Directions:

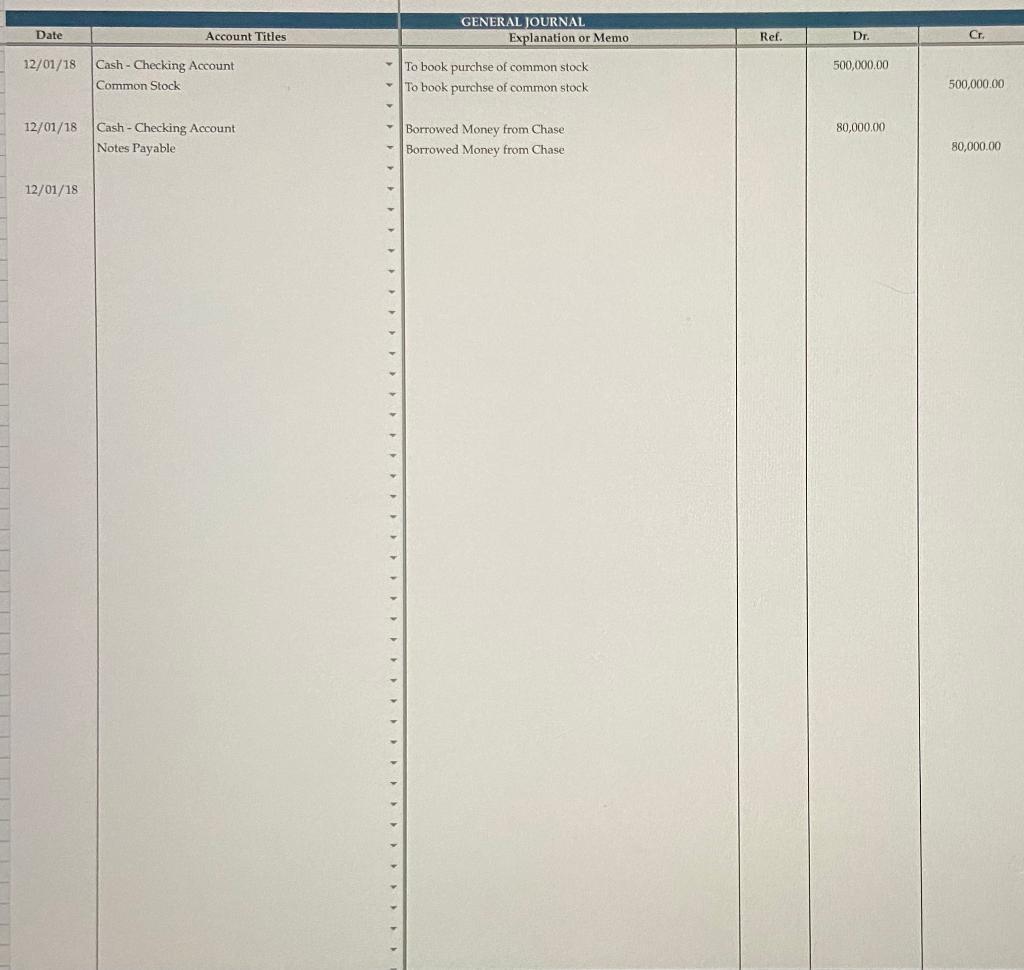

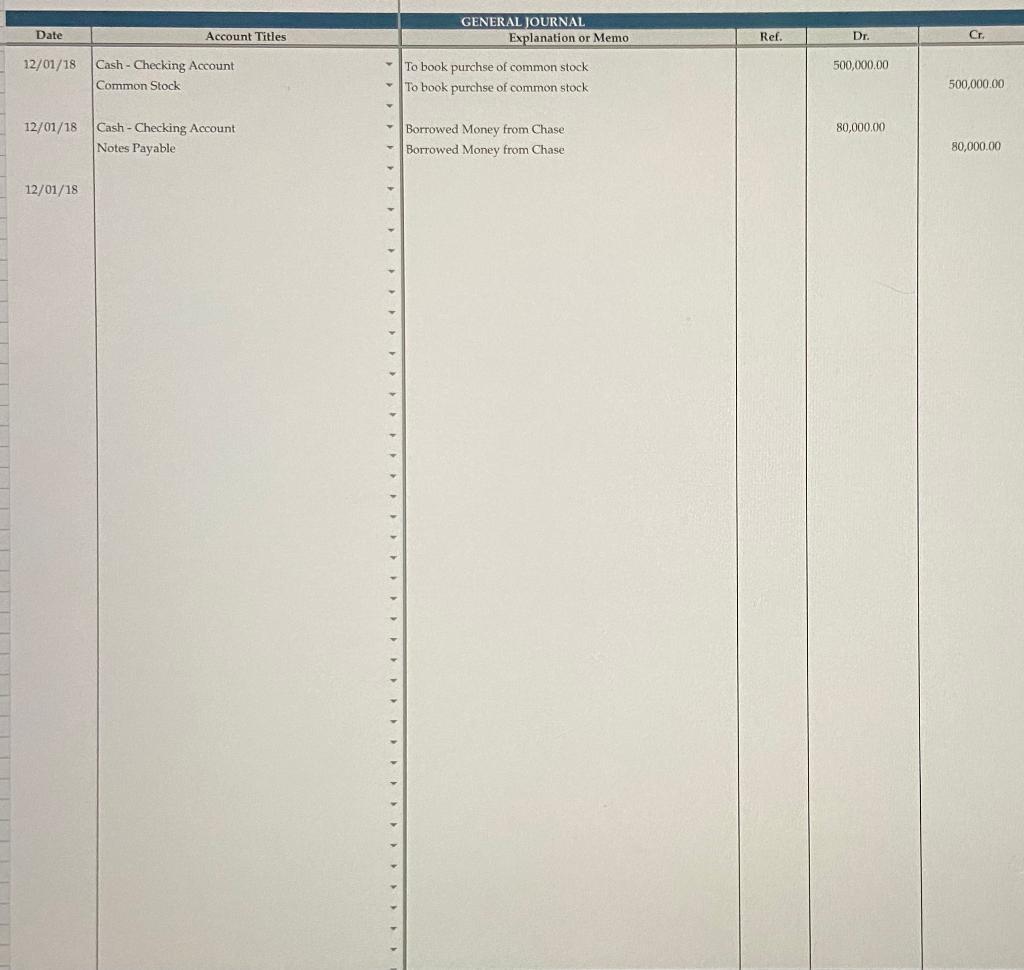

1) Journalize the financial transactions. List, Debit Account(s) first; Credit Account(s) next. And also write a brief explanation for each transaction.

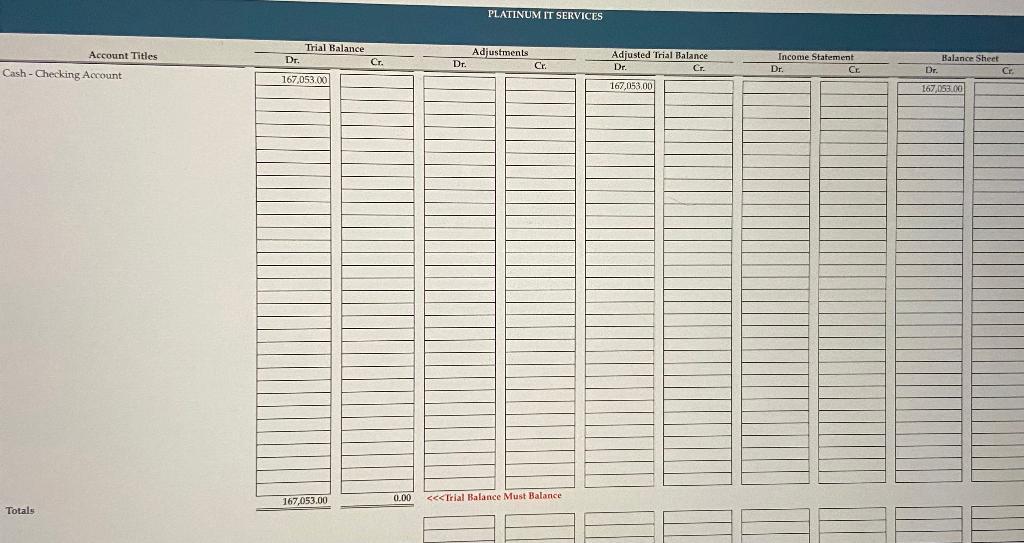

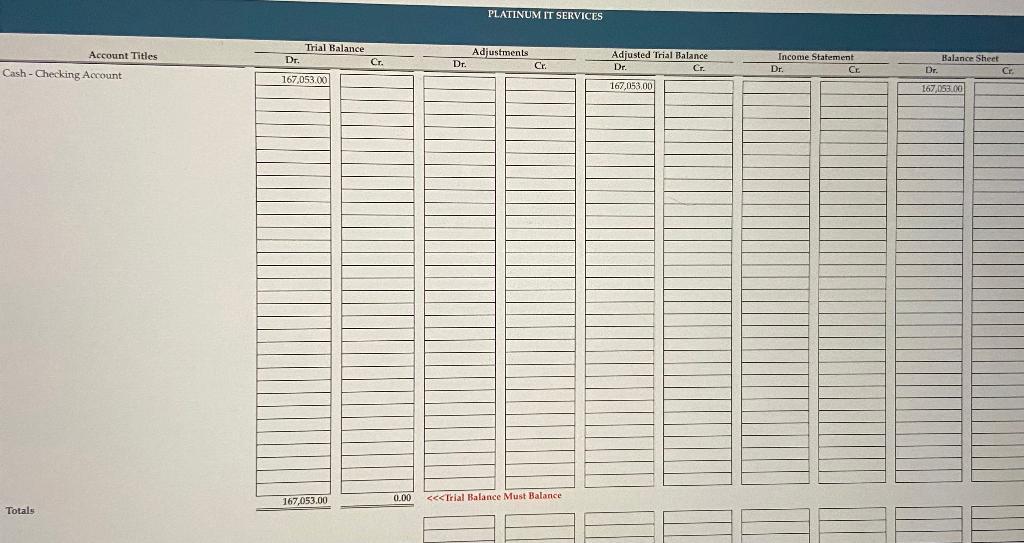

2. Prepare a Trial Balance.

3. Prepare an Adjusting entry.

Here is the information for the adjustments entry :

- Compute and record the adjustment for supplies used during the month. An inventory showed supplies on hand of $535.

-Record the adjustment for depreciation of all fixed assets.

-Record the adjustment for amortization of all intangible assets.

-Record the adjustment for interest payable.

4. Complete the worksheet, where it says "Worksheet".

5. Journalize and post the adjusting and closing entries.

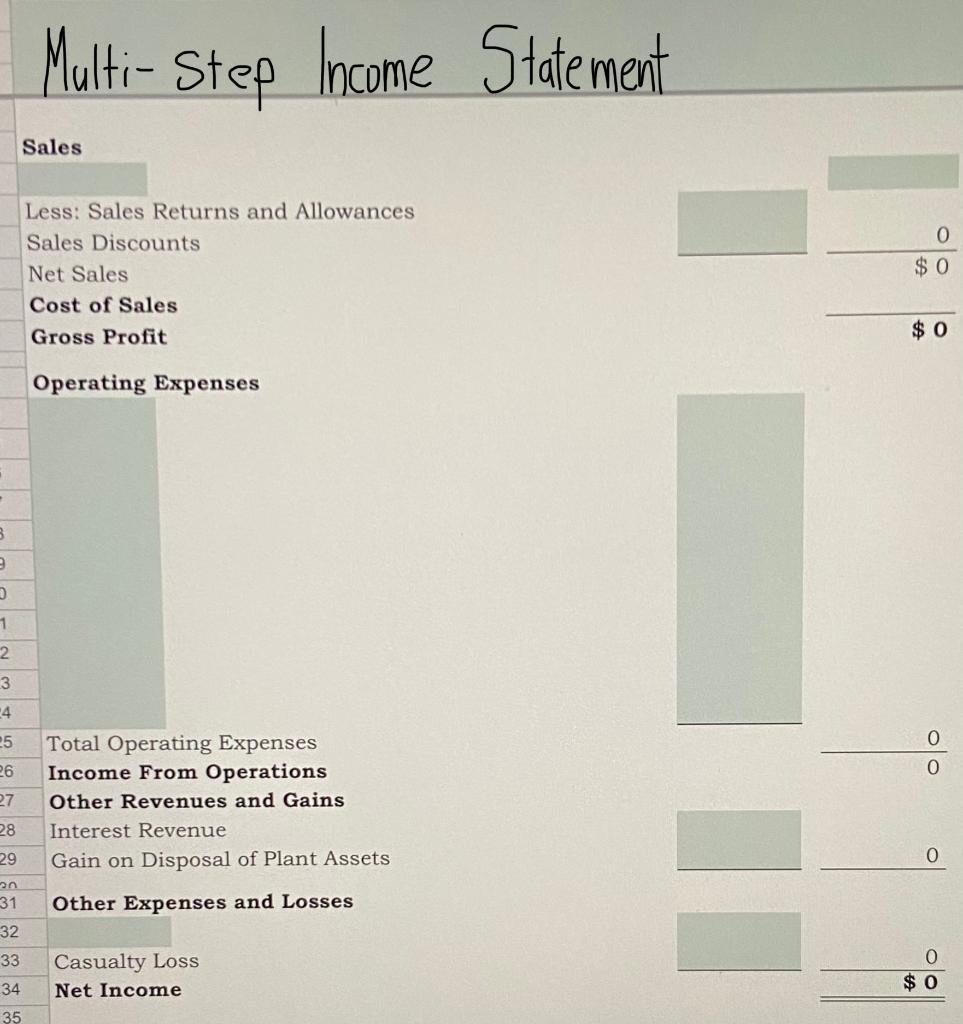

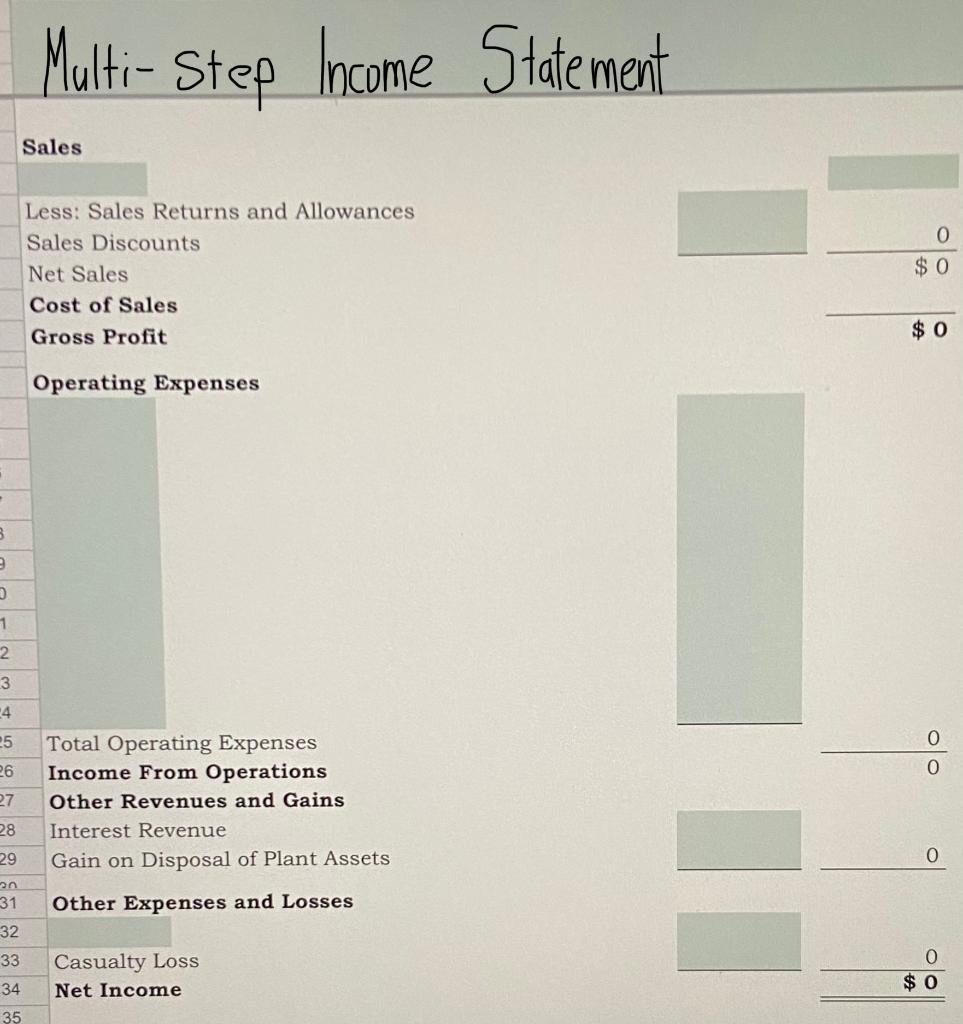

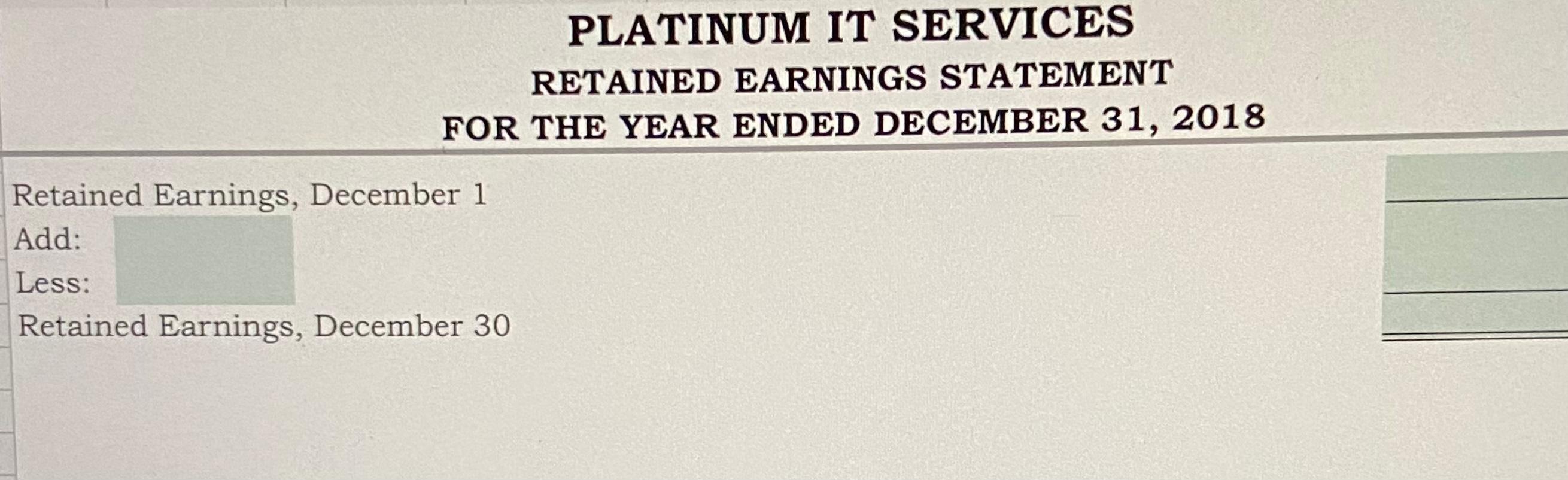

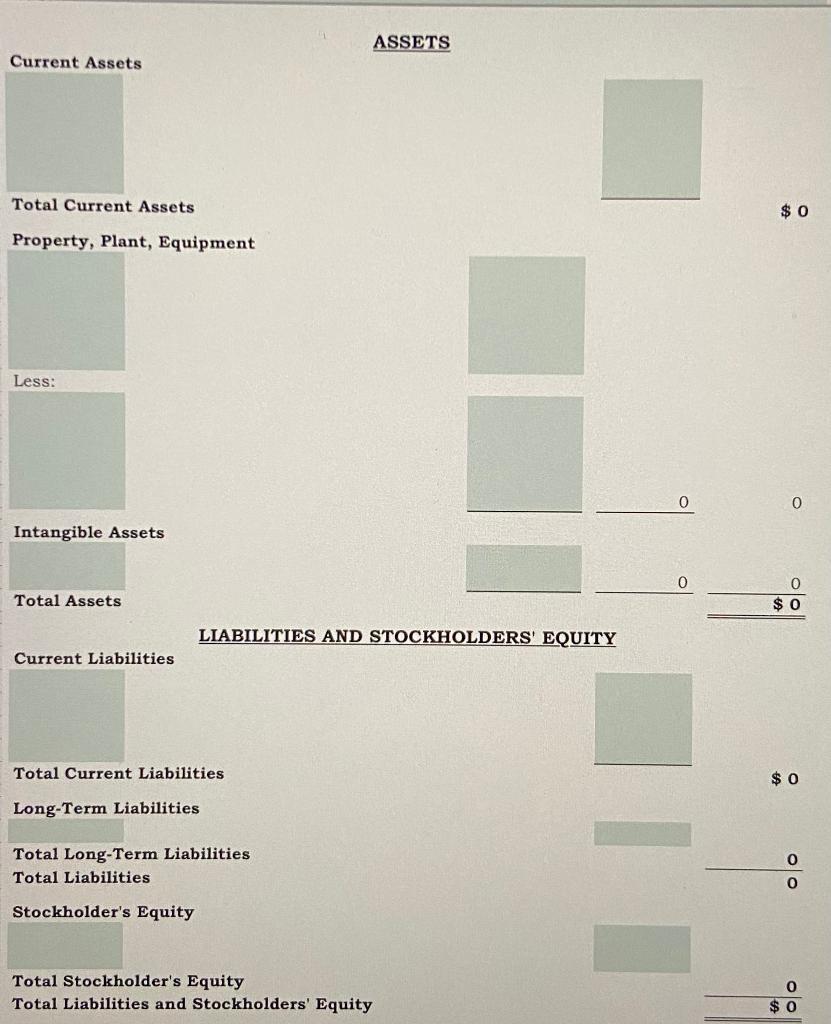

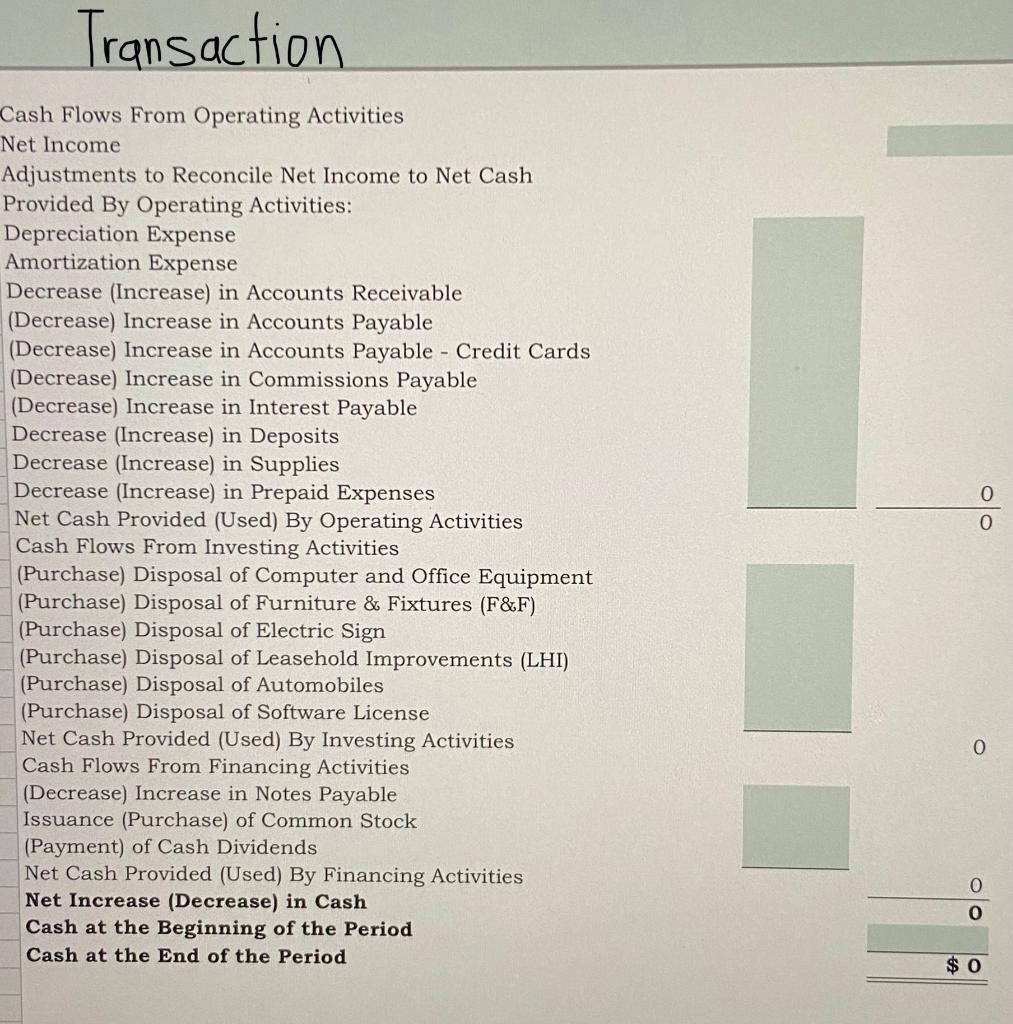

6. Prepare a Multi-Step Income Statement, Statement of Retained Earnings, Classified Balance Sheet and Statement of Cash Flows(Using the indirect method)

(Fill in the blanks for Multi-Step Income Statment)

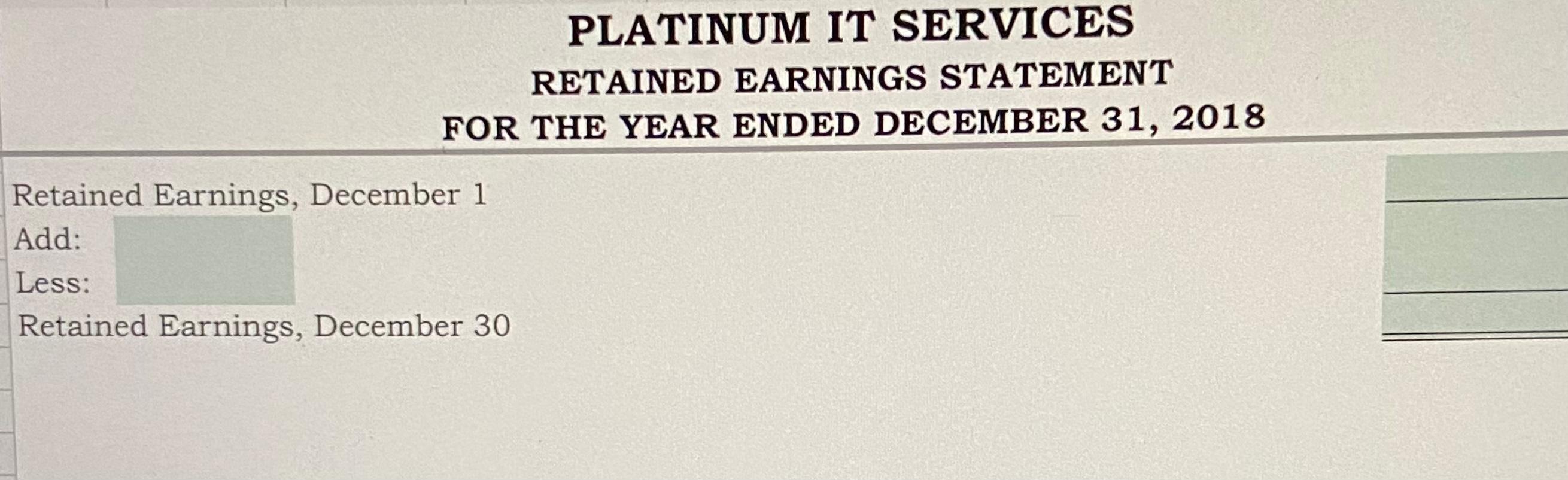

(Fill in the blanks for RETAINED EARNINGS STATEMENT)

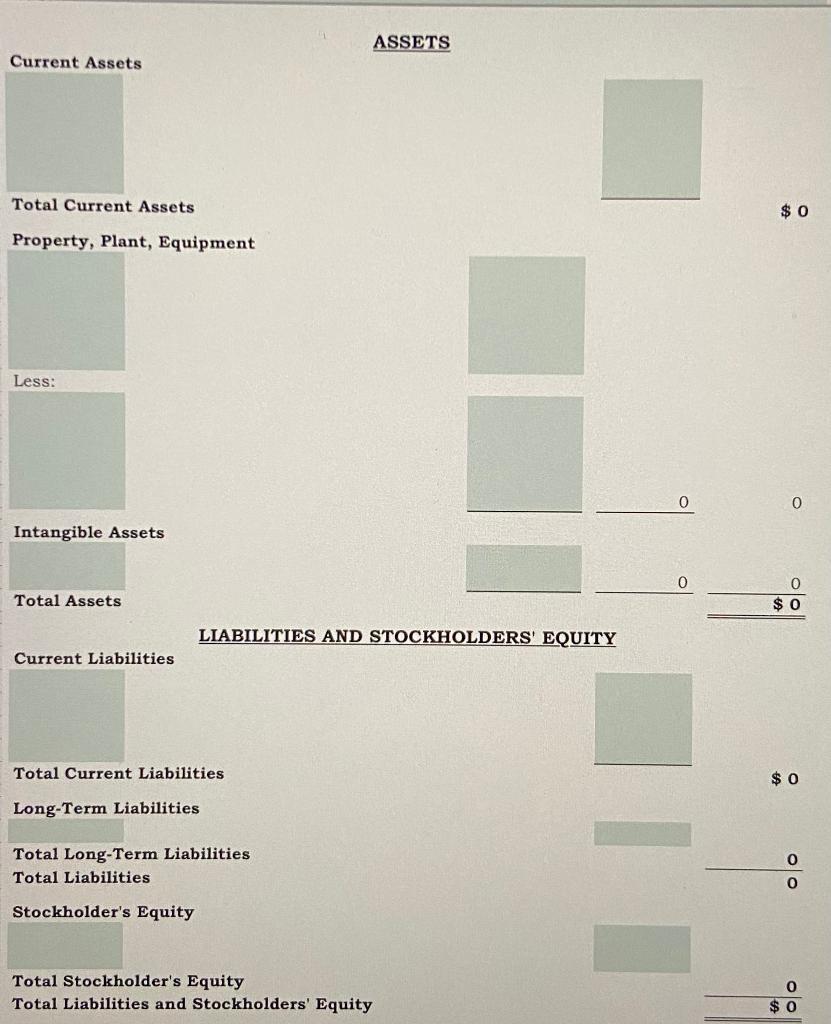

(Fill in the blanks for Asset's and Liabilites, Stockholder's Equity)

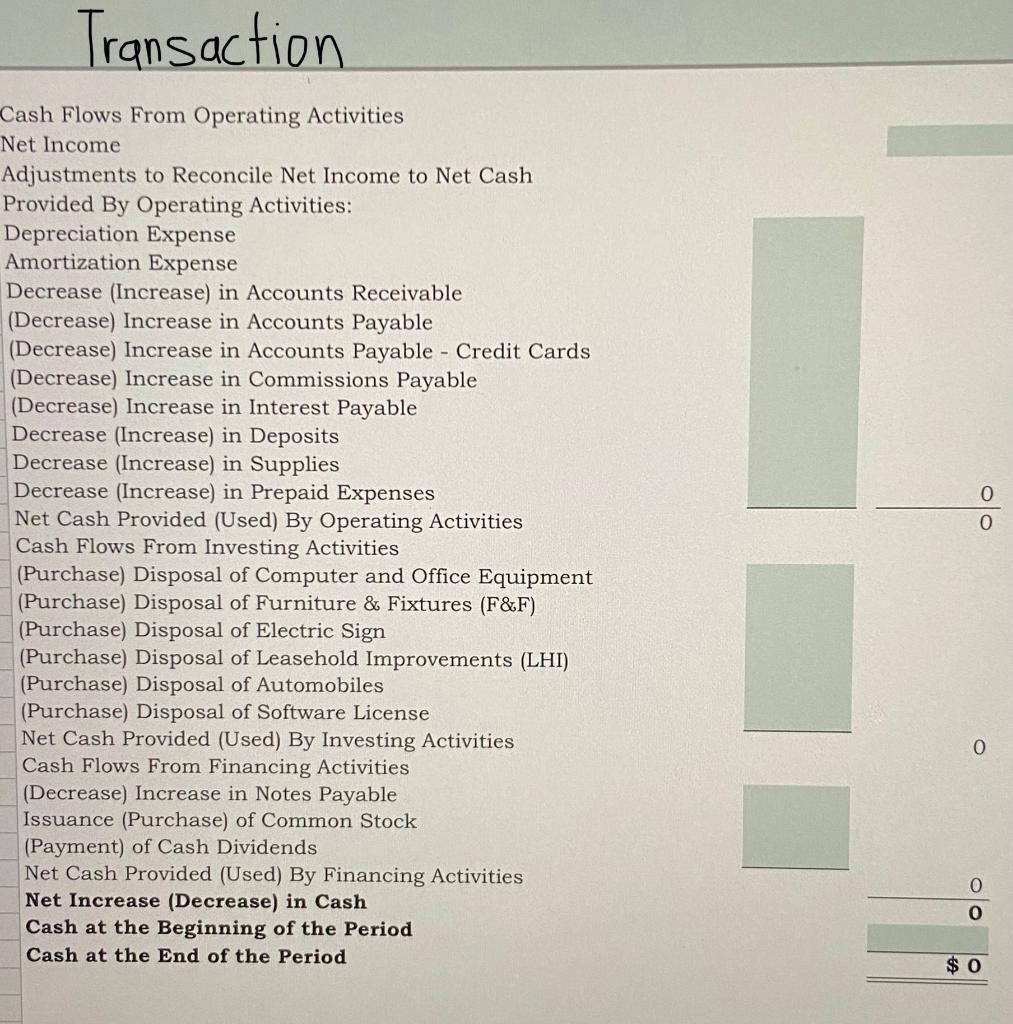

(Fill in the blanks for Transactions on worksheet )

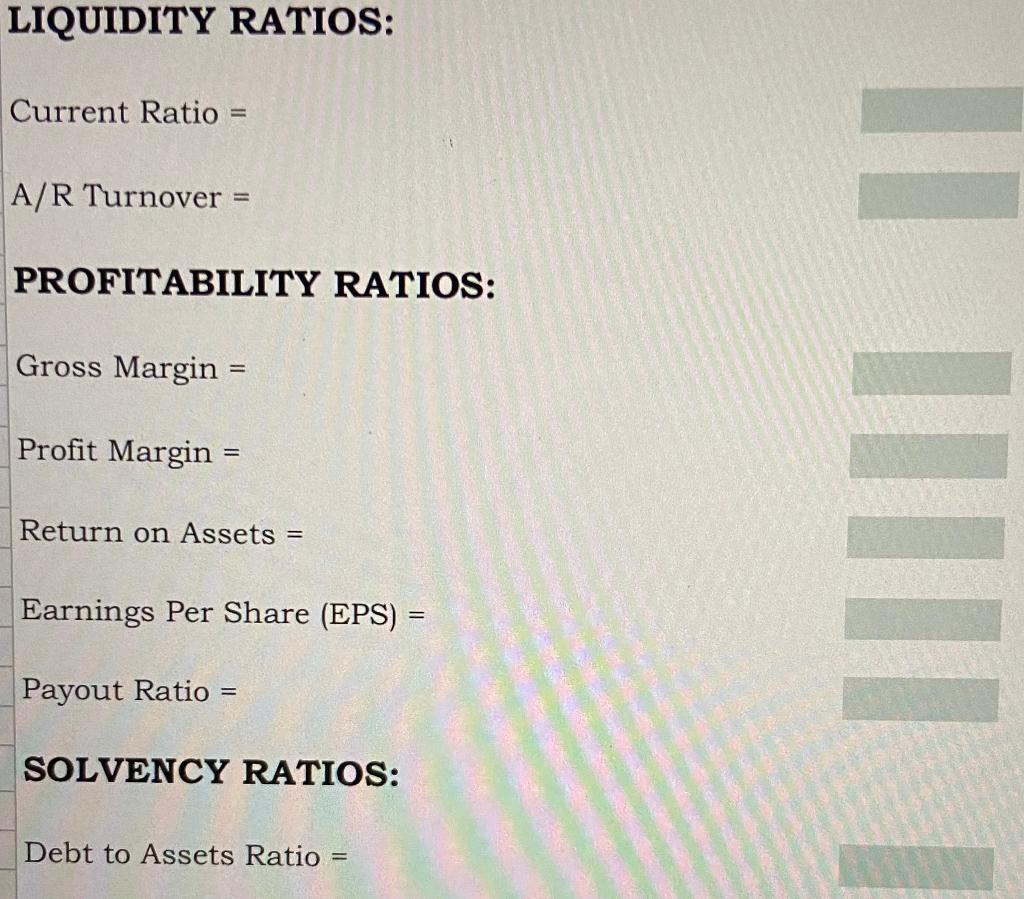

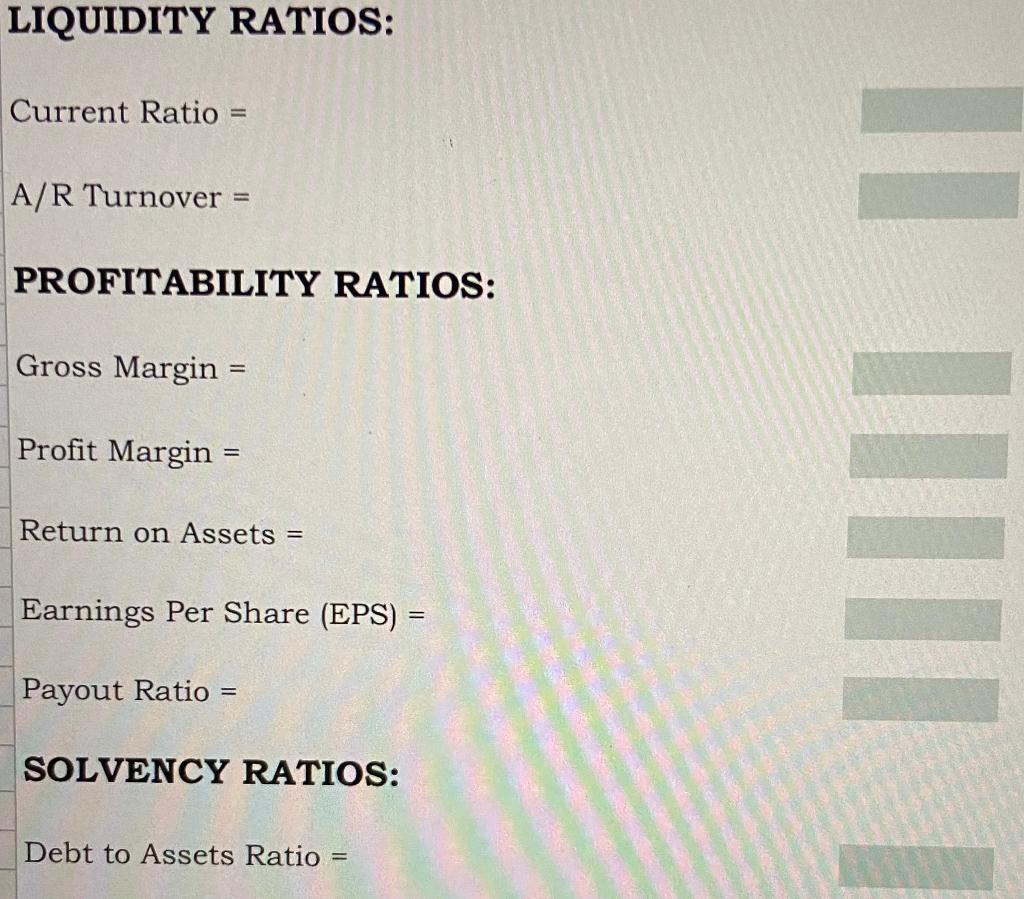

Fill in the blanks for Liquidity Ratios, Profitability Ratios and Solvency Ratios)

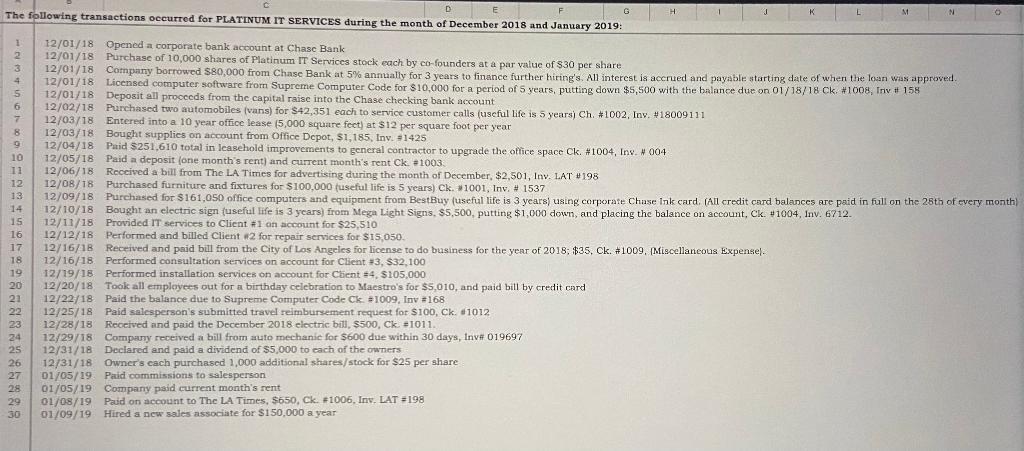

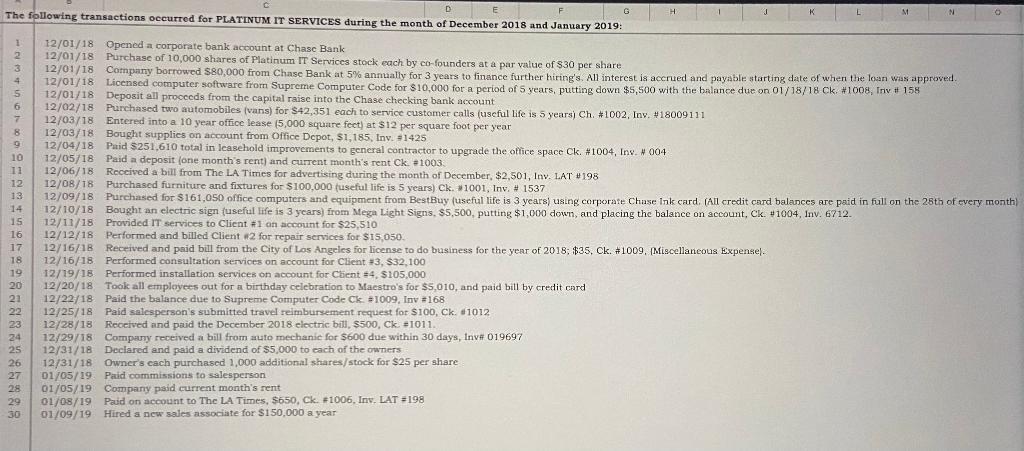

12/01/18 Opcned a corporate bank account at Chase Bank 12/01/18 Purchase of 10,000 shares of Platinum IT Services stock each by co-founders at a par value of $30 per share 12/01/18 Deposit all procecds from the capital raise into the Chase checking bank account 12/02/18 Purchased two automobiles (vans) for $42,351 each to service custamer calls (useful life is 5 years) Ch. \#1002, Inv. \#18009111 12/03/18 Entered into a 10 year office lease (5,000 square fect) at $12 per square foot per year 12/03/18 Bought supplies on account from Office Depot, $1,185, Inv. $1425 12/04/18 Paid $251,610 total in leasehold improvements to general contractor to upgrade the office space Ck. \#1004, Inv. H 004 12/05/18 Paid a deposit (one month's rent) and current month's rent Ck. =1003 12/06/18 Reccived a bill from The LA Times for advertising during the month of December, $2,501,lnv. LAT \#198 12/08/18 Purchascd furniture and fixtures for $100,000 (useful life is 5 years) Ck. 31001, Inv, \# 1537 12/10/18 Bought an electric sign (useful life is 3 ycars) from Mega Light Signs, $5,500, putting $1,000 down, and placing the balance on account, Ck. \#1004, Inv. 6712 . 12/11/18 Provided IT services to Client 1 an account for $25,510 12/12/18 Performed and billed Client n2 for repair services for $15,050. 12/16/18 Received and paid bill from the Ciry of Las Angeles for license to do business for the year of 2018 ; $35, Ck. \#1009, (Miscellaneous Expensel. 12/16/18 Performed consultation services on account for Client $3,$32,100 12/19/18 Performed installation services on account for Cbent $4,$105,000 12/20/18. Took all employees out for a birthday celebration to Maestro's for $5,010, and paid bill by credit card 12/22/18 Paid the balance due to Supreme Computer Code Ck =1009, Inv =168 12/25/18 Paid salesperson's submitted travel reimbursement request for $100, Ck. $1012 12/28/18 Feceived and paid the December 2018 electnic bill, $500, Ck. =1011. 12/29/18 Company received a bill from auto mechanie for $600 due within 30 days, Invf 019697 12/31/18 Declared and paid a dividend of $5,000 to each of the owners 12/31/18 Owner's cach purchased 1,000 additional shares/stock for $25 per share 01/05/19. Paid commissions to salesperson 01/05/19 Company paid current month's rent 01/08/19 Paid on account to The LA Times, \$650, CK. =1006, Inv. LAT =198 01/09/19 Hired a new sales associate for $150,000 a year Cash - Checking Acrount Multi-step Income Statement Retained Earnings, December 1 Add: Less: Retained Earnings, December 30 ASSETS Current Assets Total Current Assets Property, Plant, Equipment Less: Intangible Assets Total Assets $0 Total Current Liabilities Long-Term Liabilities Total Long-Term Liabilities Total Liabilities 0 LIABILITIES AND STOCKHOLDERS' EQUITY Stockholder's Equity Total Stockholder's Equity Total Liabilities and Stockholders' Equity Transaction Cash Flows From Operating Activities Net Income Adjustments to Reconcile Net Income to Net Cash Provided By Operating Activities: Depreciation Expense Amortization Expense Decrease (Increase) in Accounts Receivable (Decrease) Increase in Accounts Payable (Decrease) Increase in Accounts Payable - Credit Cards (Decrease) Increase in Commissions Payable (Decrease) Increase in Interest Payable Decrease (Increase) in Deposits Decrease (Increase) in Supplies Decrease (Increase) in Prepaid Expenses Net Cash Provided (Used) By Operating Activities Cash Flows From Investing Activities (Purchase) Disposal of Computer and Office Equipment (Purchase) Disposal of Furniture \& Fixtures (F&F) (Purchase) Disposal of Electric Sign (Purchase) Disposal of Leasehold Improvements (LHI) (Purchase) Disposal of Automobiles (Purchase) Disposal of Software License Net Cash Provided (Used) By Investing Activities Cash Flows From Financing Activities (Decrease) Increase in Notes Payable Issuance (Purchase) of Common Stock (Payment) of Cash Dividends Net Cash Provided (Used) By Financing Activities Net Increase (Decrease) in Cash Cash at the Beginning of the Period Cash at the End of the Period LIQUIDITY RATIOS: Current Ratio = A/R Turnover = PROFITABILITY RATIOS: Gross Margin = Profit Margin = Return on Assets = Earnings Per Share ( EPS )= Payout Ratio = SOLVENCY RATIOS: Debt to Assets Ratio = 12/01/18 Opcned a corporate bank account at Chase Bank 12/01/18 Purchase of 10,000 shares of Platinum IT Services stock each by co-founders at a par value of $30 per share 12/01/18 Deposit all procecds from the capital raise into the Chase checking bank account 12/02/18 Purchased two automobiles (vans) for $42,351 each to service custamer calls (useful life is 5 years) Ch. \#1002, Inv. \#18009111 12/03/18 Entered into a 10 year office lease (5,000 square fect) at $12 per square foot per year 12/03/18 Bought supplies on account from Office Depot, $1,185, Inv. $1425 12/04/18 Paid $251,610 total in leasehold improvements to general contractor to upgrade the office space Ck. \#1004, Inv. H 004 12/05/18 Paid a deposit (one month's rent) and current month's rent Ck. =1003 12/06/18 Reccived a bill from The LA Times for advertising during the month of December, $2,501,lnv. LAT \#198 12/08/18 Purchascd furniture and fixtures for $100,000 (useful life is 5 years) Ck. 31001, Inv, \# 1537 12/10/18 Bought an electric sign (useful life is 3 ycars) from Mega Light Signs, $5,500, putting $1,000 down, and placing the balance on account, Ck. \#1004, Inv. 6712 . 12/11/18 Provided IT services to Client 1 an account for $25,510 12/12/18 Performed and billed Client n2 for repair services for $15,050. 12/16/18 Received and paid bill from the Ciry of Las Angeles for license to do business for the year of 2018 ; $35, Ck. \#1009, (Miscellaneous Expensel. 12/16/18 Performed consultation services on account for Client $3,$32,100 12/19/18 Performed installation services on account for Cbent $4,$105,000 12/20/18. Took all employees out for a birthday celebration to Maestro's for $5,010, and paid bill by credit card 12/22/18 Paid the balance due to Supreme Computer Code Ck =1009, Inv =168 12/25/18 Paid salesperson's submitted travel reimbursement request for $100, Ck. $1012 12/28/18 Feceived and paid the December 2018 electnic bill, $500, Ck. =1011. 12/29/18 Company received a bill from auto mechanie for $600 due within 30 days, Invf 019697 12/31/18 Declared and paid a dividend of $5,000 to each of the owners 12/31/18 Owner's cach purchased 1,000 additional shares/stock for $25 per share 01/05/19. Paid commissions to salesperson 01/05/19 Company paid current month's rent 01/08/19 Paid on account to The LA Times, \$650, CK. =1006, Inv. LAT =198 01/09/19 Hired a new sales associate for $150,000 a year Cash - Checking Acrount Multi-step Income Statement Retained Earnings, December 1 Add: Less: Retained Earnings, December 30 ASSETS Current Assets Total Current Assets Property, Plant, Equipment Less: Intangible Assets Total Assets $0 Total Current Liabilities Long-Term Liabilities Total Long-Term Liabilities Total Liabilities 0 LIABILITIES AND STOCKHOLDERS' EQUITY Stockholder's Equity Total Stockholder's Equity Total Liabilities and Stockholders' Equity Transaction Cash Flows From Operating Activities Net Income Adjustments to Reconcile Net Income to Net Cash Provided By Operating Activities: Depreciation Expense Amortization Expense Decrease (Increase) in Accounts Receivable (Decrease) Increase in Accounts Payable (Decrease) Increase in Accounts Payable - Credit Cards (Decrease) Increase in Commissions Payable (Decrease) Increase in Interest Payable Decrease (Increase) in Deposits Decrease (Increase) in Supplies Decrease (Increase) in Prepaid Expenses Net Cash Provided (Used) By Operating Activities Cash Flows From Investing Activities (Purchase) Disposal of Computer and Office Equipment (Purchase) Disposal of Furniture \& Fixtures (F&F) (Purchase) Disposal of Electric Sign (Purchase) Disposal of Leasehold Improvements (LHI) (Purchase) Disposal of Automobiles (Purchase) Disposal of Software License Net Cash Provided (Used) By Investing Activities Cash Flows From Financing Activities (Decrease) Increase in Notes Payable Issuance (Purchase) of Common Stock (Payment) of Cash Dividends Net Cash Provided (Used) By Financing Activities Net Increase (Decrease) in Cash Cash at the Beginning of the Period Cash at the End of the Period LIQUIDITY RATIOS: Current Ratio = A/R Turnover = PROFITABILITY RATIOS: Gross Margin = Profit Margin = Return on Assets = Earnings Per Share ( EPS )= Payout Ratio = SOLVENCY RATIOS: Debt to Assets Ratio =