Question

The records of Eureka Gold Company reveal the following capital structure as of December 31, 2011. To stimulate work incentive and to bolster trade relations,

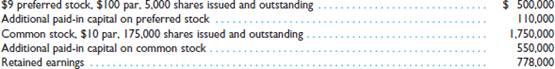

The records of Eureka Gold Company reveal the following capital structure as of December 31, 2011.

To stimulate work incentive and to bolster trade relations, Eureka Gold on May 1, 2012, issued stock options to selected executives, creditors, and others allowing the purchase of 32,000 shares of common stock for $26 a share. Market prices for the stock at various times during 2012 were:

![]()

A dividend on preferred stock was paid during the year, and there are no dividends in arrears at year-end. There are no other capital transactions during the year. Net income for 2012 was $589,000.

Instructions: Compute basic and diluted EPS for 2012.

$9 preferred stock, $100 par. 5.000 shares issued and outstanding Additional paid-in capital on preferred stock Common stock. $I0 par. 175,000 shares issued and outstanding Additional paid-in capital on common stock Retained earnings $ 500,000 1 10,000 1,750,000 550,000 778,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Net income 589000 Less Preferred dividend 5000 9 45000 Income available to common stockhol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started