Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dingus Company has paid an annual dividend equal to its annual earnings of $5.00 for the last 30 years and the market expects it

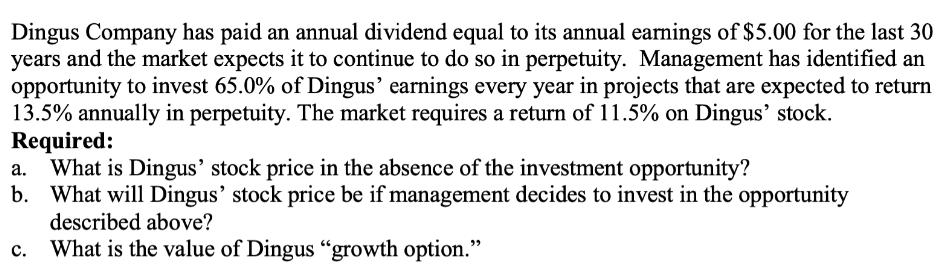

Dingus Company has paid an annual dividend equal to its annual earnings of $5.00 for the last 30 years and the market expects it to continue to do so in perpetuity. Management has identified an opportunity to invest 65.0% of Dingus' earnings every year in projects that are expected to return 13.5% annually in perpetuity. The market requires a return of 11.5% on Dingus' stock. Required: What is Dingus' stock price in the absence of the investment opportunity? b. What will Dingus' stock price be if management decides to invest in the opportunity described above? What is the value of Dingus "growth option."

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a What is Dingus stock price in the absence of the investment opportunity The stock price of Dingus ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started