Answered step by step

Verified Expert Solution

Question

1 Approved Answer

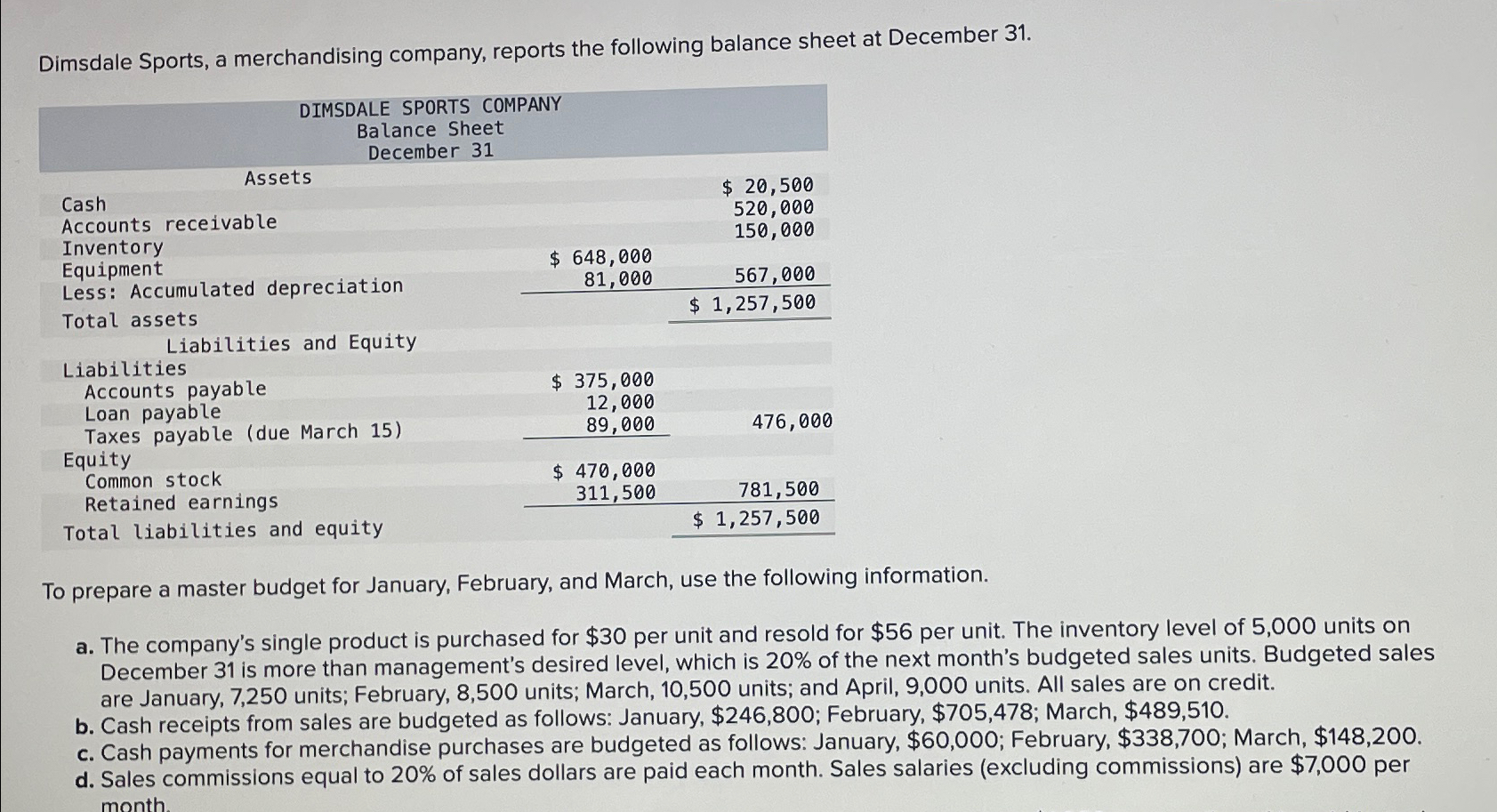

Dimsdale Sports, a merchandising company, reports the following balance sheet at December 31. DIMSDALE SPORTS COMPANY Balance Sheet Cash Assets Accounts receivable Inventory Equipment

Dimsdale Sports, a merchandising company, reports the following balance sheet at December 31. DIMSDALE SPORTS COMPANY Balance Sheet Cash Assets Accounts receivable Inventory Equipment December 31 Less: Accumulated depreciation Total assets Liabilities and Equity $ 648,000 81,000 $ 20,500 520,000 150,000 567,000 $ 1,257,500 Liabilities Accounts payable $ 375,000 Loan payable Taxes payable (due March 15) 12,000 89,000 476,000 Equity Common stock Retained earnings $ 470,000 311,500 Total liabilities and equity 781,500 $ 1,257,500 To prepare a master budget for January, February, and March, use the following information. a. The company's single product is purchased for $30 per unit and resold for $56 per unit. The inventory level of 5,000 units on December 31 is more than management's desired level, which is 20% of the next month's budgeted sales units. Budgeted sales are January, 7,250 units; February, 8,500 units; March, 10,500 units; and April, 9,000 units. All sales are on credit. b. Cash receipts from sales are budgeted as follows: January, $246,800; February, $705,478; March, $489,510. c. Cash payments for merchandise purchases are budgeted as follows: January, $60,000; February, $338,700; March, $148,200. d. Sales commissions equal to 20% of sales dollars are paid each month. Sales salaries (excluding commissions) are $7,000 per month.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Dimsdale Sports Company Master Budget JanuaryMarch Sales Budget Month Budgeted Sales Units Sales Pri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started