Answered step by step

Verified Expert Solution

Question

1 Approved Answer

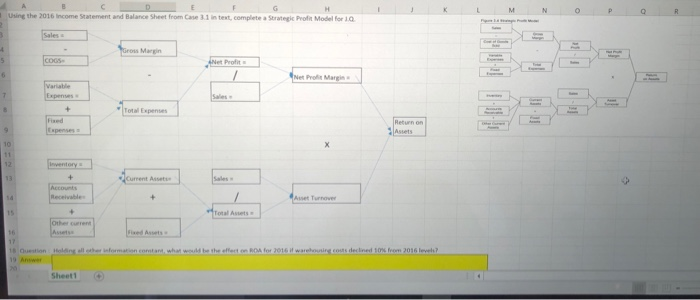

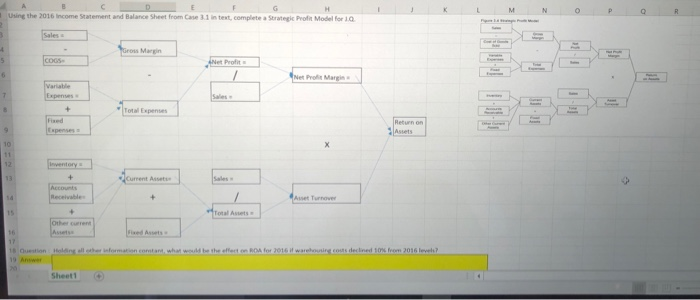

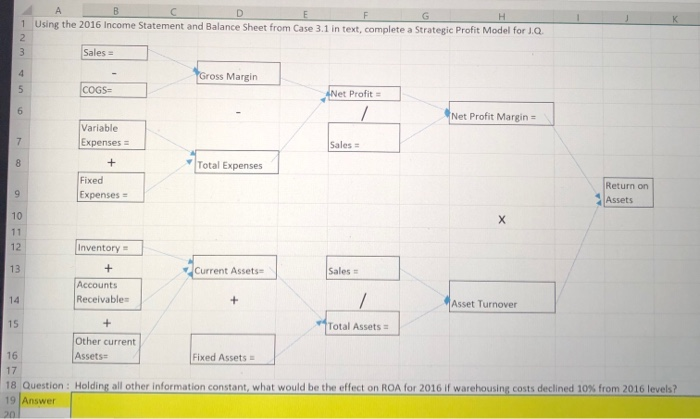

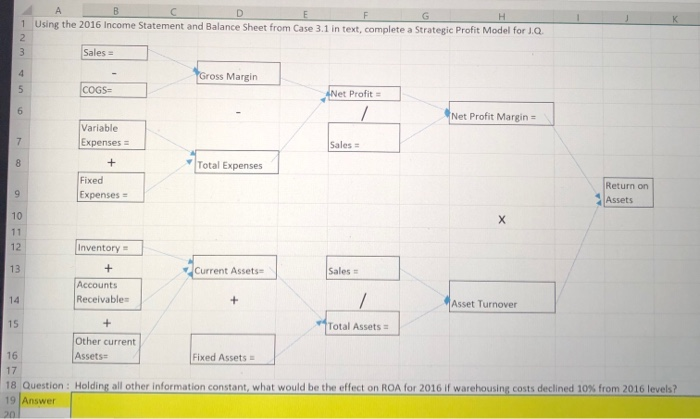

Directions: Use the income statement and balance sheet to complete the strategic profit model. Fill in the amounts after the = sign. I just need

Directions: Use the income statement and balance sheet to complete the strategic profit model. Fill in the amounts after the = sign.

I just need the boxes in the excel photo filled out with the numbers from the other photo and the question at the bottton answered. Ill try to provide clearer photos. thank you

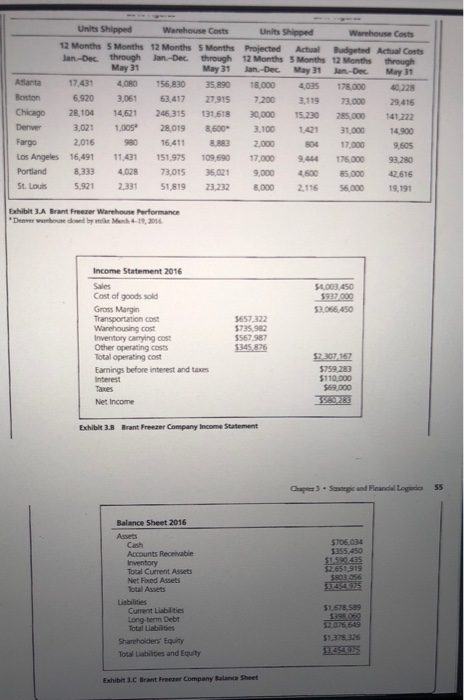

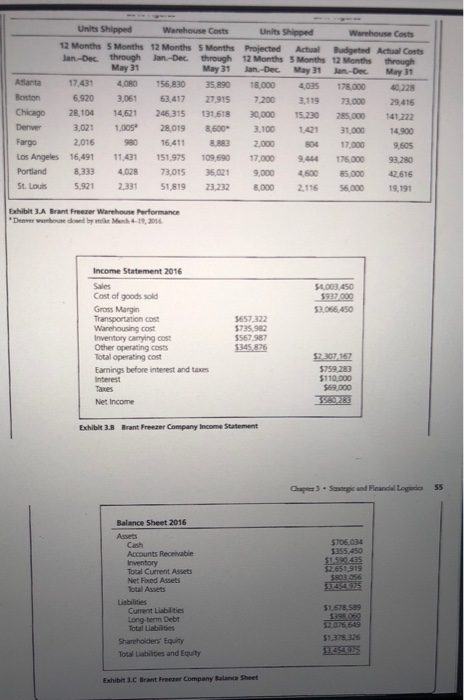

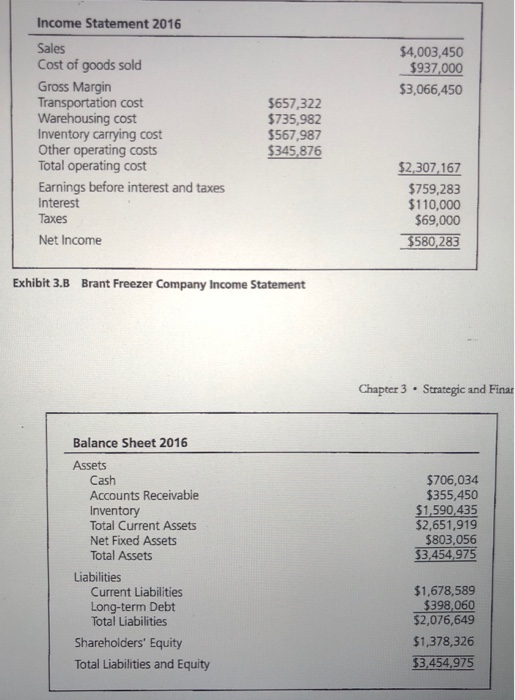

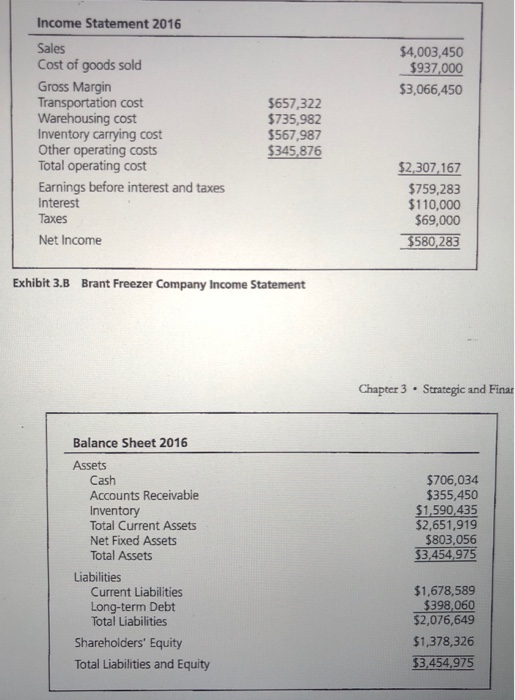

Using the 2016 income Statement and Balance Sheet from Case 3.1 in text, complete a Strategic Profia Model for 1.0 Profit Net Proft Margin ales Total Expenses 10 urrent Assetin Asset Turnove her current Fixed Assets Question ll ether information comstand, what woudd be the effert on ROA for 2016 it wa SheetlG Units Shipped Units Shipped Warehouse Costs 12 Months 5 Months 12 Months 5 Months Projected Actual Budgeted Actiual Costs Jan-Dec. through Jan-Dec. through 12 Months 5 Months 12 Months through May 31 Jan-Dec May 31 Jan-Dec. May 31 Aslanta 17,431 4,080 156,830 35,890 18,000 4035 178,00040,228 Boston 6920 3,061 63,417 27,915 7200 9 73,000 29,416 Chicago 28,104 14,621 246.315 131,618 30,000 23 285,000 141 222 Denver3,021 1,005 28,019 8600 3,100 41 31,00014.900 504 17,000 9.605 Los Angeles 16,491 11,431 151,975 109.690 17,000 944 176000 93280 Portland8,333 4028 73,015 36,021 9,0004500 85,000 42,616 St. Louis 5,9212,331 51,819 23.232 8.000 2.116 56,000 19,191 May 31 2,016 980 16,411 8.8832000 Exhibit 3.A Brant Freezer Warehoune Performance Income Statement 2016 4,003,450 $937 000 53,066,450 Cost of goods sold Gross Margin Transportation cost Warehousing cost Inventory carrying cost Other operating costs Total operating cost Eanings before interest and taxes 5657,322 $735,982 567 987 345 876 $110,000 Net Income Exhibit 3.B Brant Freezer Company Income Statement Balance Sheet 2016 Assets $706.034 5355,450 Cash Accounts Receivable Inventory Total Cument Assets Net Fixed Assets lotal Assets 52,651,91 $1,678 589 Current Liablities Long-term Debt Total Liabilities $1,378,326 Sharehoiders Equty Total Liabilties and Equity Exhibit 3.C Brant Freezer Company Balance Sheet 1 Using the 2016 Income Statement and Balance Sheet from Case 3.1 in text, complete a Strategic Profit Model for Ja Sales oss Margin COGS- et Profit Net Profit Margin Variable Expenses Sales Total Expenses Fixed Return orn Assets Expenses 10 12 Inventory 13 Current Assets Sales = Accounts 14 Receivable Asset Turnover 15 Total Assets Other current Assets: Fixed Assets 16 17 18 Question : 19 Answer Holding all other information constant, what would be the effect on ROA for 2016 if warehousing costs declined 10% from 2016 levels Income Statement 2016 Sales Cost of goods sold $4,003,450 $937,000 $3,066,450 Gross Margin Transportation cost Warehousing cost Inventory carrying cost Other operating costs Total operating cost 5657,322 $735,982 $567,987 $345,876 $2,307, 167 Earnings before interest and taxes Interest Taxes 759,283 $110,000 $69,000 Net Income Exhibit 3.B Brant Freezer Company Income Statement Chapter 3 Strategic and Finar Balance Sheet 2016 Assets Cash Accounts Receivable Inventory Total Current Assets Net Fixed Assets Total Assets $706,034 $355,450 $1,590435 $2,651,919 5803,056 Liabilities Current Liabilities Long-term Debt Total Liabilities $1,678,589 $398,060 $2,076,649 Shareholders' Equity 1,378,326 Total Liabilities and Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started