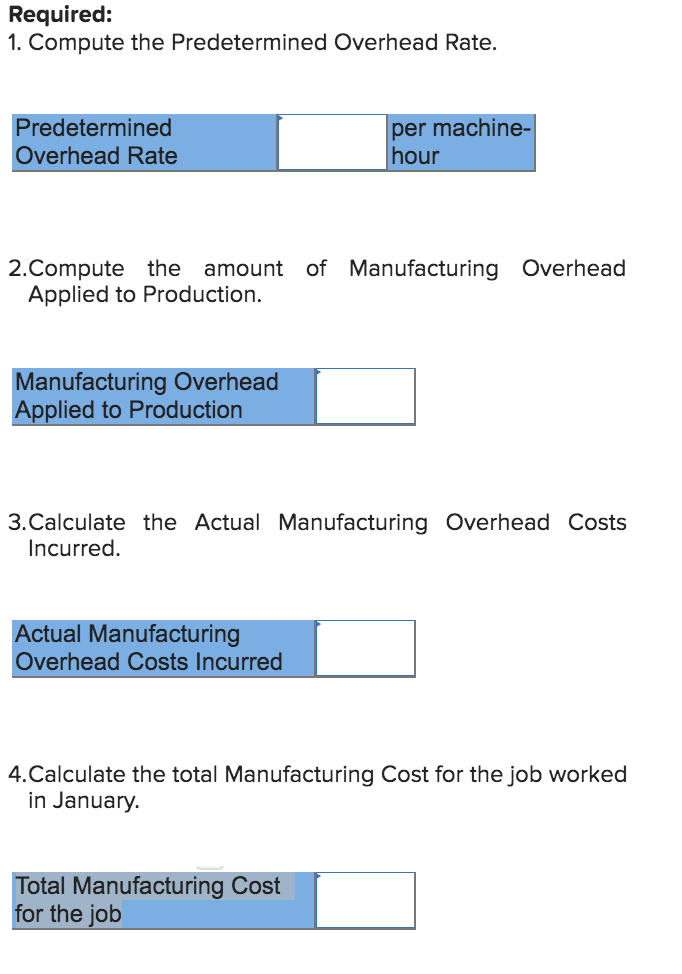

Question

Dillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing system and applies overhead costs to jobs on the basis

| Dillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing system and applies overhead costs to jobs on the basis of machine-hours. At the beginning of the year, the company used a cost formula to estimate that it would incur $4,344,600 in manufacturing overhead cost at an activity level of 557,000 machine-hours. |

| The company spent the entire month of January working on a large order for 9,000 custom made machine parts. The company had no work in process at the beginning of January. Cost data relating to January follow: |

| a. | Raw materials used in production, $251,000 (80% direct and 20% indirect). |

| b. | Labor cost incurred in the factory, $165,000, of which $55,000 was direct labor and $110,000 was indirect labor. |

| c. | Depreciation recorded on factory equipment, $62,900. |

| d. | Factory Rent and Factory Utilities costs incurred, $85,700. |

| e. | Manufacturing overhead cost was applied to production on the basis of 40,810 machine-hours actually worked during the month. |

| f. | The job was completed, and the 9,000 finished machine parts were moved into the finished goods warehouse on January 31 to await delivery to the customer. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started