables Short term debts Total current liabilities Rs 2021 230 510 680 300 200 1860 -600 80 3260 825 325 1150 2020 Rs 100 510 600 0 300 1000 -450 100 2160 720 0 720 Equity Capital Retained earnings Share premium 800 940 370 3760 700 490 250 2160 Additional Information: 1. Sales for 2021 amounted to Rs. 4000 and Cost of sales Rs. 2500 and administrative expenses (excluding depreciation and amortization) were Rs. 475. 2. Equipment costing Rs. 500 carrying value Rs. 300 was sold in 2021 for Rs. 300 3. Long term investment was sold in 2013 for Rs. 135 4. In 2021 additional shares amounting to Rs. 100 were issued at Rs. 220 i.e. at a Premium of Rs 120. 5. Dividend paid Rs. 240 C REQUIRED: Cash Flow Statements under direct method Only operating activities showing working for: depreciation for the year, Payment made to Creditors Collection from Debtors (complete cash flow statement is not required)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare a Cash Flow Statement under the direct method for operating activities we need to account ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started