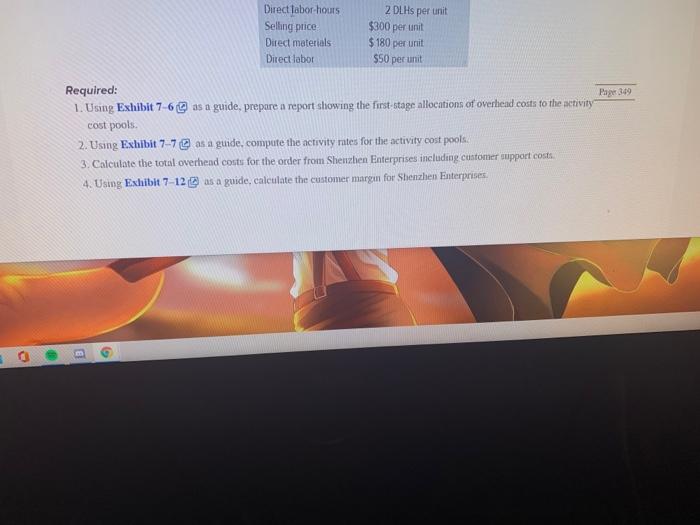

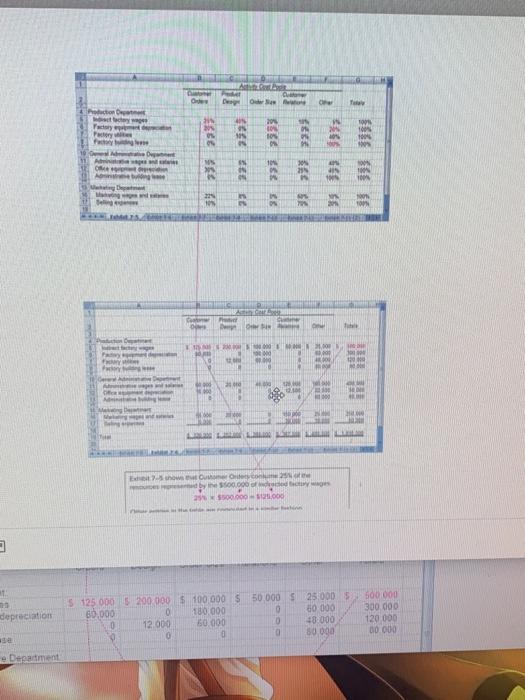

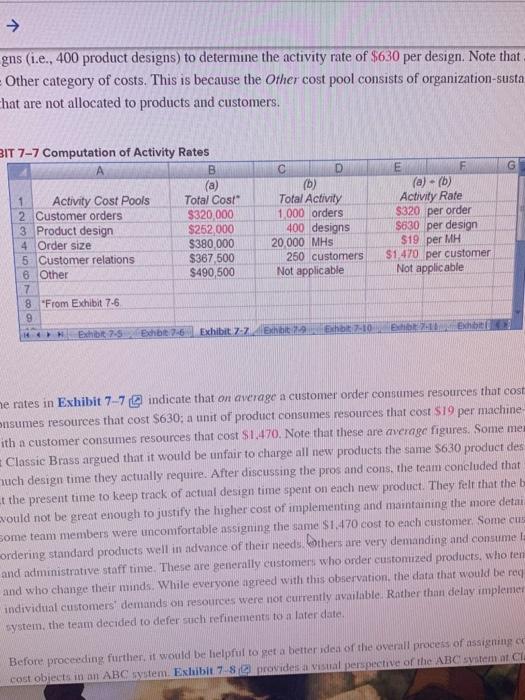

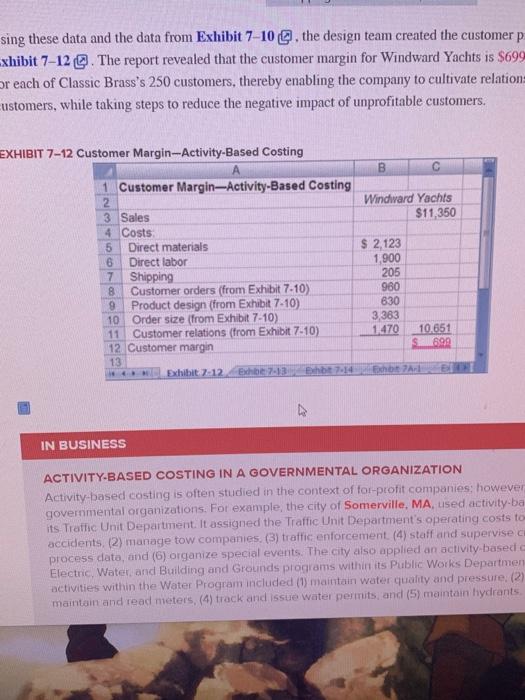

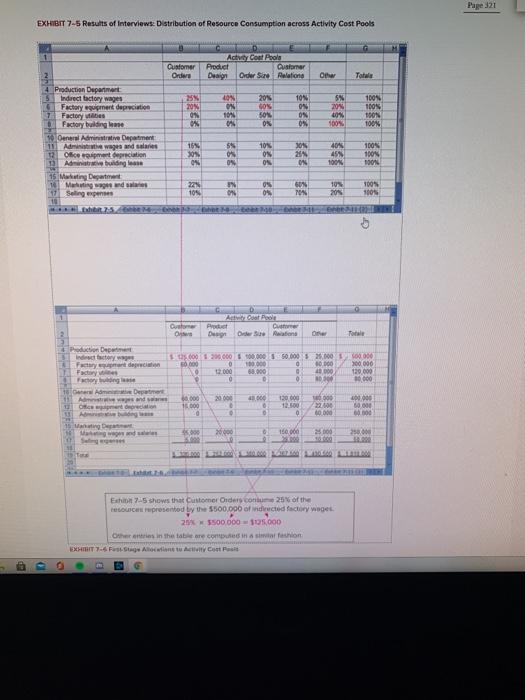

Direct labor hours Selling price Direct materials Direct labor 2 DLHS per unit $300 per unit $180 per unit $50 per unit Required: Paper 349 1. Using Exhibit 7-6 as a guide, prepare a report showing the first stage allocations of overhead costs to the activity cost pools. 2. Using Exhibit 7-7 as a guide, compute the activity rates for the activity cost pools 3. Calculate the total overhead costs for the order from Shenzhen Enterprises including customer support costs 4. Using Exhibit 7-12 as a guide, calculate the customer margin for Shenzhen Enterprises D 6 Dey who cy Petery wie 10 0 Du w 33 777 2528 39 735 73 10 DI w 21.00 . TET shows 500.000 2500.000 3 depreciation S 125 000 200 000 $ 100 000 $ 50.000 $25.000 5 60,000 180.000 50 000 12.000 50.000 0 48000 50.000 500 000 300.000 120 000 00 000 - Department gns (i.e., 400 product designs) to determine the activity rate of $630 per design. Note that Other category of costs. This is because the Other cost pool consists of organization-susta that are not allocated to products and customers. BIT 7-7 Computation of Activity Rates B G 1 Activity Cost Pools 2 Customer orders 3 Product design 4 Order size 5 Customer relations 6: Other 7 8 "From Exhibit 7-6 9 Total Cost" $320,000 $252 000 $380,000 $367 500 $490,500 D (b) Total Activity 1.000 orders 400 designs 20 000 MHs 250 customers Not applicable E F (a) (b) Activity Rate $320 per order $630 per design $19 per MH $1.470 per customer Not applicable Exhibit:10 E11Exhibit 144 Exhibit 7-9 Echbt76 Exhibit 7-7 Exhibit he rates in Exhibit 7-7 indicate that on average a customer order consumes resources that cost onsumes resources that cost $630, a unit of product consumes resources that cost $19 per machine ith a customer consumes resources that cost $1,470. Note that these are average figures. Some me Classic Brass argued that it would be unfair to charge all new products the same $630 product des uch design time they actually require. After discussing the pros and cons, the team concluded that t the present time to keep track of actual design time spent on each new product. They felt that the b vould not be great enough to justify the higher cost of implementing and maintaining the more detai Some team members were uncomfortable assigning the same $1.470 cost to ench customer. Some cus ordering standard products well in advance of their needs others are very demanding and consumel and administrative staff time. These are generally customers who order customized products, who ten and who change their minds. While everyone agreed with this observation, the data that would be req individual customers' demands on resources were not currently available. Rather than delay implemer system, the team decided to defer such refinement to a later date Before proceeding further, it would be helpful to get a better idea of the overall process of assigning cost objects in an ABC system. Exhibit7 8 e provides a visual perspective of the ABC vitam at sing these data and the data from Exhibit 7-10 . the design team created the customer p -xhibit 7-12 . The report revealed that the customer margin for Windward Yachts is $699 or each of Classic Brass's 250 customers, thereby enabling the company to cultivate relations customers, while taking steps to reduce the negative impact of unprofitable customers. EXHIBIT 7-12 Customer Margin---Activity-Based Costing A B 1 Customer Margin-Activity-Based Costing 2 Windliard Yachts 3 Sales $11,350 4 Costs 5 Direct materials $ 2,123 6 Direct labor 1,900 7 Shipping 205 8 Customer orders (from Exhibit 7-10) 980 9 Product design (from Exhibit 7-10) 630 10 Order size (from Exhibit 7-10) 3,363 11 Customer relations (from Exhibit 7-10) 1.470 10.651 12. Customer margin 899 13 Exhibit 2-12 Edhe 7-13Bhbt7.14hb Arl IN BUSINESS ACTIVITY-BASED COSTING IN A GOVERNMENTAL ORGANIZATION Activity-based costing is often studied in the context of for-profit companies, however governmental organizations. For example, the city of Somerville, MA, used activity-ba its Traffic Unit Department. It assigned the Traffic Unit Department's operating costs to accidents (2) manage tow companies (3) traffic enforcement (4) staff and supervise cu process data, and (6) organize special events. The city also applied an activity-based Electric, Water and Building and Grounds programs within its Public Works Departmen activities within the Water Program included (1) maintain water quality and pressure (2) maintain and read meters, (4) track and issue water permits and (5) maintain hydrants Page 321 EXHIBIT 7-5 Results of interviews: Distribution of Resource Consumption across Activity Cost Pools G Customer Order Actor Control Product Customer Dearg Order Sie Relations Other Tata 20 COM 20N ON 04 ON 104 04 10N ON ON ON SN 209 40% 500 100N TOOS TOON 100% ON , 4 Production Department Indirect actory wages Factory agent depreciation 7 Factory was 0 Factory building eneral Administrative Department 11 Admin wages and salaries Oficerection 1 A buildings 15 Makating Department 10 Minggu de 11 Selling expenses 10 ht:52M 5 06 ON 10 ON 304 2013 4045 45 100% 100% DON ON IN 0% 10% SON 70 100 0 105 2013 1001 who Or Tole A Google Custom Q Os De Die wat On Production Dept factory 5.000 1.200.000 100.000 150.000.000 Fetyder 000 100 000 10.000 Factory 2.000 50.000 0 000 Feng 0 0 20.00 10 Ad Department And 0 000 20.000 130 000 000 Ocene 16.000 . 12.00 0 Dod 10000 300.000 120.000 10.000 0.000 8000 6000 Mang Det 000 150 pod 200 Ex-5 shows the customer des contum 25% of the tesources represented by the $500.000 of inducted factory vogel 20 3500.000 - 10.000 Others in the table are come in a life EXHIT 7-5 F Anti Cestit Direct labor hours Selling price Direct materials Direct labor 2 DLHS per unit $300 per unit $180 per unit $50 per unit Required: Paper 349 1. Using Exhibit 7-6 as a guide, prepare a report showing the first stage allocations of overhead costs to the activity cost pools. 2. Using Exhibit 7-7 as a guide, compute the activity rates for the activity cost pools 3. Calculate the total overhead costs for the order from Shenzhen Enterprises including customer support costs 4. Using Exhibit 7-12 as a guide, calculate the customer margin for Shenzhen Enterprises D 6 Dey who cy Petery wie 10 0 Du w 33 777 2528 39 735 73 10 DI w 21.00 . TET shows 500.000 2500.000 3 depreciation S 125 000 200 000 $ 100 000 $ 50.000 $25.000 5 60,000 180.000 50 000 12.000 50.000 0 48000 50.000 500 000 300.000 120 000 00 000 - Department gns (i.e., 400 product designs) to determine the activity rate of $630 per design. Note that Other category of costs. This is because the Other cost pool consists of organization-susta that are not allocated to products and customers. BIT 7-7 Computation of Activity Rates B G 1 Activity Cost Pools 2 Customer orders 3 Product design 4 Order size 5 Customer relations 6: Other 7 8 "From Exhibit 7-6 9 Total Cost" $320,000 $252 000 $380,000 $367 500 $490,500 D (b) Total Activity 1.000 orders 400 designs 20 000 MHs 250 customers Not applicable E F (a) (b) Activity Rate $320 per order $630 per design $19 per MH $1.470 per customer Not applicable Exhibit:10 E11Exhibit 144 Exhibit 7-9 Echbt76 Exhibit 7-7 Exhibit he rates in Exhibit 7-7 indicate that on average a customer order consumes resources that cost onsumes resources that cost $630, a unit of product consumes resources that cost $19 per machine ith a customer consumes resources that cost $1,470. Note that these are average figures. Some me Classic Brass argued that it would be unfair to charge all new products the same $630 product des uch design time they actually require. After discussing the pros and cons, the team concluded that t the present time to keep track of actual design time spent on each new product. They felt that the b vould not be great enough to justify the higher cost of implementing and maintaining the more detai Some team members were uncomfortable assigning the same $1.470 cost to ench customer. Some cus ordering standard products well in advance of their needs others are very demanding and consumel and administrative staff time. These are generally customers who order customized products, who ten and who change their minds. While everyone agreed with this observation, the data that would be req individual customers' demands on resources were not currently available. Rather than delay implemer system, the team decided to defer such refinement to a later date Before proceeding further, it would be helpful to get a better idea of the overall process of assigning cost objects in an ABC system. Exhibit7 8 e provides a visual perspective of the ABC vitam at sing these data and the data from Exhibit 7-10 . the design team created the customer p -xhibit 7-12 . The report revealed that the customer margin for Windward Yachts is $699 or each of Classic Brass's 250 customers, thereby enabling the company to cultivate relations customers, while taking steps to reduce the negative impact of unprofitable customers. EXHIBIT 7-12 Customer Margin---Activity-Based Costing A B 1 Customer Margin-Activity-Based Costing 2 Windliard Yachts 3 Sales $11,350 4 Costs 5 Direct materials $ 2,123 6 Direct labor 1,900 7 Shipping 205 8 Customer orders (from Exhibit 7-10) 980 9 Product design (from Exhibit 7-10) 630 10 Order size (from Exhibit 7-10) 3,363 11 Customer relations (from Exhibit 7-10) 1.470 10.651 12. Customer margin 899 13 Exhibit 2-12 Edhe 7-13Bhbt7.14hb Arl IN BUSINESS ACTIVITY-BASED COSTING IN A GOVERNMENTAL ORGANIZATION Activity-based costing is often studied in the context of for-profit companies, however governmental organizations. For example, the city of Somerville, MA, used activity-ba its Traffic Unit Department. It assigned the Traffic Unit Department's operating costs to accidents (2) manage tow companies (3) traffic enforcement (4) staff and supervise cu process data, and (6) organize special events. The city also applied an activity-based Electric, Water and Building and Grounds programs within its Public Works Departmen activities within the Water Program included (1) maintain water quality and pressure (2) maintain and read meters, (4) track and issue water permits and (5) maintain hydrants Page 321 EXHIBIT 7-5 Results of interviews: Distribution of Resource Consumption across Activity Cost Pools G Customer Order Actor Control Product Customer Dearg Order Sie Relations Other Tata 20 COM 20N ON 04 ON 104 04 10N ON ON ON SN 209 40% 500 100N TOOS TOON 100% ON , 4 Production Department Indirect actory wages Factory agent depreciation 7 Factory was 0 Factory building eneral Administrative Department 11 Admin wages and salaries Oficerection 1 A buildings 15 Makating Department 10 Minggu de 11 Selling expenses 10 ht:52M 5 06 ON 10 ON 304 2013 4045 45 100% 100% DON ON IN 0% 10% SON 70 100 0 105 2013 1001 who Or Tole A Google Custom Q Os De Die wat On Production Dept factory 5.000 1.200.000 100.000 150.000.000 Fetyder 000 100 000 10.000 Factory 2.000 50.000 0 000 Feng 0 0 20.00 10 Ad Department And 0 000 20.000 130 000 000 Ocene 16.000 . 12.00 0 Dod 10000 300.000 120.000 10.000 0.000 8000 6000 Mang Det 000 150 pod 200 Ex-5 shows the customer des contum 25% of the tesources represented by the $500.000 of inducted factory vogel 20 3500.000 - 10.000 Others in the table are come in a life EXHIT 7-5 F Anti Cestit