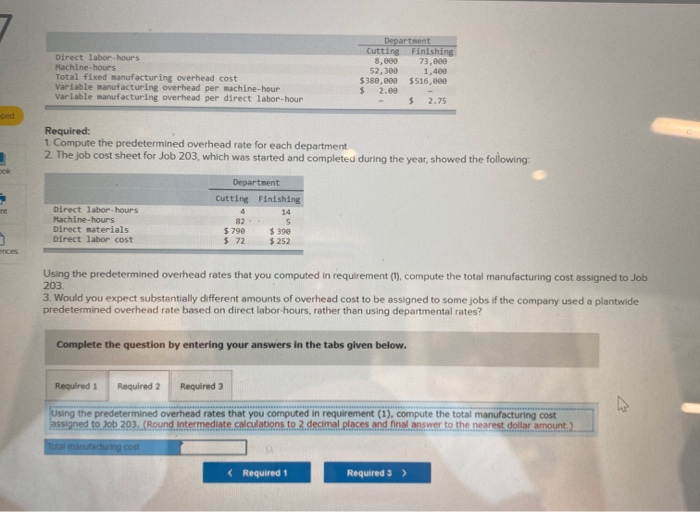

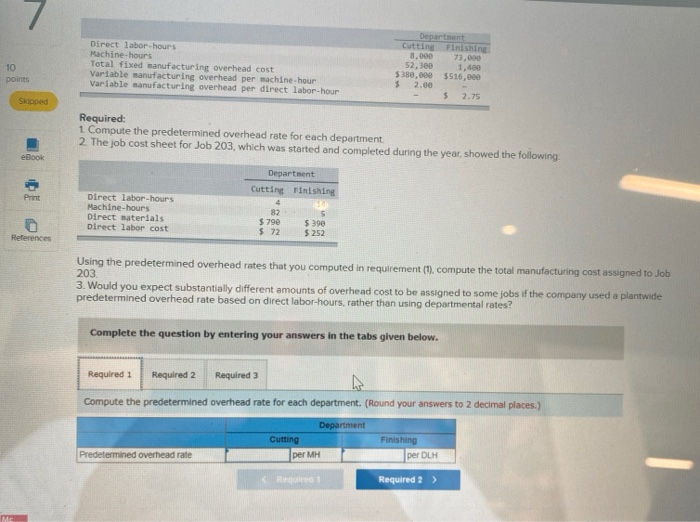

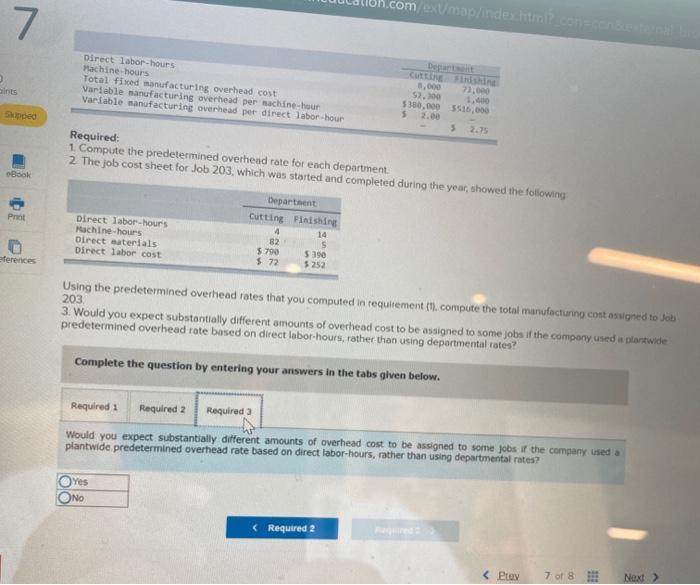

Direct labor-hours Machine-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour Department Cutting Finishing 8,000 73,000 52,300 1,400 $380,000 $516,000 $ 2.00 $ 2.75 Required: 1. Compute the predetermined overhead rate for each department 2 The job cost sheet for Job 203, which was started and completed during the year, showed the following: Direct labor-hours Machine-hours Direct materials Direct labor cost Department Cutting Finishing 14 82 5 $ 790 $ 390 $ 72 $ 252 Using the predetermined overhead rates that you computed in requirement (1), compute the total manufacturing cost assigned to Job 203 3. Would you expect substantially different amounts of overhead cost to be assigned to some jobs if the company used a plantwide predetermined overhead rate based on direct labor hours, rather than using departmental rates? Complete the question by entering your answers in the tabs given below. Required 1 Required 2 Required 3 Using the predetermined overhead rates that you computed in requirement (1), compute the total manufacturing cost assigned to Job 203. (Round Intermediate calculations to 2 decimal places and final answer to the nearest dollar amount Total manufacturing cost 10 points Direct labor-hours Machine-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour Department Cutting Finishing 8.000 73.000 52,300 1,400 $380,000 $516,000 $ 2.00 5 2.75 Skipped Required: 1. Compute the predetermined overhead rate for each department 2 The job cost sheet for Job 203, which was started and completed during the year, showed the following: eBook Print Direct labor-hours Machine-hours Direct materials Direct labor cost Department Cutting Finishing 4 82 $ 79e $ 390 $ 72 $ 252 References Using the predetermined overhead rates that you computed in requirement (1), compute the total manufacturing cost assigned to Job 203 3. Would you expect substantially different amounts of overhead cost to be assigned to some jobs if the company used a plantwide predetermined overhead rate based on direct labor-hours, rather than using departmental rates? Complete the question by entering your answers in the tabs given below. Required 1 Required 2 Required 3 Compute the predetermined overhead rate for each department. (Round your answers to 2 decimal places.) Department Cutting Finishing Predetermined overhead rate per MH per DLH Required Required 2 > M .com/ext/map/index.html?con consekterna 7 2 Direct labor-hours Machine-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor hour Sints Department Cutting Finishing 3.000 73.000 52,300 1,400 $380,000 $516,000 5 2.00 5 2.75 Skloped Required: 1. Compute the predetermined overhead rate for each department 2. The job cost sheet for Job 203, which was started and completed during the year, showed the following eBook Print Direct labor-hours Machine-hours Direct materials Direct labor cost Department Cutting Finishing 4 14 82 5 $ 790 $ 390 $ 72 $ 252 eferences Using the predetermined overhead rates that you computed in requirement (1), compute the total manufacturing cost assigned to Job 203 3. Would you expect substantially different amounts of overhead cost to be assigned to some jobs if the company used a plantwide predetermined overhead rate based on direct labor-hours, rather than using departmental rates? Complete the question by entering your answers in the tabs given below. Required 1 Required 2 Required 3 Would you expect substantially different amounts of overhead cost to be assigned to some jobs if the company used a plantwide predetermined overhead rate based on direct labor-hours, rather than using departmental rates? Yes ONO