Answered step by step

Verified Expert Solution

Question

1 Approved Answer

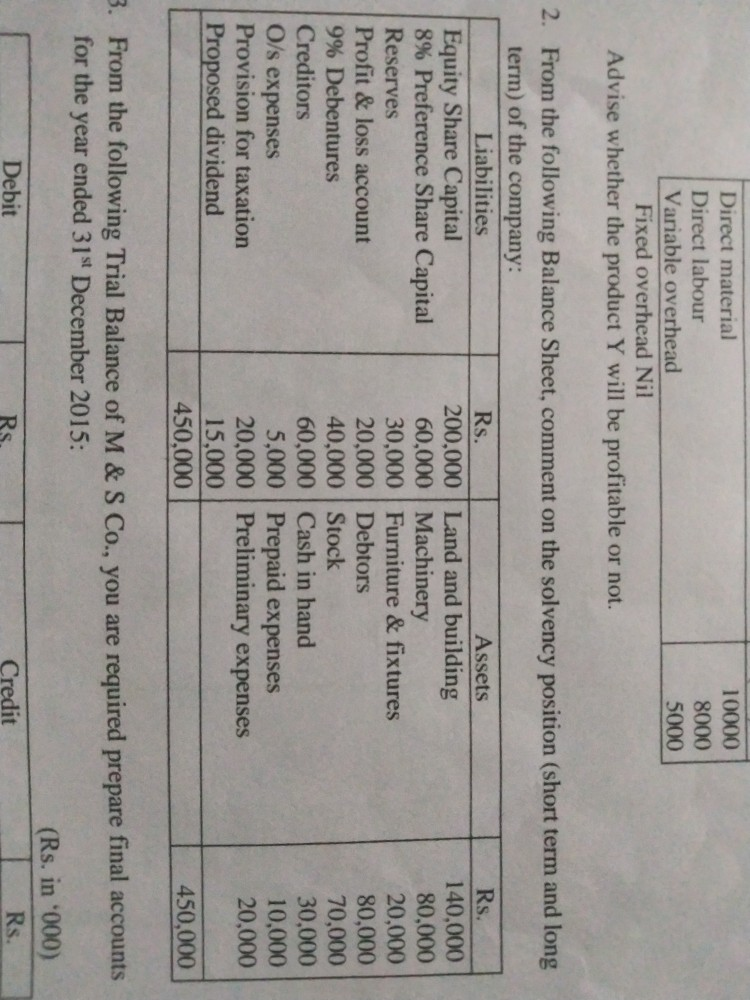

Direct material Direct labour Variable overhead Fixed overhead Nil Advise whether the product Y will be profitable or not. 10000 8000 5000 2. From the

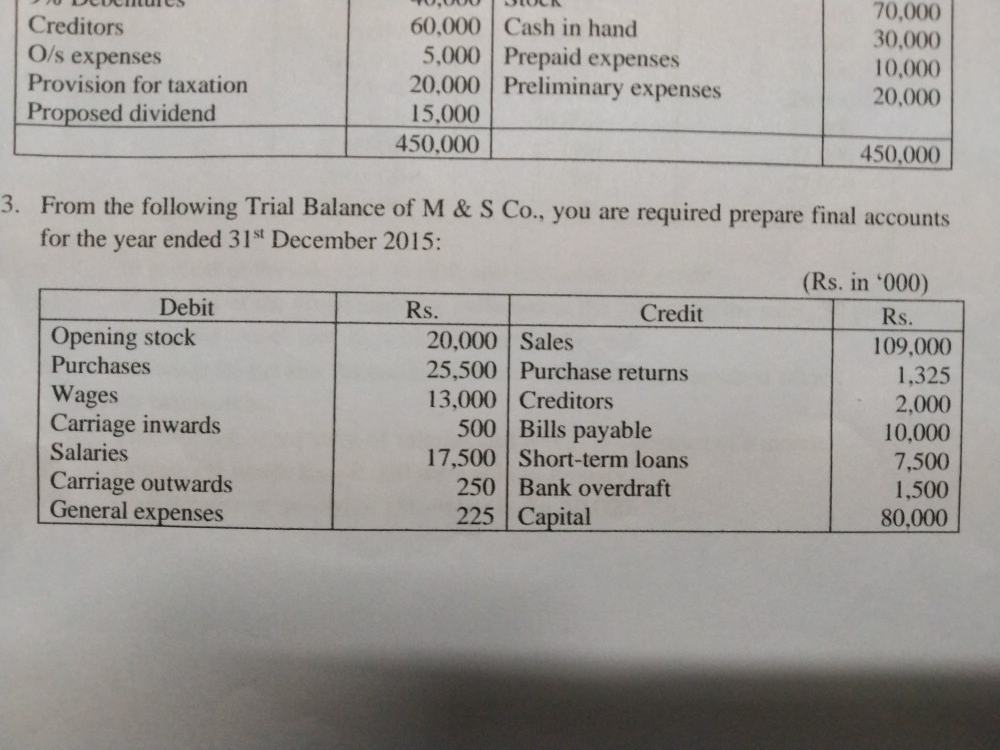

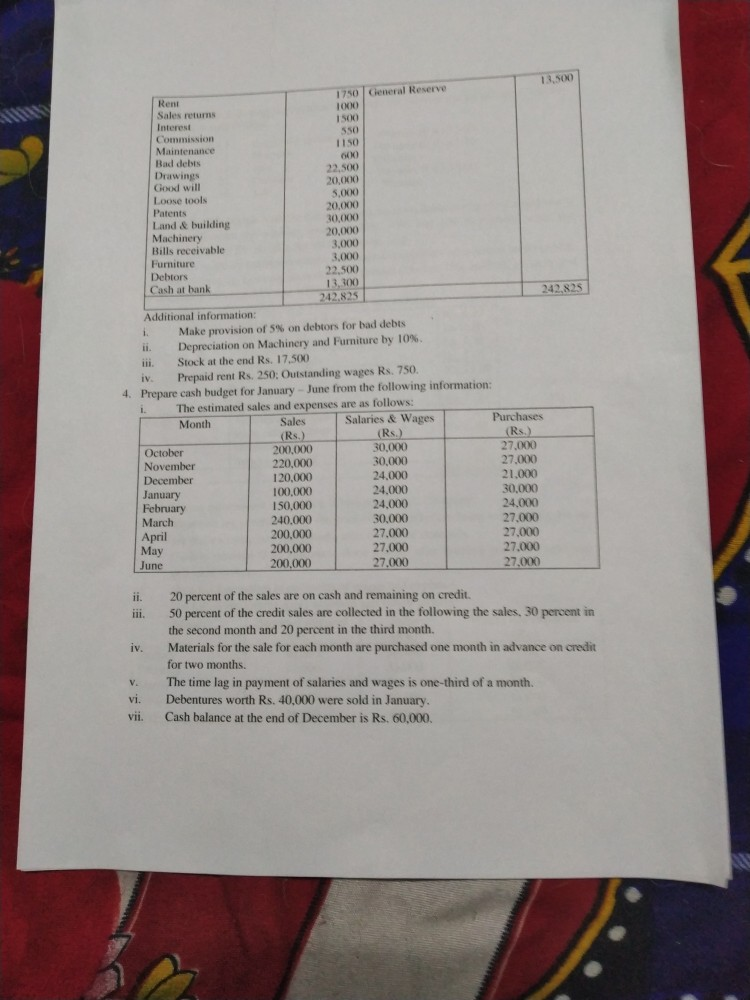

Direct material Direct labour Variable overhead Fixed overhead Nil Advise whether the product Y will be profitable or not. 10000 8000 5000 2. From the following Balance Sheet, comment on the solvency position (short term and long term) of the company: Liabilities Rs. Assets Rs. Equity Share Capital 200,000 Land and building 140,000 8% Preference Share Capital 60,000 Machinery 80,000 Reserves 30,000 Furniture & fixtures 20,000 Profit & loss account 20,000 Debtors 80,000 9% Debentures 40,000 Stock 70,000 Creditors 60,000 Cash in hand 30,000 O/s expenses 5,000 Prepaid expenses 10,000 Provision for taxation 20,000 Preliminary expenses 20,000 Proposed dividend 15,000 450,000 450,000 3. From the following Trial Balance of M&S Co., you are required prepare final accounts for the year ended 31st December 2015: (Rs. in '000) Debit Credit Rs. Creditors O/s expenses Provision for taxation Proposed dividend 60,000 Cash in hand 5,000 Prepaid expenses 20,000 Preliminary expenses 15.000 450,000 70,000 30,000 10,000 20,000 450,000 3. From the following Trial Balance of M & S Co., you are required prepare final accounts for the year ended 31st December 2015: (Rs. in 000) Debit Rs. Credit Rs. Opening stock 20,000 Sales 109,000 Purchases 25,500 Purchase returns 1.325 Wages 13,000 Creditors 2.000 Carriage inwards 500 Bills payable 10,000 Salaries 17,500 Short-term loans 7,500 Carriage outwards 250 Bank overdraft 1,500 225 Capital 80,000 General expenses 13 SONO 1750 General Reserve Reni 1000 Sales retums 1500 Interest 50 Commission I ISO Maintenance Bad debts 600 Drawings 22.500 Good will 20.000 Loose tools 5.000 Patents 20,000 Land & building 30.000 Machinery 20.000 Bills receivable 3.000 Furniture 3.000 Debtors 22.500 Cash at bank 13.300 242.825 242.825 Additional information: Make provision of 5% on debtors for bad debts Depreciation on Machinery and Furniture by 10% iii. Stock at the end Rs. 17.500 IV Prepaid rent Rs. 250: Outstanding wages Rs.750. 4. Prepare cash budget for January - June from the following information: 1. The estimated sales and expenses are as follows: Month Sales Salaries & Wages Purchases (Rs.) (Rs.) (Rs.) October 200,000 30.000 27.000 November 220,000 30,000 27.000 December 120,000 24,000 21,000 January 100.COM 24.000 30,000 February 150,000 24.000 24.000 March 240,000 30,000 27.000 April 200,000 27.000 27,000 May 200,000 27.000 27.000 June 200,000 27.000 27,000 ii. ill. iv. 20 percent of the sales are on cash and remaining on credit. 50 percent of the credit sales are collected in the following the sales. 30 percent in the second month and 20 percent in the third month. Materials for the sale for each month are purchased one month in advance on credit for two months. The time lag in payment of salaries and wages is one-third of a month. Debentures worth Rs. 40,000 were sold in January. Cash balance at the end of December is Rs. 60,000. V. vi. vii. Direct material Direct labour Variable overhead Fixed overhead Nil Advise whether the product Y will be profitable or not. 10000 8000 5000 2. From the following Balance Sheet, comment on the solvency position (short term and long term) of the company: Liabilities Rs. Assets Rs. Equity Share Capital 200,000 Land and building 140,000 8% Preference Share Capital 60,000 Machinery 80,000 Reserves 30,000 Furniture & fixtures 20,000 Profit & loss account 20,000 Debtors 80,000 9% Debentures 40,000 Stock 70,000 Creditors 60,000 Cash in hand 30,000 O/s expenses 5,000 Prepaid expenses 10,000 Provision for taxation 20,000 Preliminary expenses 20,000 Proposed dividend 15,000 450,000 450,000 3. From the following Trial Balance of M&S Co., you are required prepare final accounts for the year ended 31st December 2015: (Rs. in '000) Debit Credit Rs. Creditors O/s expenses Provision for taxation Proposed dividend 60,000 Cash in hand 5,000 Prepaid expenses 20,000 Preliminary expenses 15.000 450,000 70,000 30,000 10,000 20,000 450,000 3. From the following Trial Balance of M & S Co., you are required prepare final accounts for the year ended 31st December 2015: (Rs. in 000) Debit Rs. Credit Rs. Opening stock 20,000 Sales 109,000 Purchases 25,500 Purchase returns 1.325 Wages 13,000 Creditors 2.000 Carriage inwards 500 Bills payable 10,000 Salaries 17,500 Short-term loans 7,500 Carriage outwards 250 Bank overdraft 1,500 225 Capital 80,000 General expenses 13 SONO 1750 General Reserve Reni 1000 Sales retums 1500 Interest 50 Commission I ISO Maintenance Bad debts 600 Drawings 22.500 Good will 20.000 Loose tools 5.000 Patents 20,000 Land & building 30.000 Machinery 20.000 Bills receivable 3.000 Furniture 3.000 Debtors 22.500 Cash at bank 13.300 242.825 242.825 Additional information: Make provision of 5% on debtors for bad debts Depreciation on Machinery and Furniture by 10% iii. Stock at the end Rs. 17.500 IV Prepaid rent Rs. 250: Outstanding wages Rs.750. 4. Prepare cash budget for January - June from the following information: 1. The estimated sales and expenses are as follows: Month Sales Salaries & Wages Purchases (Rs.) (Rs.) (Rs.) October 200,000 30.000 27.000 November 220,000 30,000 27.000 December 120,000 24,000 21,000 January 100.COM 24.000 30,000 February 150,000 24.000 24.000 March 240,000 30,000 27.000 April 200,000 27.000 27,000 May 200,000 27.000 27.000 June 200,000 27.000 27,000 ii. ill. iv. 20 percent of the sales are on cash and remaining on credit. 50 percent of the credit sales are collected in the following the sales. 30 percent in the second month and 20 percent in the third month. Materials for the sale for each month are purchased one month in advance on credit for two months. The time lag in payment of salaries and wages is one-third of a month. Debentures worth Rs. 40,000 were sold in January. Cash balance at the end of December is Rs. 60,000. V. vi. vii

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started