Answered step by step

Verified Expert Solution

Question

1 Approved Answer

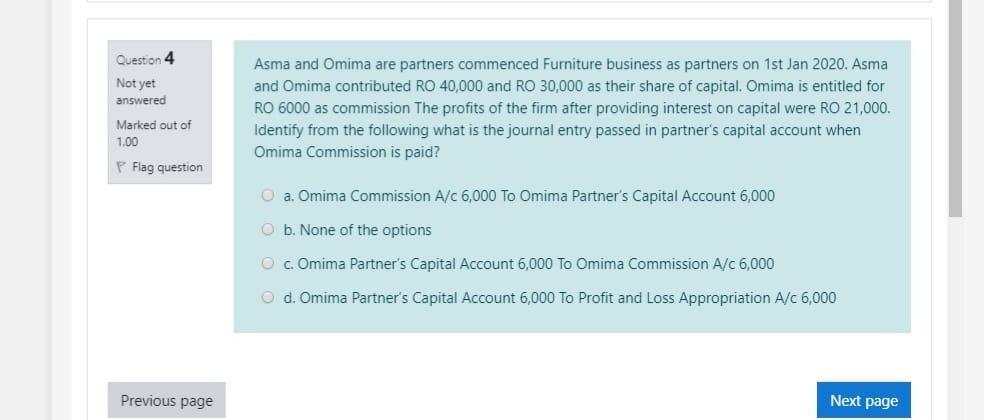

direct answer with out explean Question 4 Not yet answered Asma and Omima are partners commenced Furniture business as partners on 1st Jan 2020. Asma

direct answer with out explean

Question 4 Not yet answered Asma and Omima are partners commenced Furniture business as partners on 1st Jan 2020. Asma and Omima contributed RO 40,000 and RO 30,000 as their share of capital. Omima is entitled for RO 6000 as commission The profits of the firm after providing interest on capital were RO 21,000. Identify from the following what is the journal entry passed in partner's capital account when Omima Commission is paid? Marked out of 1.00 Flag question O a. Omima Commission A/c 6,000 To Omima Partner's Capital Account 6,000 b. None of the options c. Omima Partner's Capital Account 6,000 To Omima Commission A/C 6,000 d. Omima Partner's Capital Account 6,000 To Profit and Loss Appropriation A/c 6,000 Previous page Next pageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started