Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discovery DAC is an Irish owned company specialising in distribution services. It is concerned at the pace of changing legislation and the requirement to

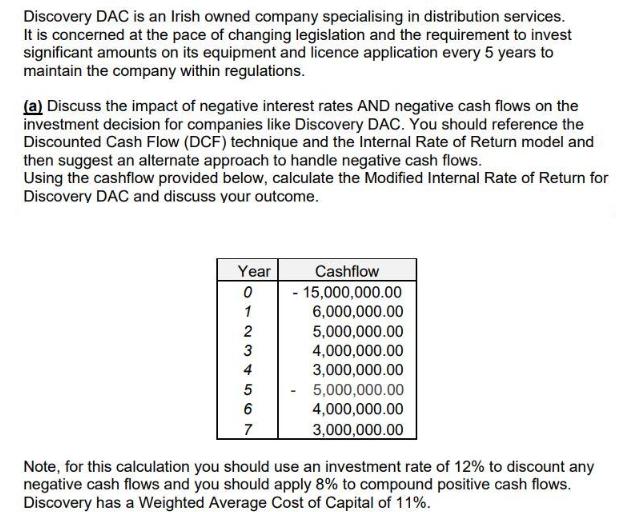

Discovery DAC is an Irish owned company specialising in distribution services. It is concerned at the pace of changing legislation and the requirement to invest significant amounts on its equipment and licence application every 5 years to maintain the company within regulations. (a) Discuss the impact of negative interest rates AND negative cash flows on the investment decision for companies like Discovery DAC. You should reference the Discounted Cash Flow (DCF) technique and the Internal Rate of Return model and then suggest an alternate approach to handle negative cash flows. Using the cashflow provided below, calculate the Modified Internal Rate of Return for Discovery DAC and discuss your outcome. Year 0 1 234567 Cashflow - 15,000,000.00 6,000,000.00 5,000,000.00 4,000,000.00 3,000,000.00 5,000,000.00 4,000,000.00 3,000,000.00 Note, for this calculation you should use an investment rate of 12% to discount any negative cash flows and you should apply 8% to compound positive cash flows. Discovery has a Weighted Average Cost of Capital of 11%.

Step by Step Solution

★★★★★

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Negative interest rates and negative cash flows can significantly impact investment decisions for companies like Discovery DAC Heres how they affect t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started