Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Directions/Scenario: You have been working for Amazon Marketplace, Inc. at their corporate office as an Accountant. You and your team have been tasked with

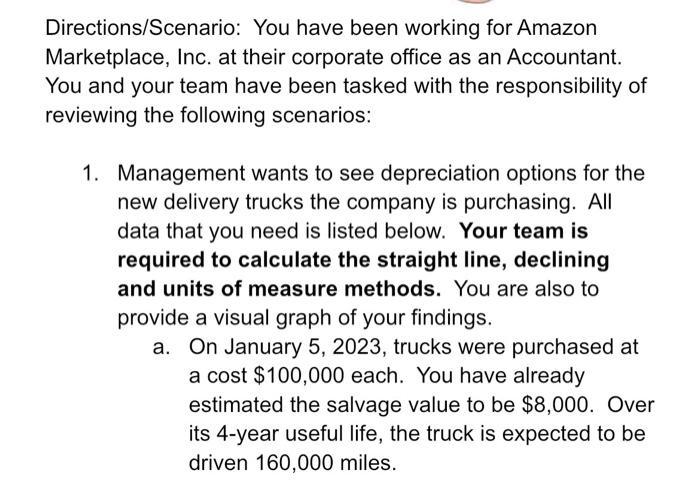

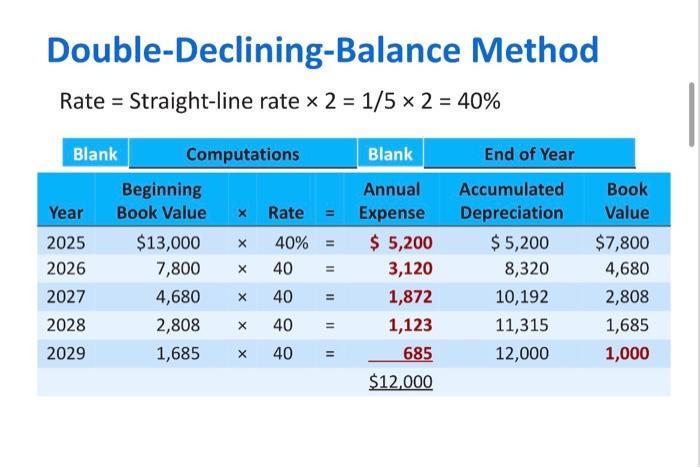

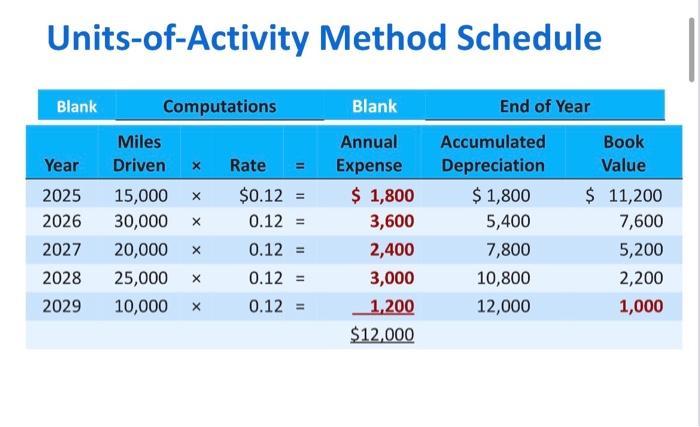

Directions/Scenario: You have been working for Amazon Marketplace, Inc. at their corporate office as an Accountant. You and your team have been tasked with the responsibility of reviewing the following scenarios: 1. Management wants to see depreciation options for the new delivery trucks the company is purchasing. All data that you need is listed below. Your team is required to calculate the straight line, declining and units of measure methods. You are also to provide a visual graph of your findings. a. On January 5, 2023, trucks were purchased at a cost $100,000 each. You have already estimated the salvage value to be $8,000. Over its 4-year useful life, the truck is expected to be driven 160,000 miles. Double-Declining-Balance Method Rate = Straight-line rate x 2 = 1/5 x 2 = 40% Blank Year 2025 2026 2027 2028 2029 Computations Beginning Book Value X Rate $13,000 X 40% 7,800 X 40 4,680 X 40 2,808 X 40 1,685 X 40 = = 11 = = 11 II Blank Annual Expense $ 5,200 3,120 1,872 1,123 685 $12,000 End of Year Accumulated Depreciation $ 5,200 8,320 10,192 11,315 12,000 Book Value $7,800 4,680 2,808 1,685 1,000 Units-of-Activity Method Schedule Blank Computations Miles Year Driven X Rate 2025 15,000 X 2026 30,000 X 2027 20,000 X 2028 25,000 X 2029 10,000 X $0.12 = 0.12 = 0.12 = 0.12 = 0.12 = Blank Annual Expense $ 1,800 3,600 2,400 3,000 1,200 $12,000 End of Year Accumulated Depreciation $ 1,800 5,400 7,800 10,800 12,000 Book Value $ 11,200 7,600 5,200 2,200 1,000

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started