Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are planning to invest in two stocks and a risk free asset. You are sure that economy is expected to behave according to

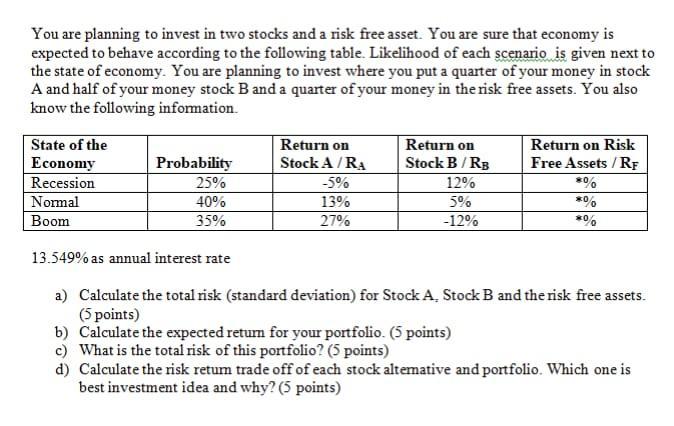

You are planning to invest in two stocks and a risk free asset. You are sure that economy is expected to behave according to the following table. Likelihood of each scenario is given next to the state of economy. You are planning to invest where you put a quarter of your money in stock A and half of your money stock B and a quarter of your money in the risk free assets. You also know the following information. State of the Economy Recession Normal Boom Probability 25% 40% 35% Return on Stock A/RA -5% 13% 27% Return on Stock B/RB 12% 5% -12% Return on Risk Free Assets / RF 80% *0% *0 13.549% as annual interest rate a) Calculate the total risk (standard deviation) for Stock A, Stock B and the risk free assets. (5 points) b) Calculate the expected return for your portfolio. (5 points) c) What is the total risk of this portfolio? (5 points) d) Calculate the risk return trade off of each stock alterative and portfolio. Which one is best investment idea and why? (5 points)

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Economy Probality Returnp RetunB PX Py xx y7 Dxx ply1p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started