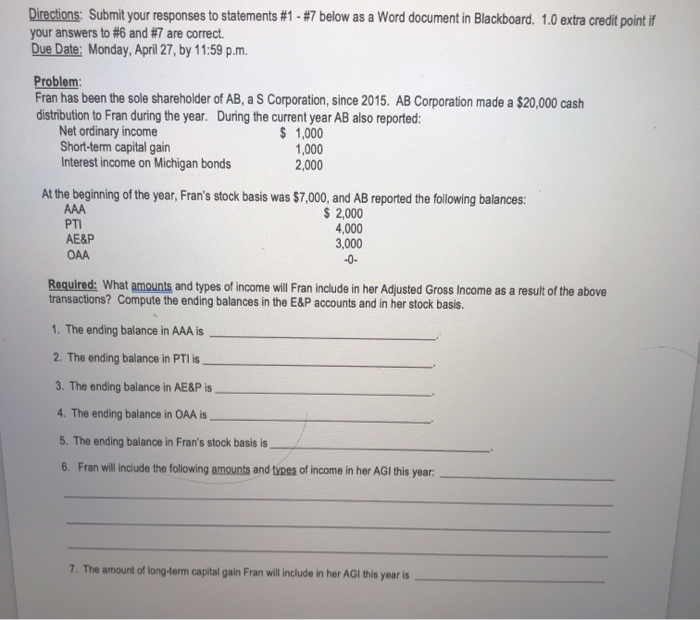

Directions: Submit your responses to statements #1 - #7 below as a Word document in Blackboard. 1.0 extra credit point if your answers to #6 and #7 are correct. Due Date: Monday, April 27, by 11:59 p.m. Problem Fran has been the sole shareholder of AB, a S Corporation, since 2015. AB Corporation made a $20,000 cash distribution to Fran during the year. During the current year AB also reported: Net ordinary income $ 1,000 Short-term capital gain 1,000 Interest income on Michigan bonds 2,000 At the beginning of the year, Fran's stock basis was $7,000, and AB reported the following balances: AAA $ 2,000 4,000 AE&P 3,000 OAA PTI Required: What amounts and types of income will Fran include in her Adjusted Gross Income as a result of the above transactions? Compute the ending balances in the E&P accounts and in her stock basis. 1. The ending balance in AAA is 2. The ending balance in PTI is 3. The ending balance in AE&P is 4. The ending balance in OAA is 5. The ending balance in Fran's stock basis is 6. Fran will include the following amounts and types of income in her AGI this year: 7. The amount of long-term capital gain Fran will include in her AGI this year is Directions: Submit your responses to statements #1 - #7 below as a Word document in Blackboard. 1.0 extra credit point if your answers to #6 and #7 are correct. Due Date: Monday, April 27, by 11:59 p.m. Problem Fran has been the sole shareholder of AB, a S Corporation, since 2015. AB Corporation made a $20,000 cash distribution to Fran during the year. During the current year AB also reported: Net ordinary income $ 1,000 Short-term capital gain 1,000 Interest income on Michigan bonds 2,000 At the beginning of the year, Fran's stock basis was $7,000, and AB reported the following balances: AAA $ 2,000 4,000 AE&P 3,000 OAA PTI Required: What amounts and types of income will Fran include in her Adjusted Gross Income as a result of the above transactions? Compute the ending balances in the E&P accounts and in her stock basis. 1. The ending balance in AAA is 2. The ending balance in PTI is 3. The ending balance in AE&P is 4. The ending balance in OAA is 5. The ending balance in Fran's stock basis is 6. Fran will include the following amounts and types of income in her AGI this year: 7. The amount of long-term capital gain Fran will include in her AGI this year is