Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Directions: Complete all answers on separate paper. Use pencil for all problems. Show the formula first and your calculations. You can check your answer

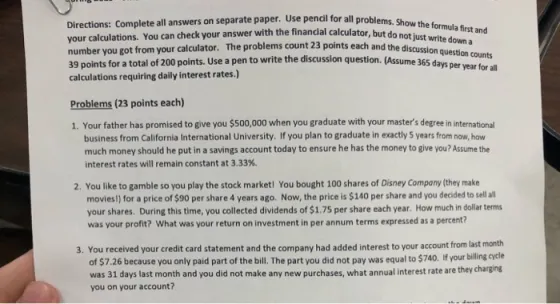

Directions: Complete all answers on separate paper. Use pencil for all problems. Show the formula first and your calculations. You can check your answer with the financial calculator, but do not just write down a number you got from your calculator. The problems count 23 points each and the discussion question counts 39 points for a total of 200 points. Use a pen to write the discussion question. (Assume 365 days per year for all calculations requiring daily interest rates.) Problems (23 points each) 1. Your father has promised to give you $500,000 when you graduate with your master's degree in international business from California International University. If you plan to graduate in exactly 5 years from now, how much money should he put in a savings account today to ensure he has the money to give you? Assume the interest rates will remain constant at 3.33%. 2. You like to gamble so you play the stock market! You bought 100 shares of Disney Company (they make movies!) for a price of $90 per share 4 years ago. Now, the price is $140 per share and you decided to sell all your shares. During this time, you collected dividends of $1.75 per share each year. How much in dollar terms was your profit? What was your return on investment in per annum terms expressed as a percent? 3. You received your credit card statement and the company had added interest to your account from last month of $7.26 because you only paid part of the bill. The part you did not pay was equal to $740. If your billing cycle was 31 days last month and you did not make any new purchases, what annual interest rate are they charging you on your account?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Your father has promised to give you 550000 when you graduate with your masters degree in internat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started