Answered step by step

Verified Expert Solution

Question

1 Approved Answer

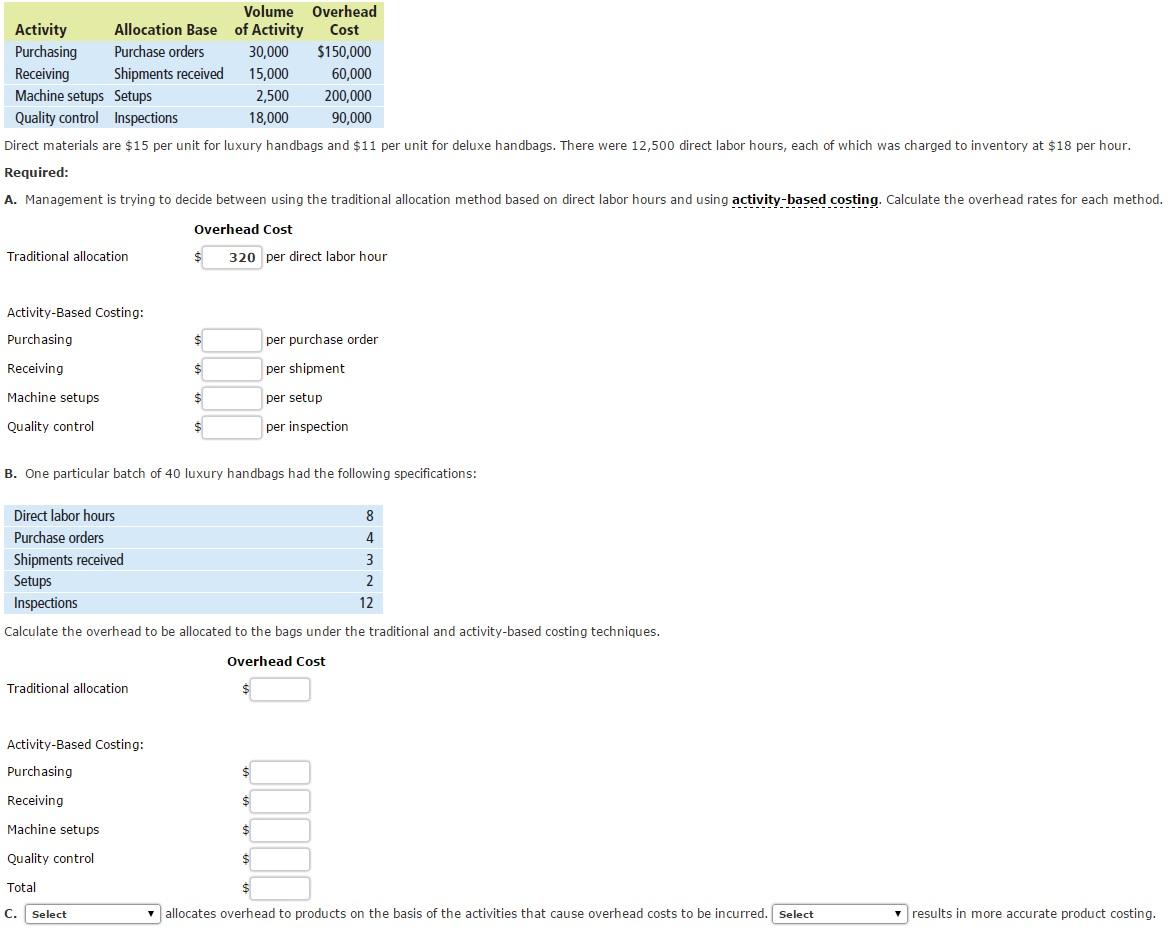

Volume Overhead Cost Activity Purchasing Purchase orders $150,000 Receiving Shipments received 60,000 Machine setups Setups 200,000 Quality control Inspections 90,000 Direct materials are $15

Volume Overhead Cost Activity Purchasing Purchase orders $150,000 Receiving Shipments received 60,000 Machine setups Setups 200,000 Quality control Inspections 90,000 Direct materials are $15 per unit for luxury handbags and $11 per unit for deluxe handbags. There were 12,500 direct labor hours, each of which was charged to inventory at $18 per hour. Required: Allocation Base of Activity A. Management is trying to decide between using the traditional allocation method based on direct labor hours and using activity-based costing. Calculate the overhead rates for each method. Overhead Cost 320 per direct labor hour Traditional allocation Activity-Based Costing: Purchasing Receiving Machine setups Quality control Traditional allocation $ Activity-Based Costing: Purchasing Receiving Machine setups Quality control Total C. Select $ $ $ 30,000 15,000 2,500 18,000 $ B. One particular batch of 40 luxury handbags had the following specifications: Direct labor hours Purchase orders Shipments received Setups Inspections Calculate the overhead to be allocated to the bags under the traditional and activity-based costing techniques. Overhead Cost per purchase order per shipment per setup per inspection. $ $ $ 000 8 4 3 2 12 allocates overhead to products on the basis of the activities that cause overhead costs to be incurred. Select results in more accurate product costing.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A To calculate overhead using the Traditional allocation method Total Overhead Direct Labor Hours To...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started