Question

Discoverit! Company has just paid $1.5 dividend payment. The current stock price is $20 and has 2,500,000 outstanding shares. Calculate the growth rate using the

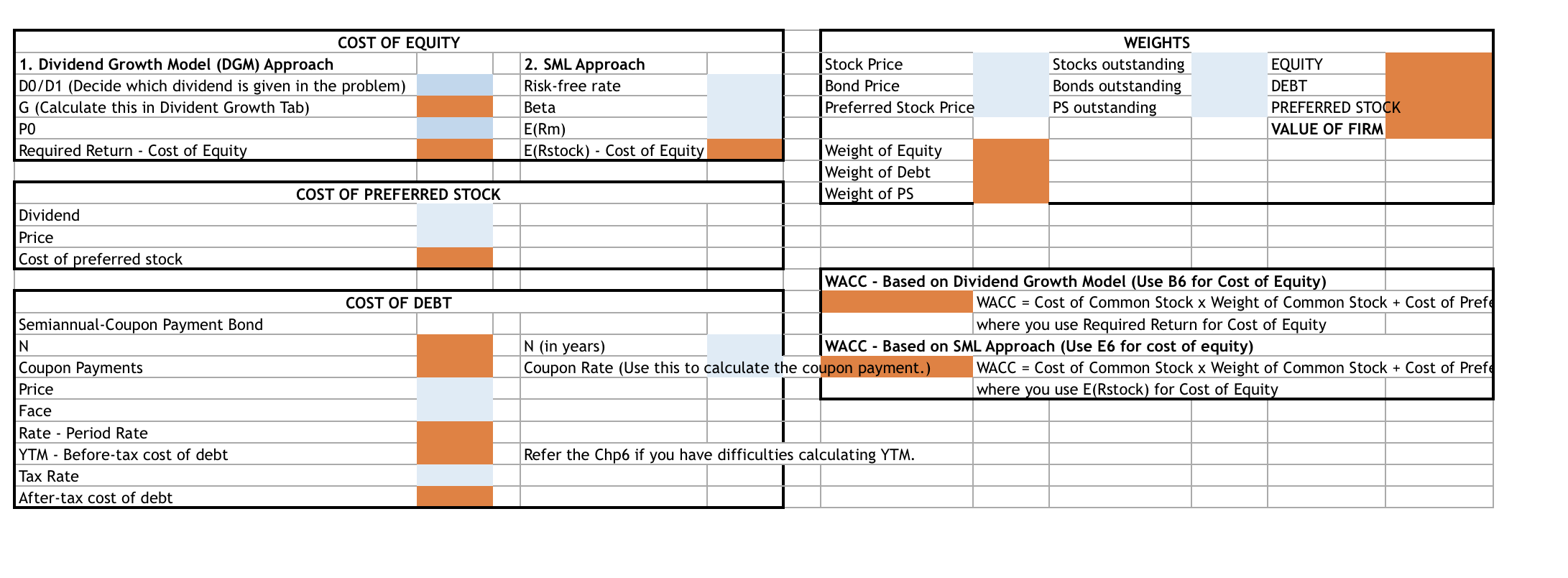

| Discoverit! Company has just paid $1.5 dividend payment. The current stock price is $20 and has 2,500,000 outstanding shares. Calculate the growth rate using the dividend payments given under Dividend Growth Tab of this same Excel Sheet and keep two decimals when you use this growth rate in DGM. Calculate cost of equity, based on DGM. |

| The company has a beta of 1.2 and return on the market is 6%. Risk free rate is 2.2%. Calculate cost of equity, based on SML. |

| The company has 500,000 preferred stock outstanding with selling price of $25 and dividend payment of $3. |

| Discoverit! has only one bond outstanding with a maturity period of 10 years. The bond makes semiannual coupon payments and the coupon rates is 10%. The selling price of the bond is $1,050 and face is $1,000. The tax rate is 21% and the company has 2,000 bonds outstanding. Calculate before and after-tax cost of debt. |

| Calculate WACC using SML approach to calculate Cost of Equity. |

| Calculate WACC using Dividend Growth Model approach to calculate Cost of Equity. |

| Note: All the blue highlighted cells on the WACC worksheet are the numbers that you can just get from the question and enter in your excel sheet. |

| Note: All the orange highlighted cells on the WACC worksheet require calculation. |

| |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started