Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(d)is more/less negative as share price drops am Lee, a junior analyst at Alpha Capital, is working on the pricing of a European put option.

(d)is more/less negative as share price drops

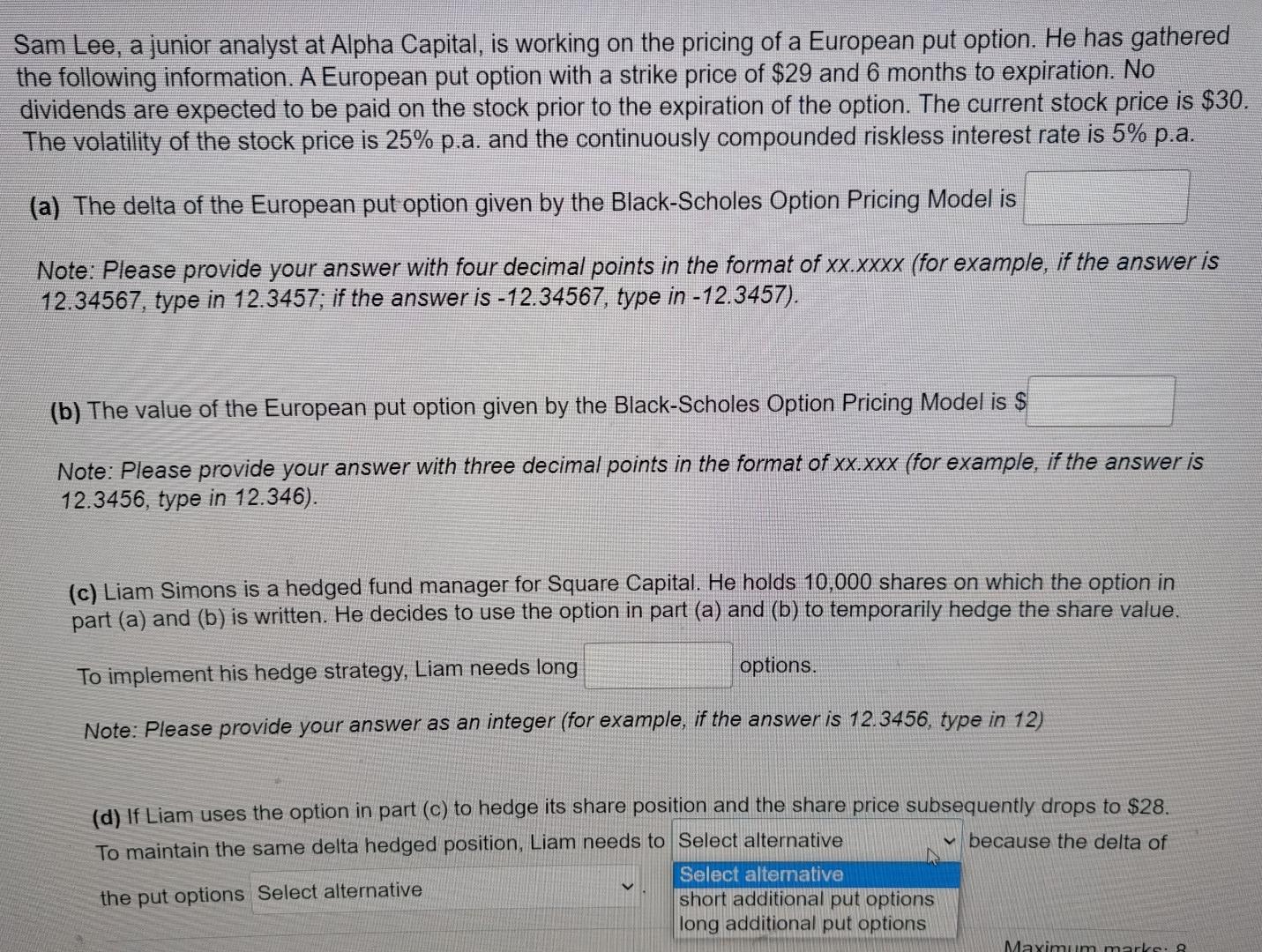

am Lee, a junior analyst at Alpha Capital, is working on the pricing of a European put option. He has gathered e following information. A European put option with a strike price of $29 and 6 months to expiration. No vidends are expected to be paid on the stock prior to the expiration of the option. The current stock price is $36 he volatility of the stock price is 25% p.a. and the continuously compounded riskless interest rate is 5% p.a. a) The delta of the European put option given by the Black-Scholes Option Pricing Model is Note: Please provide your answer with four decimal points in the format of xx.xXXX (for example, if the answer is 12.34567, type in 12.3457; if the answer is -12.34567, type in -12.3457 ). (b) The value of the European put option given by the Black-Scholes Option Pricing Model is $ Note: Please provide your answer with three decimal points in the format of XX.XXX (for example, if the answer is 12.3456 , type in 12.346). (c) Liam Simons is a hedged fund manager for Square Capital. He holds 10,000 shares on which the option in part (a) and (b) is written. He decides to use the option in part (a) and (b) to temporarily hedge the share value. To implement his hedge strategy, Liam needs long options. Note: Please provide your answer as an integer (for example, if the answer is 12.3456, type in 12) (d) If Liam uses the option in part (c) to hedge its share position and the share price subsequently drops to $28. To maintain the same delta hedged position, Liam needs to because the delta of the put optionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started