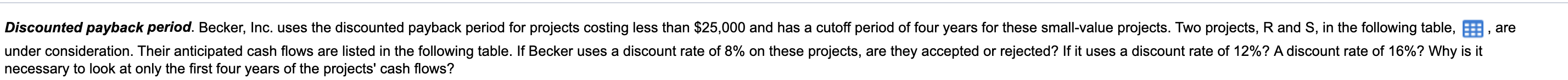

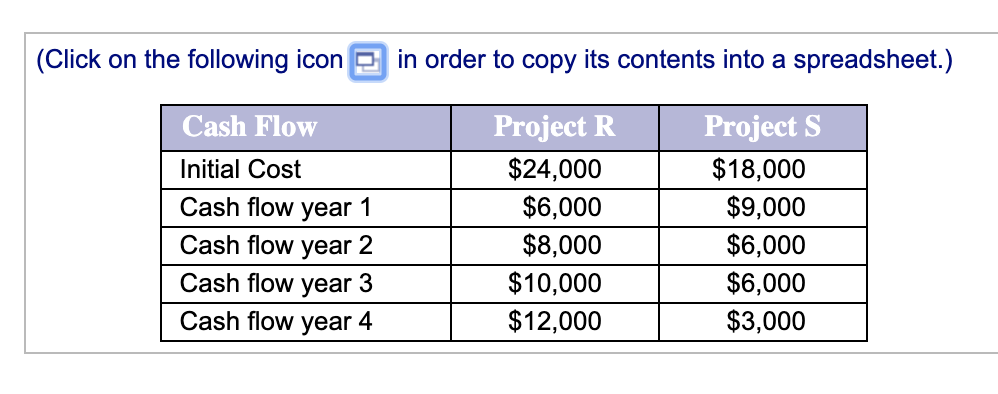

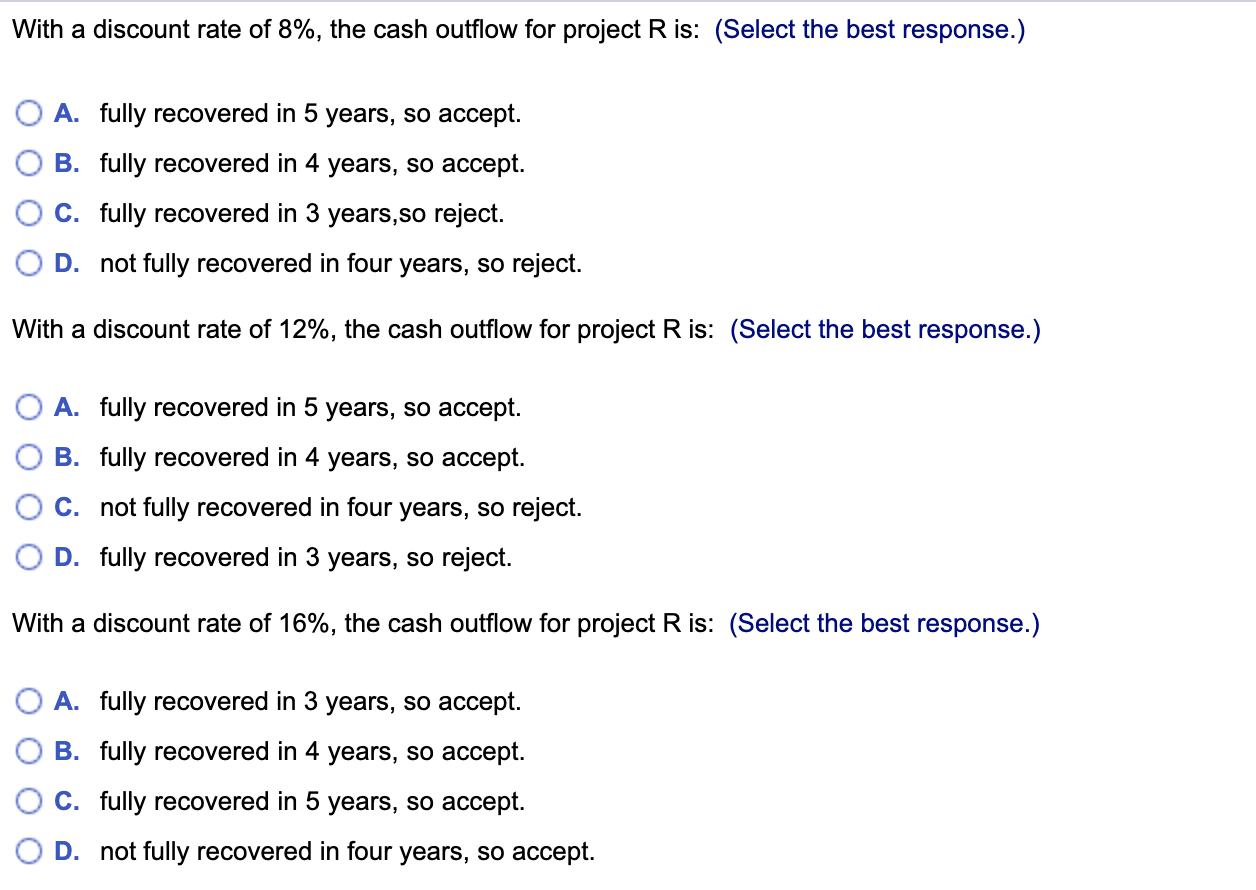

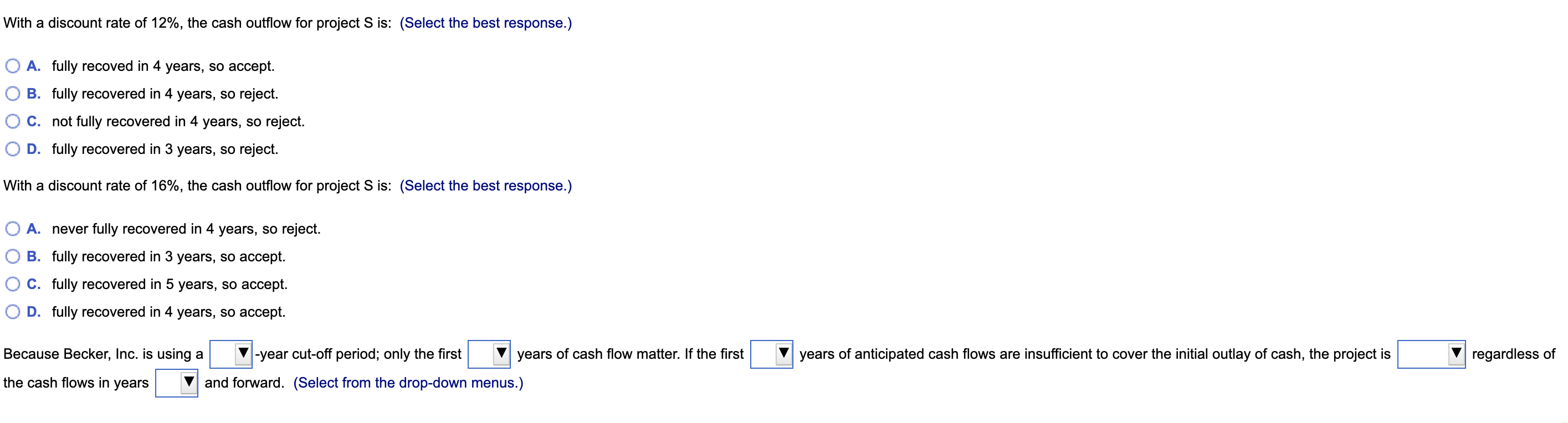

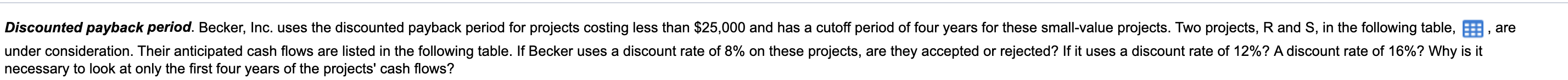

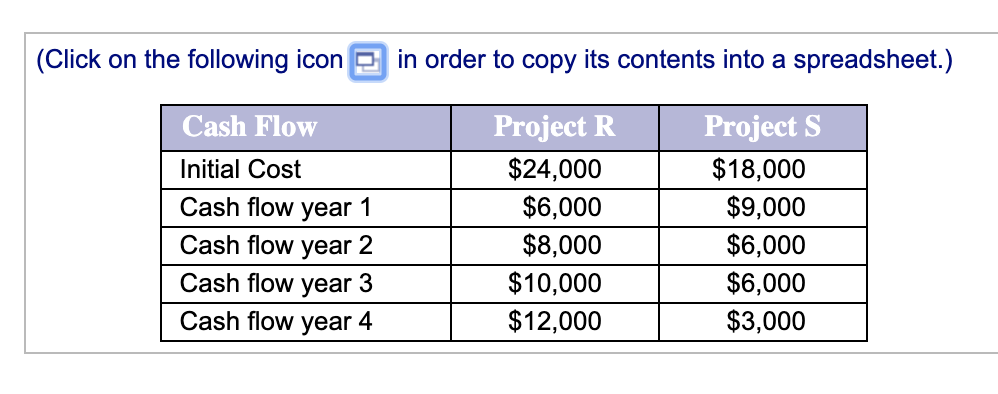

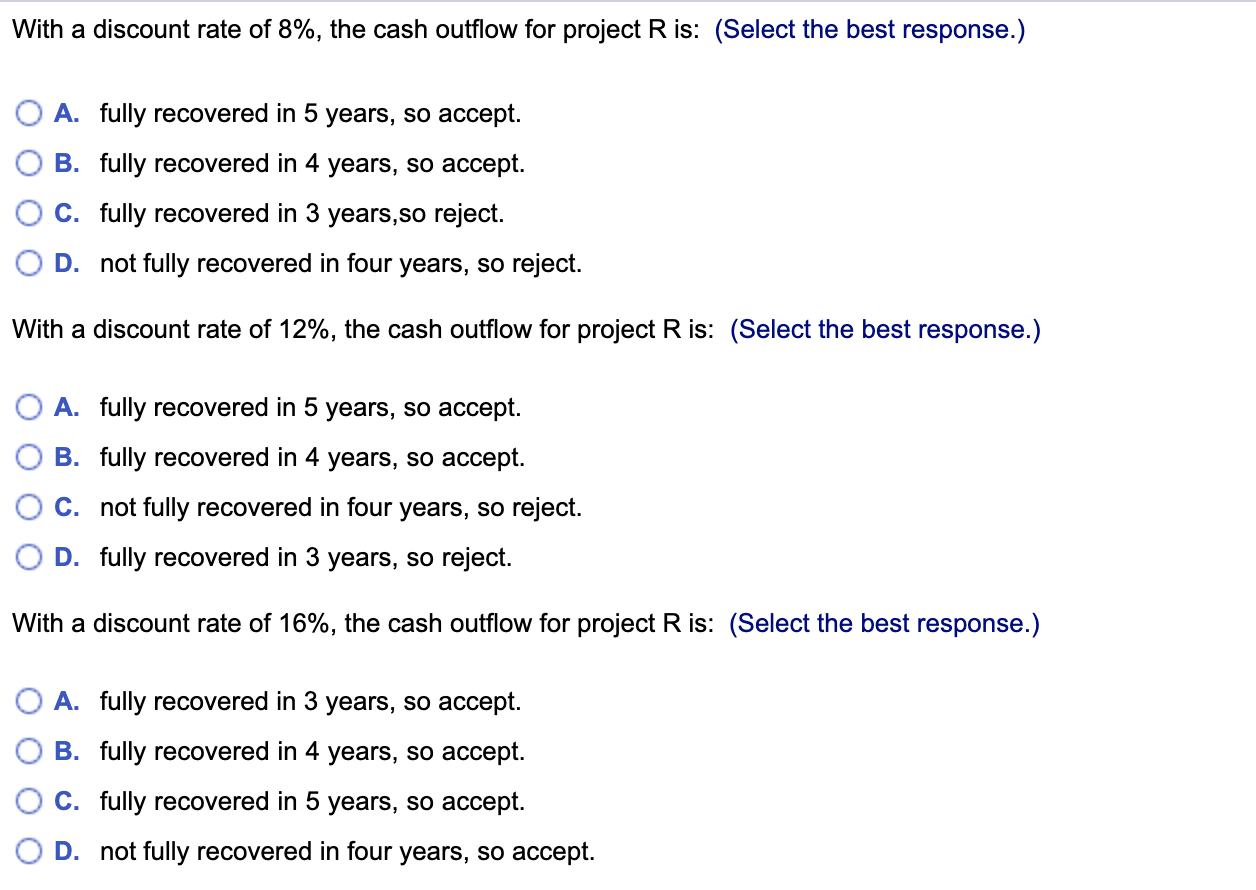

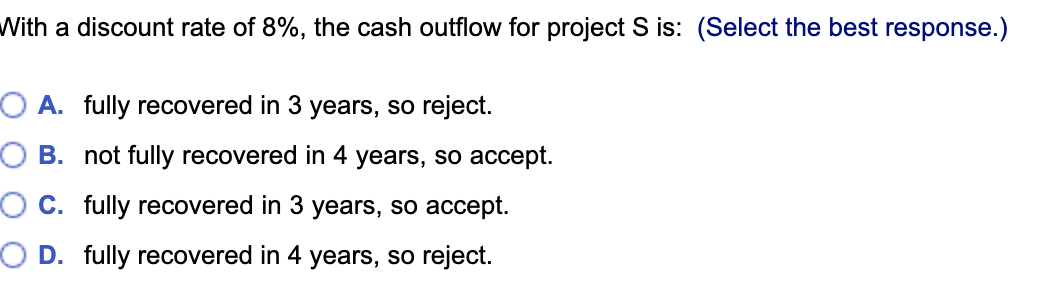

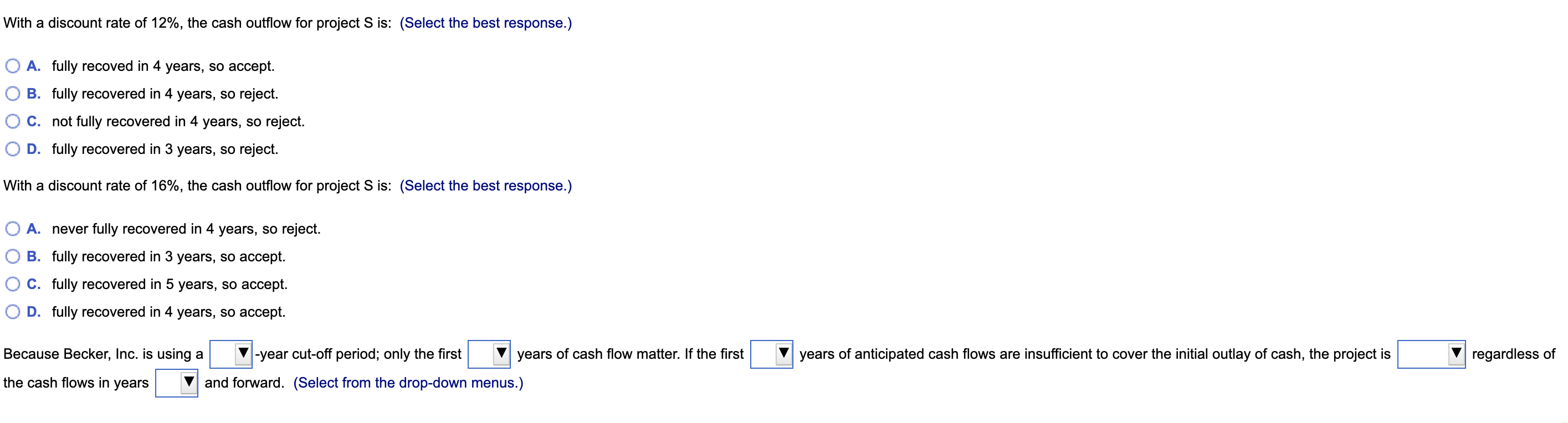

Discounted payback period. Becker, Inc. uses the discounted payback period for projects costing less than $25,000 and has a cutoff period of four years for these small-value projects. Two projects, R and S, in the following table, E, are under consideration. Their anticipated cash flows are listed in the following table. If Becker uses a discount rate of 8% on these projects, are they accepted or rejected? If it uses a discount rate of 12%? A discount rate of 16%? Why is it necessary to look at only the first four years of the projects' cash flows? (Click on the following icon in order to copy its contents into a spreadsheet.) Cash Flow Initial Cost Cash flow year 1 Cash flow year 2 Cash flow year 3 Cash flow year 4 Project R $24,000 $6,000 $8,000 $10,000 $12,000 Project S $18,000 $9,000 $6,000 $6,000 $3,000 With a discount rate of 8%, the cash outflow for project Ris: (Select the best response.) A. fully recovered in 5 years, so accept. B. fully recovered in 4 years, so accept. C. fully recovered in 3 years,so reject. D. not fully recovered in four years, so reject. With a discount rate of 12%, the cash outflow for project R is: (Select the best response.) O A. fully recovered in 5 years, so accept. B. fully recovered in 4 years, so accept. C. not fully recovered in four years, so reject. D. fully recovered in 3 years, so reject. With a discount rate of 16%, the cash outflow for project R is: (Select the best response.) A. fully recovered in 3 years, so accept. B. fully recovered in 4 years, so accept. C. fully recovered in 5 years, so accept. D. not fully recovered in four years, so accept. With a discount rate of 8%, the cash outflow for project S is: (Select the best response.) O A. fully recovered in 3 years, so reject. O B. not fully recovered in 4 years, so accept. O C. fully recovered in 3 years, so accept. OD. fully recovered in 4 years, so reject. With a discount rate of 12%, the cash outflow for project Sis: (Select the best response.) O A. fully recoved in 4 years, so accept. B. fully recovered in 4 years, so reject. C. not fully recovered in 4 years, so reject. D. fully recovered in 3 years, so reject. With a discount rate of 16%, the cash outflow for project S is: (Select the best response.) A. never fully recovered in 4 years, so reject. B. fully red vered in 3 years, so accept. C. fully recovered in 5 years, so accept. D. fully recovered in 4 years, so accept. years of anticipated cash flows are insufficient to cover the initial outlay of cash, the project is regardless of Because Becker, Inc. is using a -year cut-off period; only the first years of cash flow matter. If the first the cash flows in years and forward. (Select from the drop-down menus.)