Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discounted Cash Flow Analysis and Term Loan Negotiations The company requests for a term loan to expand its export production capacity. There is a

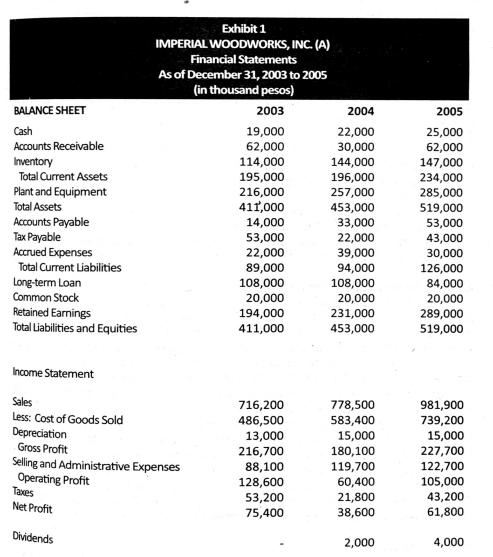

Discounted Cash Flow Analysis and Term Loan Negotiations The company requests for a term loan to expand its export production capacity. There is a ready market...it is a leading exporter... the order books are full. In February 2006, Ric Imperial, owner and general manager of Imperial Woodworks, Inc., visited Noel Lee, account officer of International Bank to request for a term loan for P140 million, needed to finance a major expansion of the capacity. Company Background Imperial Woodworks, Inc. specialized in "knocked-down" cabinets and furniture that were manufactured to customer specifications from a relatively narrow product line. The production facility of the company was designed to be efficient at production runs of 2,000 to 3,000 units per product. The company exported about 60 percent of its products to neighboring countries, mainly Japan, Hong Kong and Taiwan. In both export and domestic markets, the company developed and carefully nurtured over the years a reputation for high quality products. For this reason, it attracted orders from customers at good prices. The company's export orders came from foreign wholesalers that distributed Imperial Woodworks products to department and furniture stores. The design of the company's furniture and cabinets were attractive in the foreign market because they were just copies of foreign furniture with the most popular design. International Bank was one of the commercial banks that participated in the re-lending of international development assistance credit funds administered by the government through the Development Bank of the Philippines. Typically, the bank only financed fixed assets investments and loans issued in US dollars for which the borrower carried the foreign exchange risk. This facility is especially suited for exporters because they are naturally and fully hedged against foreign exchange risk. Imperial Woodworks was one such company that can enjoy the longer tenors and lower interest rates of foreign currency loans (compared to commercial bank loans) and yet not be exposed to foreign currency risk. A number of local companies folded up during the Asian crisis because they were not naturally hedged and yet accessed "cheaper" foreign currency loans. International Bank was currently accessing the funds that it borrowed for 10 percent and re-lent on 5 to 10-year term at 12 to 14 percent. Recently, the Development Bank of the Philippines encouraged the bank to expand its participation in the program. The Term Loan Request In January 2006, Ric Imperial was considering his plan to double his factory capacity by installing P175 million worth of new woodworking machinery, mostly sourced from Germany. The existing factory building had sufficient unused space to accommodate the new machinery. Imperial told International Bank that his existing operating capacity was P1.0 billion of sales per year. He was turning down customer orders the size of which far exceeded his production capacity. In the period July-December 2005, for example, the company turned down customer orders worth P3.0 billion. Imperial said that he conservatively estimate sales to reach P2.5 billion per year within 3 years, equivalent to full capacity and to maintain this level thereafter. He planned to maximize revenues by dedicating the increase in sales due to the expansion to high-value products. He expected gross margins to be at least 20 percent better than his average performance for the last three years because of the more modern equipment. When he visited the bank to request for the term loan in February, Imperial submitted his company's income statement and balance sheets shown in Exhibit 1. At the bank, Imperial told Noel Lee that his company, since its founding in 1980, had always been profitable and had grown substantially since he first operated it as a carpenter's shop. He always had a backlog of orders. He now felt secure of his company's trade reputation and its ability to double its sales volume after building up its machinery capacity and product lines from copies of popular foreign designs. Furthermore, since a large part of the company's factory overhead, selling and administration expenses were fixed, he believed that the proposed extra capacity would more than double profits and pay for the investment within a short time. He believed that the local and foreign markets for furniture were certain to grow in the future because of expansion in both markets. Imperial told the bank that he could readily hire the additional workers that were required to operate the expanded factory. He knew that the company would need additional working capital to finance the proposed growth in sales. He anticipated that additional working capital needed would be adequately covered by the unused P16 million working capital credit line supported by purchase orders that he had negotiated with another commercial bank. Following Imperial's visit, Lee contacted a number of local representatives of foreign buyers and agents of Imperial Woodworks. These representatives confirmed that the company's products were of high quality and that the company had a good reputation for timely deliveries of orders. His contacts also confirmed that the markets for cabinets and furniture were expanding. They noted that Imperial Woodworks' prices were somewhat high but expected the company to continue to get its share of these markets. Only one wholesaler representative cautiously ventured that price competition was becoming an increasingly important factor in the furniture market. Looking at the company's financial statements, Lee observed that when the company's sales almost doubled between 2002 and 2005, it maintained a reasonably strong financial position. Lee was impressed with the entrepreneurial attitude of Imperial and with the performance of his company. When Lee visited the factory of Imperial Woodworks in early March 2006, he was favorably impressed with the well-designed production process and the apparently knowledgeable factory management and skills of workers. The Account Officer's Problem With the information given to him, Lee prepared the documents for a project loan to Imperial Woodworks. He will present the term loan proposal to the bank's Credit Committee for approval. The amount was for P140 million for machinery. Imperial Woodworks was to raise the balance of P35 million of its requirement from internal funds, mostly profits, in 2006. BALANCE SHEET Cash Accounts Receivable Inventory Total Current Assets Plant and Equipment Total Assets Accounts Payable Tax Payable Accrued Expenses Total Current Liabilities Long-term Loan Common Stock Retained Earnings Total Liabilities and Equities Income Statement Sales Less: Cost of Goods Sold Depreciation Gross Profit Selling and Administrative Expenses Operating Profit Taxes Net Profit Exhibit 1 IMPERIAL WOODWORKS, INC. (A) Financial Statements As of December 31, 2003 to 2005 (in thousand pesos) 2003 Dividends 19,000 62,000 114,000 195,000 216,000 411,000 14,000 53,000 22,000 89,000 108,000 20,000 194,000 411,000 716,200 486,500 13,000 216,700 88,100 128,600 53,200 75,400 2004 22,000 30,000 144,000 196,000 257,000 453,000 33,000 22,000 39,000 94,000 108,000 20,000 231,000 453,000 778,500 583,400 15,000 180,100 119,700 60,400 21,800 38,600 2,000 2005 25,000 62,000 147,000 234,000 285,000 519,000 53,000 43,000 30,000 126,000 84,000 20,000 289,000 519,000 981,900 739,200 15,000 227,700 122,700 105,000 43,200 61,800 4,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION Based on the information provided here are some key points and considerations for the term loan request and the account officers problem Loan Request The company Imperial Woodworks Inc is see...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started