Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discon Ltd has a 28 February financial year end and decides on 30 November 2016 to dispose of a disposal group within the next

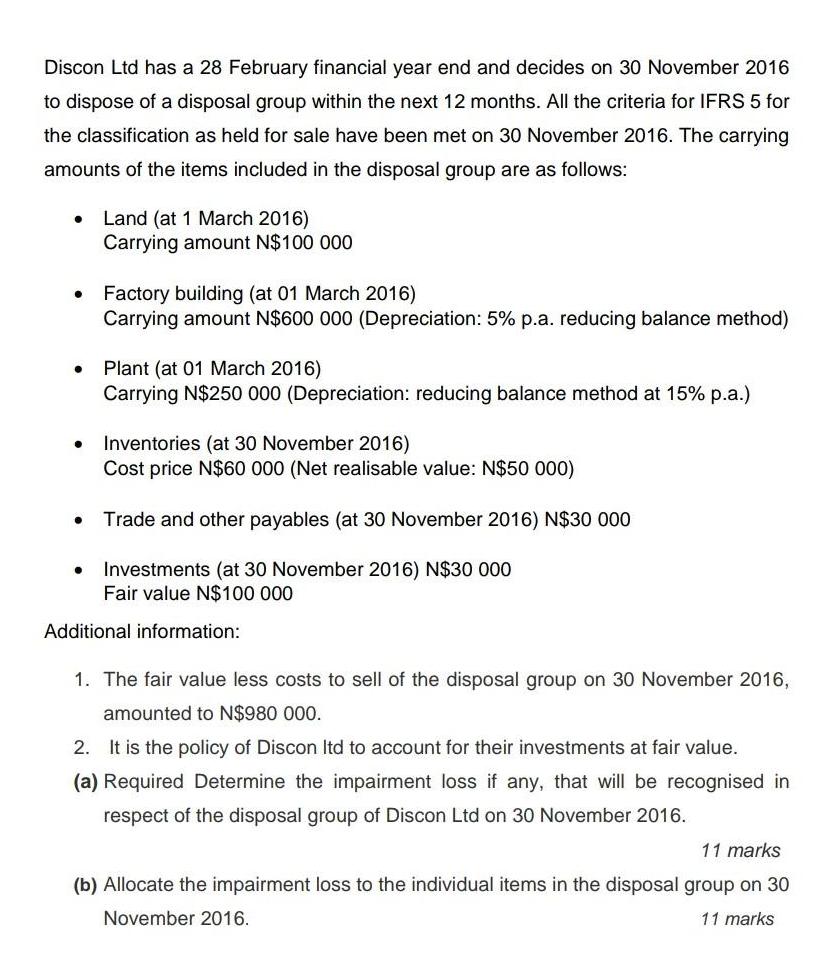

Discon Ltd has a 28 February financial year end and decides on 30 November 2016 to dispose of a disposal group within the next 12 months. All the criteria for IFRS 5 for the classification as held for sale have been met on 30 November 2016. The carrying amounts of the items included in the disposal group are as follows: Land (at 1 March 2016) Carrying amount N$100 000 Factory building (at 01 March 2016) Carrying amount N$600 000 (Depreciation: 5% p.a. reducing balance method) Plant (at 01 March 2016) Carrying N$250 000 (Depreciation: reducing balance method at 15% p.a.) Inventories (at 30 November 2016) Cost price N$60 000 (Net realisable value: N$50 000) Trade and other payables (at 30 November 2016) N$30 000 Investments (at 30 November 2016) N$30 000 Fair value N$100 000 Additional information: 1. The fair value less costs to sell of the disposal group on 30 November 2016, amounted to N$980 000. 2. It is the policy of Discon Itd to account for their investments at fair value. (a) Required Determine the impairment loss if any, that will be recognised in respect of the disposal group of Discon Ltd on 30 November 2016. 11 marks (b) Allocate the impairment loss to the individual items in the disposal group on 30 November 2016. 11 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the impairment loss for the disposal group of Discon Ltd on 30 November 2016 we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started