Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DirectTV sells receivers and satellite dishes and provides satellite television programming to customers. DirectTV enters into a transaction with Customer X (X) where X

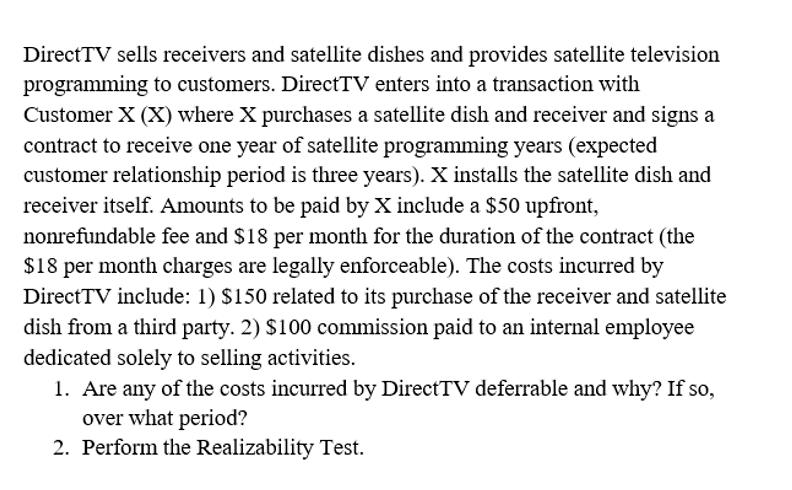

DirectTV sells receivers and satellite dishes and provides satellite television programming to customers. DirectTV enters into a transaction with Customer X (X) where X purchases a satellite dish and receiver and signs a contract to receive one year of satellite programming years (expected customer relationship period is three years). X installs the satellite dish and receiver itself. Amounts to be paid by X include a $50 upfront, nonrefundable fee and $18 per month for the duration of the contract (the $18 per month charges are legally enforceable). The costs incurred by DirectTV include: 1) $150 related to its purchase of the receiver and satellite dish from a third party. 2) $100 commission paid to an internal employee dedicated solely to selling activities. 1. Are any of the costs incurred by DirectTV deferrable and why? If so, over what period? 2. Perform the Realizability Test.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 It should be deferred as the cost incurred now gives revenue over the period of contract 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started