Answered step by step

Verified Expert Solution

Question

1 Approved Answer

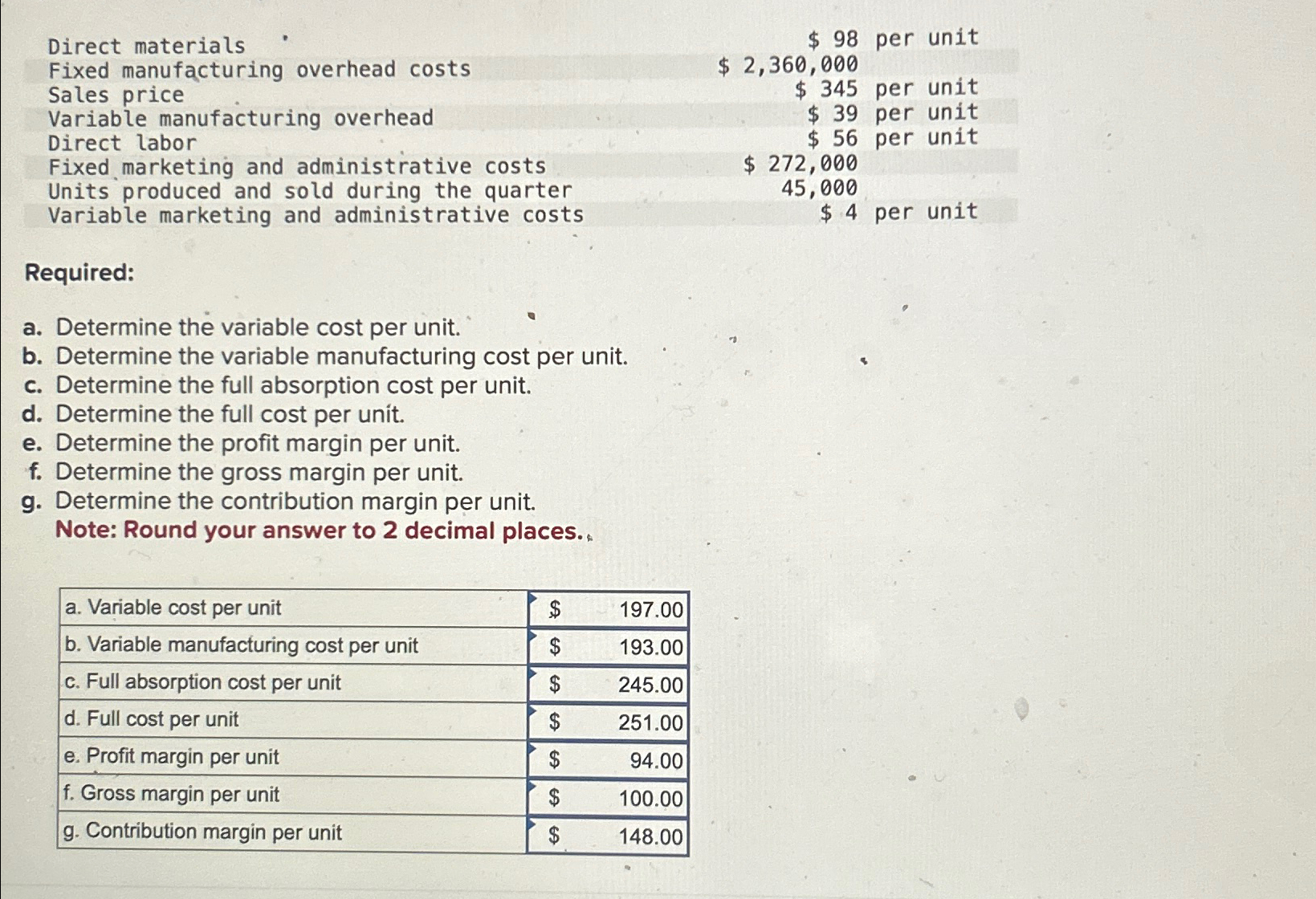

Direct materials Fixed manufacturing overhead costs Sales price Variable manufacturing overhead Direct labor Fixed marketing and administrative costs Units produced and sold during the

Direct materials Fixed manufacturing overhead costs Sales price Variable manufacturing overhead Direct labor Fixed marketing and administrative costs Units produced and sold during the quarter Variable marketing and administrative costs Required: a. Determine the variable cost per unit. b. Determine the variable manufacturing cost per unit. c. Determine the full absorption cost per unit. d. Determine the full cost per unit. e. Determine the profit margin per unit. f. Determine the gross margin per unit. g. Determine the contribution margin per unit. Note: Round your answer to 2 decimal places.. $ 98 per unit $ 2,360,000 $ 345 per unit $ 39 per unit $ 56 per unit $ 272,000 45,000 $ 4 per unit a. Variable cost per unit $ 197.00 b. Variable manufacturing cost per unit $ 193.00 c. Full absorption cost per unit $ 245.00 d. Full cost per unit $ 251.00 e. Profit margin per unit $ 94.00 f. Gross margin per unit $ 100.00 g. Contribution margin per unit $ 148.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Variable cost per unit 19700 We directly see variable costs include direct materials 98 variable m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started