Answered step by step

Verified Expert Solution

Question

1 Approved Answer

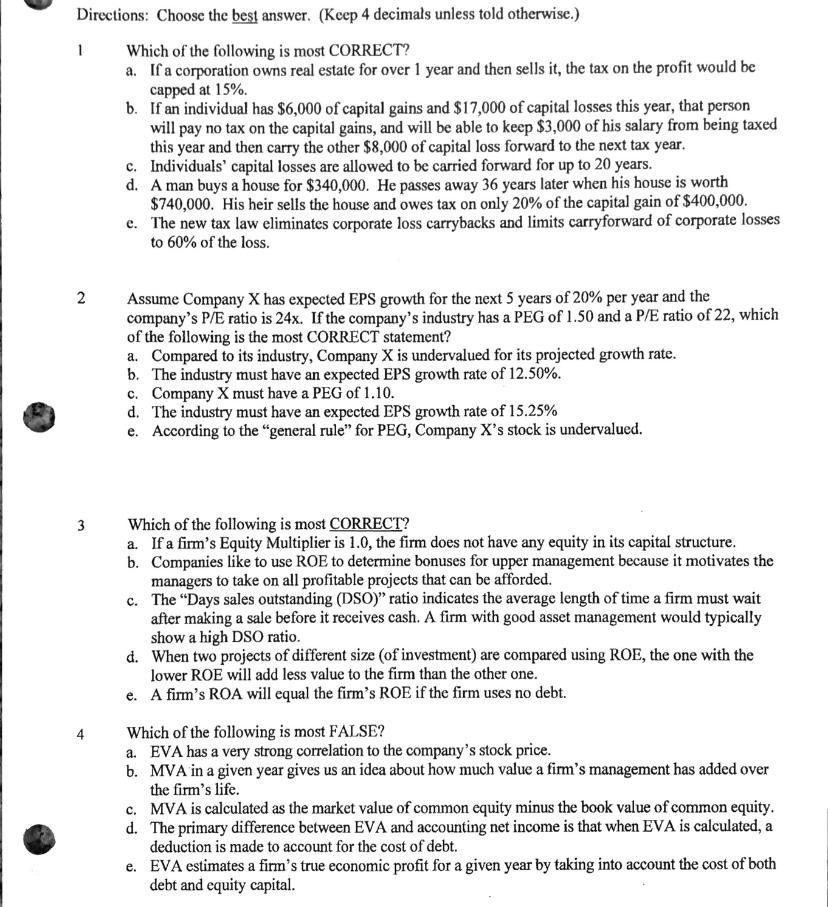

Directions: Choose the best answer. (Keep 4 decimals unless told otherwise.) Which of the following is most CORRECT? a. If a corporation owns real

Directions: Choose the best answer. (Keep 4 decimals unless told otherwise.) Which of the following is most CORRECT? a. If a corporation owns real estate for over 1 year and then sells it, the tax on the profit would be capped at 15%. b. If an individual has $6,000 of capital gains and $17,000 of capital losses this year, that person will pay no tax on the capital gains, and will be able to keep $3,000 of his salary from being taxed this year and then carry the other $8,000 of capital loss forward to the next tax year. Individuals' capital losses are allowed to be carried forward for up to 20 years. 1 2 3 c. d. A man buys a house for $340,000. He passes away 36 years later when his house is worth $740,000. His heir sells the house and owes tax on only 20% of the capital gain of $400,000. The new tax law eliminates corporate loss carrybacks and limits carryforward of corporate losses e. to 60% of the loss. Assume Company X has expected EPS growth for the next 5 years of 20% per year and the company's P/E ratio is 24x. If the company's industry has a PEG of 1.50 and a P/E ratio of 22, which of the following is the most CORRECT statement? a. Compared to its industry, Company X is undervalued for its projected growth rate. b. The industry must have an expected EPS growth rate of 12.50%. c. Company X must have a PEG of 1.10. d. The industry must have an expected EPS growth rate of 15.25% e. According to the "general rule" for PEG, Company X's stock is undervalued. Which of the following is most CORRECT? a. If a firm's Equity Multiplier is 1.0, the firm does not have any equity in its capital structure. b. Companies like to use ROE to determine bonuses for upper management because it motivates the managers to take on all profitable projects that can be afforded. c. The "Days sales outstanding (DSO)" ratio indicates the average length of time a firm must wait after making a sale before it receives cash. A firm with good asset management would typically show a high DSO ratio. d. When two projects of different size (of investment) are compared using ROE, the one with the lower ROE will add less value to the firm than the other one. e. A firm's ROA will equal the firm's ROE if the firm uses no debt. Which of the following is most FALSE? a. EVA has a very strong correlation to the company's stock price. b. MVA in a given year gives us an idea about how much value a firm's management has added over the firm's life. c. MVA is calculated as the market value of common equity minus the book value of common equity. d. The primary difference between EVA and accounting net income is that when EVA is calculated, a deduction is made to account for the cost of debt. e. EVA estimates a firm's true economic profit for a given year by taking into account the cost of both debt and equity capital.

Step by Step Solution

★★★★★

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1The most correct answer among the opti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started