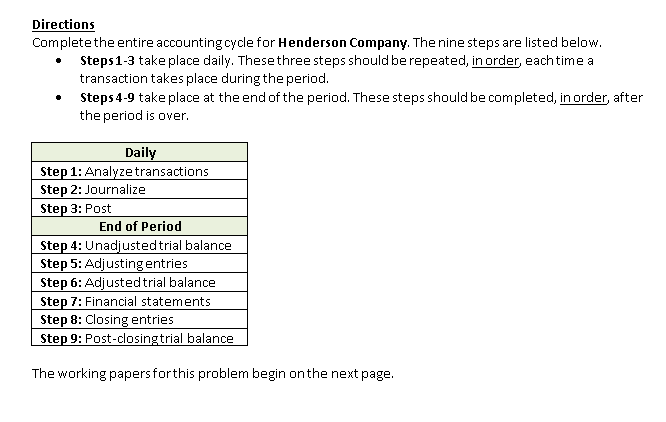

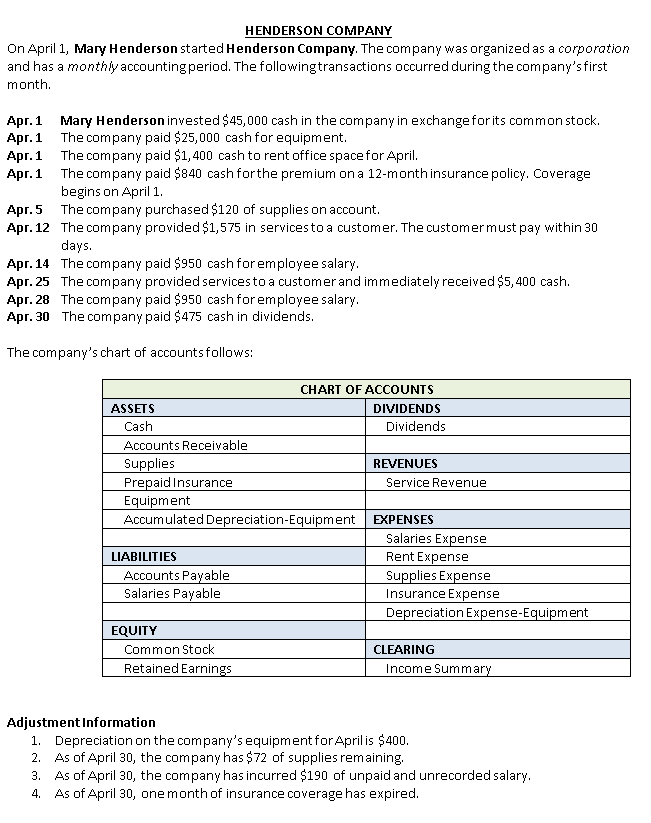

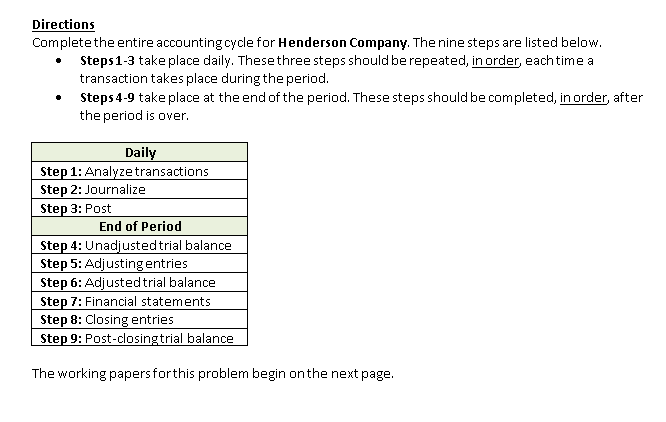

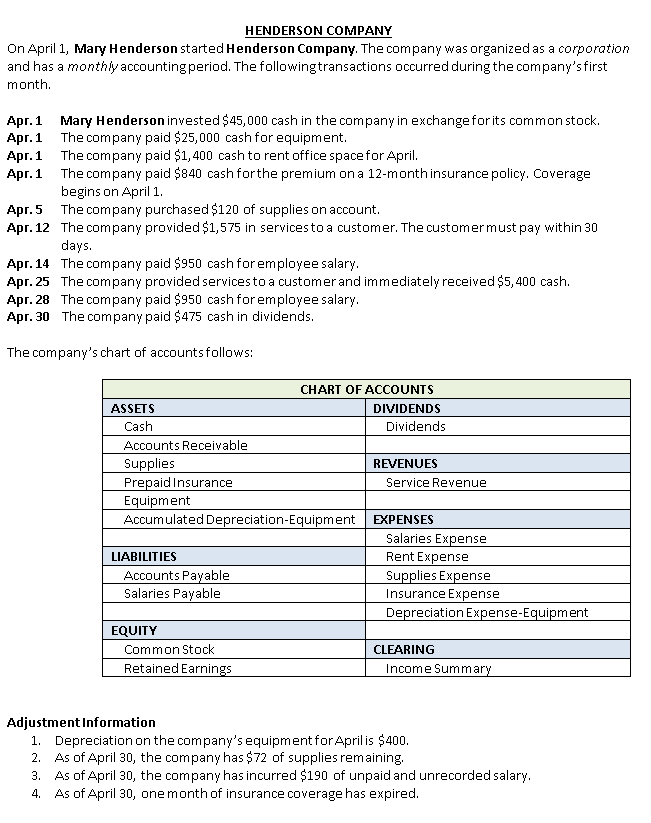

Directions Complete the entire accounting cycle for Henderson Company. The nine steps are listed below. Steps 1-3 take place daily. These three steps should be repeated, in order, each time a transaction takes place during the period. Steps 4-9 take place at the end of the period. These steps should be completed, in order, after the period is over. Daily Step 1: Analyze transactions Step 2: Journalize Step 3: Post End of Period Step 4: Unadjusted trial balance Step 5: Adjusting entries Step 6: Adjusted trial balance Step 7: Financial statements Step 8: Closing entries Step 9: Post-closing trial balance The working papersforthis problem begin on the next page. HENDERSON COMPANY On April 1, Mary Henderson started Henderson Company. The company was organized as a corporation and has a monthly accounting period. The following transactions occurred during the company's first month. Apr.1 Mary Henderson invested $45,000 cash in the company in exchange forits common stock. Apr. 1 The company paid $25,000 cash for equipment. Apr. 1 The company paid $1,400 cash to rent office space for April. Apr.1 The company paid $840 cash forthe premium on a 12-month insurance policy. Coverage begins on April 1. Apr.5 The company purchased $120 of supplies on account. Apr. 12 The company provided $1,575 in services to a customer. The customermust pay within 30 days. Apr. 14 The company paid $950 cash for employee salary. Apr.25 The company provided services to a customer and immediately received $5,400 cash. Apr. 28 The company paid $950 cash for employee salary. Apr. 30 The company paid $475 cash in dividends. The company's chart of accounts follows: CHART OF ACCOUNTS ASSETS DIVIDENDS Cash Dividends Accounts Receivable Supplies REVENUES Prepaid Insurance Service Revenue Equipment Accumulated Depreciation-Equipment EXPENSES Salaries Expense LIABILITIES Rent Expense Accounts Payable Supplies Expense Salaries Payable Insurance Expense Depreciation Expense-Equipment EQUITY Common Stock CLEARING Retained Earnings Income Summary Adjustment Information 1. Depreciation on the company's equipment for April is $400. 2. As of April 30, the company has $72 of supplies remaining, 3. As of April 30, the company has incurred $190 of unpaid and unrecorded salary. 4. As of April 30, one month of insurance coverage has expired