Question

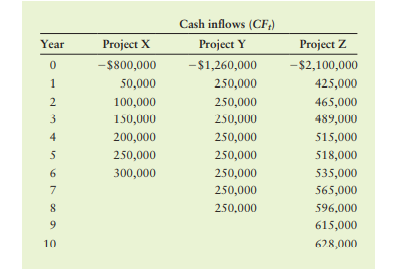

Discounted payback periods As a financial analyst for your company, you have been asked to calculate the discounted payback period for the following projects and

a. What is the discounted payback period of each project?

b. Which projects should the company invest in based on the maximum allowable payback period?

Year 0 1 2 3 N 4 5 6 7 8 9 10 Project X -$800,000 50,000 100,000 150,000 200,000 250,000 300,000 Cash inflows (CF) Project Y -$1,260,000 250,000 250,000 250,000 250,000 250,000 250,000 250,000 250,000 Project Z -$2,100,000 425,000 465,000 489,000 515,000 518,000 535,000 565,000 596,000 615,000 628,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Managerial Finance

Authors: Chad Zutter, Scott Smart

16th Global Edition

1292400641, 978-1292400648

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App