Discuss Issues raise in the case and recommendations on how to resolve the issues.

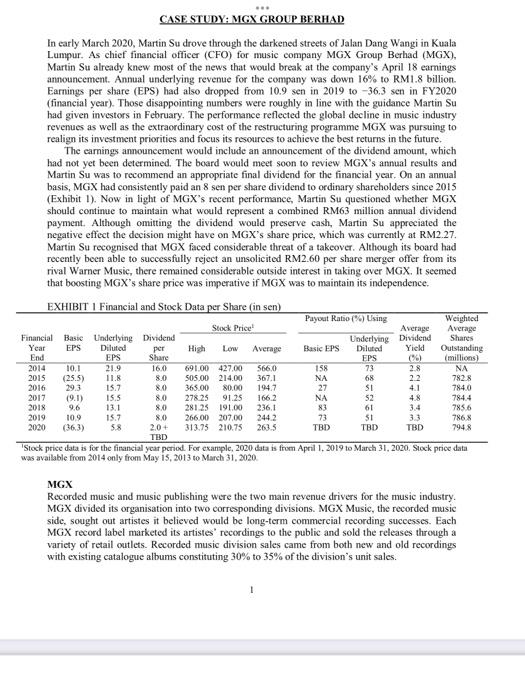

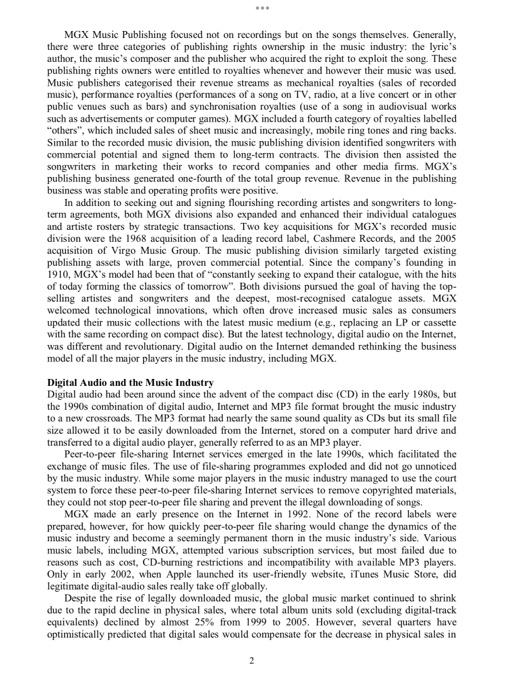

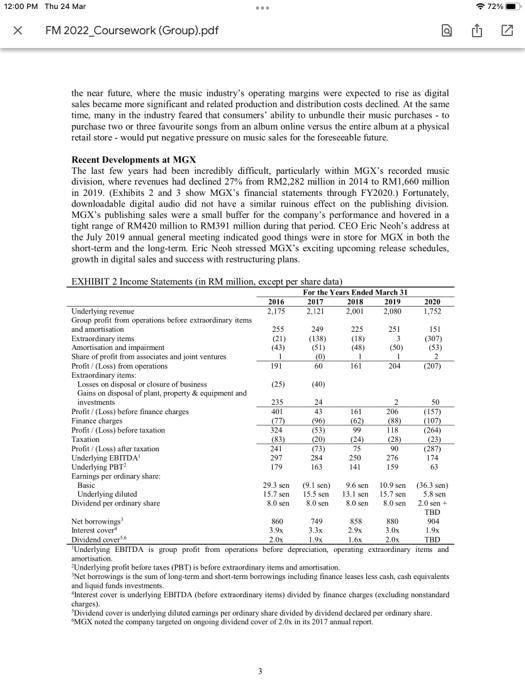

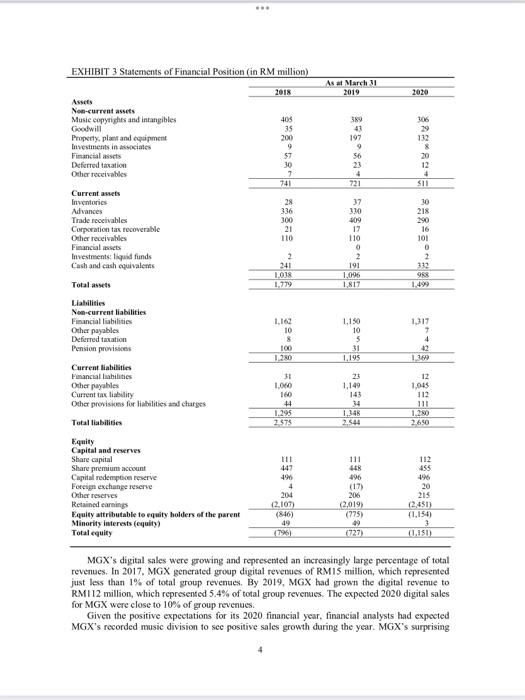

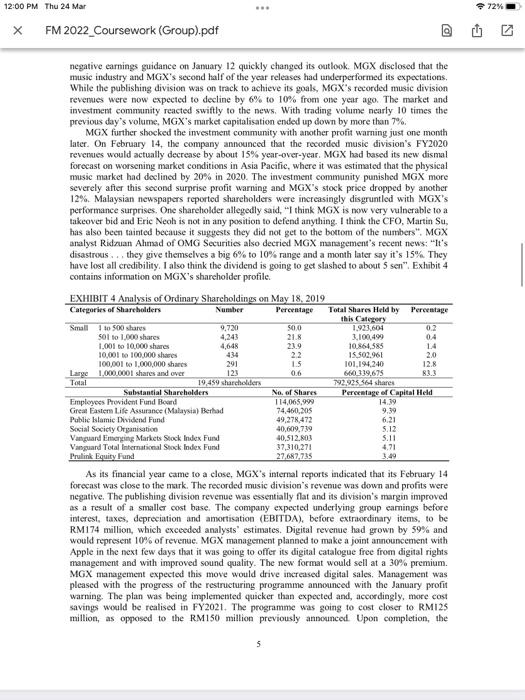

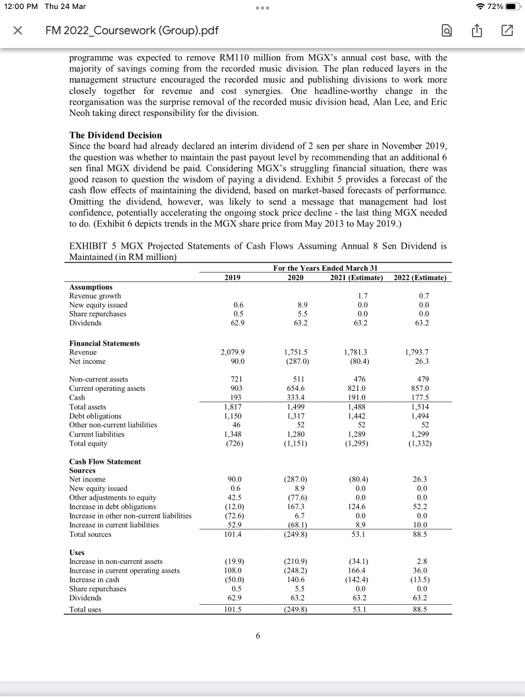

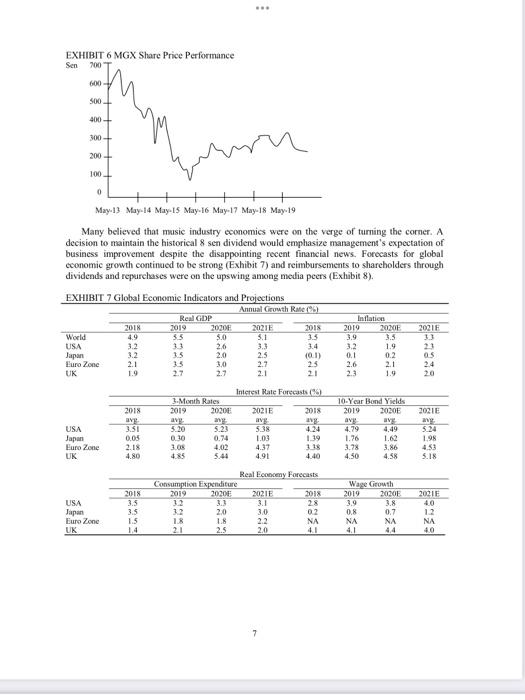

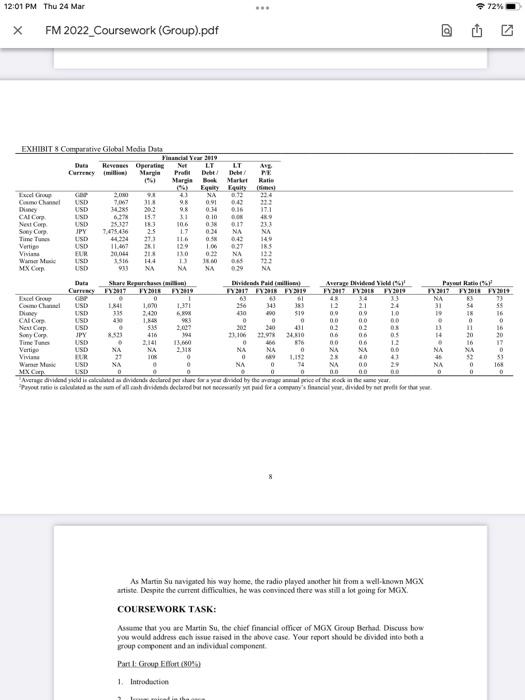

CASE STUDY: MGX GROUP BERHAD In early March 2020, Martin Su drove through the darkened streets of Jalan Dang Wangi in Kuala Lumpur. As chief financial officer (CFO) for music company MGX Group Berhad (MGX), Martin Su already knew most of the news that would break at the company's April 18 earnings announcement. Annual underlying revenue for the company was down 16% to RM1.8 billion. Earnings per share (EPS) had also dropped from 10.9 sen in 2019 to -36,3 sen in FY2020 (financial year). Those disappointing numbers were roughly in line with the guidance Martin Su had given investors in February. The performance reflected the global decline in music industry revenues as well as the extraordinary cost of the restructuring programme MGX was pursuing to realign its investment priorities and focus its resources to achieve the best returns in the future. The earnings announcement would include an announcement of the dividend amount, which had not yet been determined. The board would meet soon to review MGX's annual results and Martin Su was to recommend an appropriate final dividend for the financial year. On an annual basis, MGX had consistently paid an 8 sen per share dividend to ordinary shareholders since 2015 (Exhibit 1). Now in light of MGX's recent performance, Martin Su questioned whether MGX should continue to maintain what would represent a combined RM63 million annual dividend payment. Although omitting the dividend would preserve cash, Martin Su appreciated the negative effect the decision might have on MGX's share price, which was currently at RM2.27. Martin Su recognised that MGX faced considerable threat of a takeover. Although its board had recently been able to successfully reject an unsolicited RM2.60 per share merger offer from its rival Warner Music, there remained considerable outside interest in taking over MGX. It seemed that boosting MGX's share price was imperative if MGX was to maintain its independence. EXHIBIT I Financial and Stock Data per Share (in sen) Payout Ratio (%) Using Weighted Stock Price! Average Average Financial Basic Underlying Dividend Underlying Dividend Shares Year EPS Diluted per High Low Average Basic EPS Diluted Yield Outstanding End EPS Share EPS (millions) 2014 10,1 21.9 16,0 691.00 427,00 566,0 158 73 2.8 NA 2015 (25.5) 11.8 8.0 505.00 214.00 367.1 NA 68 22 7828 2016 29.3 15.7 80 363.00 80.00 1947 27 SI 4.1 784.0 2017 19.1) 15.5 80 27825 91.25 166.2 52 4.8 7844 2018 13.1 8.0 281.25 191.00 236.1 83 7856 2019 109 8.0 266,00 207.00 2442 73 51 33 7868 2020 5.8 2.0 + 313.75 210.75 263.5 TBD TBD TBD 794.8 TBD Stock price data is for the financial year period. For example, 2020 data is from April 1, 2019 to March 31, 2020. Stock price data was available from 2014 only from May is, 2013 to March 31, 2020 NA 9.6 61 15.7 MGX Recorded music and music publishing were the two main revenue drivers for the music industry. MGX divided its organisation into two corresponding divisions. MGX Music, the recorded music side, sought out artistes it believed would be long-term commercial recording successes. Each MGX record label marketed its artistes' recording to the public and sold the releases through a variety of retail outlets. Recorded music division sales came from both new and old recordings with existing catalogue albums constituting 30% to 35% of the division's unit sales. MGX Music Publishing focused not on recordings but on the songs themselves. Generally, there were three categories of publishing rights ownership in the music industry: the lyrics author, the music's composer and the publisher who acquired the right to exploit the song. These publishing rights owners were entitled to royalties whenever and however their music was used. Music Publishers categorised their revenue streams as mechanical royalties (sales of recorded music), performance royalties (performances of a song on TV, radio, at a live concert or in other public venues such as bars) and synchronisation royalties (use of a song in audiovisual works such as advertisements or computer games). MGX included a fourth category of royalties labelled "others", which included sales of sheet music and increasingly, mobile ring tones and ring backs. Similar to the recorded music division, the music publishing division identified songwriters with commercial potential and signed them to long-term contracts. The division then assisted the songwriters in marketing their works to record companies and other media firms. MGX's publishing business generated one-fourth of the total group revenue. Revenue in the publishing business was stable and operating profits were positive. In addition to secking out and signing flourishing recording artistes and songwriters to long- term agreements, both MGX divisions also expanded and enhanced their individual catalogues and artiste rosters by strategic transactions. Two key acquisitions for MGX's recorded music division were the 1968 acquisition of a leading record label, Cashmere Records, and the 2005 acquisition of Virgo Music Group. The music publishing division similarly targeted existing publishing assets with large, proven commercial potential. Since the company's founding in 1910, MGX's model had been that of "constantly seeking to expand their catalogue with the hits of today forming the classics of tomorrow". Both divisions pursued the goal of having the top- selling artistes and songwriters and the deepest, most-recognised catalogue assets. MGX welcomed technological innovations, which often drove increased music sales as consumers updated their music collections with the latest music medium (eg., replacing an LP or cassette with the same recording on compact disc). But the latest technology, digital audio on the Internet, was different and revolutionary. Digital audio on the Internet demanded rethinking the business model of all the major players in the music industry, including MGX Digital Audio and the Music Industry Digital audio had been around since the advent of the compact disc (CD) in the early 1980s, but the 1990s combination of digital audio, Internet and MP3 file format brought the music industry to a new crossroads. The MP3 format had nearly the same sound quality as CDs but its small file size allowed it to be casily downloaded from the Internet, stored on a computer hard drive and transferred to a digital audio player, generally referred to as an MP3 player. Peer-to-peer file-sharing Internet services emerged in the late 1990s, which facilitated the exchange of music files. The use of file-sharing programmes exploded and did not go unnoticed by the music industry. While some major players in the music industry managed to use the court system to force these peer-to-peer file-sharing Internet services to remove copyrighted materials, they could not stop peer-to-peer file sharing and prevent the illegal downloading of songs. MGX made an early presence on the Internet in 1992. None of the record labels were prepared, however, for how quickly peer-to-peer file sharing would change the dynamics of the music industry and become a seemingly permanent thorn in the music industry's side. Various music labels, including MGX, attempted various subscription services, but most failed due to reasons such as cost, CD-burning restrictions and incompatibility with available MP3 players. Only in early 2002, when Apple launched its user-friendly website, iTunes Music Store, did legitimate digital-audio sales really take off globally. Despite the rise of legally downloaded music, the global music market continued to shrink due to the rapid decline in physical sales, where total album units sold (excluding digital-track equivalents) declined by almost 25% from 1999 to 2005. However, several quarters have optimistically predicted that digital sales would compensate for the decrease in physical sales in 2 12:00 PM Thu 24 Mar ... 72% 1 . FM 2022_Coursework (Group).pdf 41 the near future, where the music industry's operating margins were expected to rise as digital sales became more significant and related production and distribution costs declined. At the same time, many in the industry feared that consumers' ability to unbundle their music purchases - to purchase two or three favourite songs from an album online versus the entire album at a physical retail store - would put negative pressure on music sales for the foreseeable future. Recent Developments at MGX The last few years had been incredibly difficult, particularly within MGX's recorded music division, where revenues had declined 27% from RM2,282 million in 2014 to RM1,660 million in 2019. (Exhibits 2 and 3 show MGX's financial statements through FY2020.) Fortunately, downloadable digital audio did not have a similar ruinous effect on the publishing division MGX's publishing sales were a small buffer for the company's performance and hovered in a tight range of RM420 million to RM391 million during that period. CEO Eric Neoh's address at the July 2019 annual general meeting indicated good things were in store for MGX in both the short-term and the long-term Eric Neoh stressed MGX's exciting upcoming release schedules, growth in digital sales and success with restructuring plans. EXHIBIT 2 Income Statements (in RM million, except per share data) For the Years Ended March 31 2016 2017 2018 2019 2020 Underlying revenue 2,175 2.121 2,001 2,080 1,752 Group profit from operations before extraordinary items and amortisatice 255 249 225 251 151 Extraordinary items (138) (18) 3 (107) Amortisation and impairment (SI) (48) (30) (53) Share of protit from associates and joint ventures 10 1 1 Profit (Loss) from operations 191 60 161 204 (207) Extraordinary items: Losses on disposal or closure of business (25) (40) Gains on disposal of plant property & equipment and investments 235 24 2 50 Protit/Loss) before finance charges 401 43 161 206 (157) Finance charges 07 (96) (62) (88) (107) Profit/(Less) before taxation 124 (53) (264) Taxation (83) (20) (24) (28) (23) Profiteatter taxation 241 (73) 75 90 (287) Underlying EBITDA 297 284 250 276 174 Underlying PBT 179 163 141 159 63 Earnings per ordinary share Basic 29. sen 19.1 sen) 9.6 sen 10.9 sen (36 3 sen Underlying diluted 15.7 sen 13.1 sen 15.7 sem 5.8 Dividend per ordinary share 80 sen 80 sen 8.0 sen 20 sen TBD Net borrowings 80 749 880 904 Interest cover 1.9 3.3 2.9 3.0 1.9% Dividende 2. 1.6 2.0 TRD Underlying EBITDA is group profit from operations before depreciation, operating extraordinary items and amortisation Underlying profit before takes IPBT) is before extraordinary items and amortisation Net borrowings is the sum of long-term and short-term borrowings including finance leases less cash, cash equivalents and liquid funds investments Interest cover is underlying EBITDA (before extraordinary items) divided by finance charges (excluding nonstandard charges) Dividend cover is underlying diluted camins per ordinary share divided by dividend declared per dinary share. MGX noted the company targeted on ongoing dividend cover of 2.x in its 2017 annual report 118 1999agra 15.5 80 sen 19 3 ... EXHIBIT 3 Statements of Financial Position (in RM million) As at March 31 2019 2020 306 29 132 & 405 35 200 9 57 30 7 741 389 41 197 9 56 23 4 721 12 4 SII 28 336 300 21 110 Assets Non-current assets Music copyrights and intangibles Goodwill Property, plant and equipment Investments in associates Financial assets Deferred taxation Other receivables Current assets Inventories Advances Trade receivables Corporation tax recoverable Other receivables Financial assets Investments: liquid funds Cash and cash equivalents Total assets Liabilities Non-current liabilities Financial liabilities Other payables Deferred taxation Pension provisies Current liabilities Financial abilities Other payables Current tax liability Other provision for liabilities and charges Total liabilities 37 330 409 12 110 0 2 191 1,096 1817 10 218 290 16 101 0 2 330 988 1.49 2 241 1.08 1.779 11 10 8 100 20 1.150 10 5 31 1.195 1.317 7 4 42 1.380 31 1.000 100 4 1.295 2575 23 1.149 143 34 1.14 2.544 12 1.045 112 111 1.280 2.650 Equity Capital and reserves Share capital Share premium account Capital redemption reserve Foreign exchange reserve Other reserves Retained earnings Equity attributable to equity holders of the parent Minority Interests (equity) Totalcquity 111 447 496 4 204 2,107) (846) 111 468 496 (17) 206 (2,019) (775) 49 (727) 112 455 496 20 215 2.451) (1.154) 7961 (1.150) MGX's digital sales were growing and represented an increasingly large percentage of total revenues. In 2017, MGX generated group digital revenues of RMIS million, which represented just less than 1% of total group revenues. By 2019, MGX had grown the digital revenue to RM112 million, which represented 5.4% of total group revenues. The expected 2020 digital sales for MGX were close to 10% of group revenues. Given the positive expectations for its 2020 financial year, financial analysts had expected MGX's recorded music division to see positive sales growth during the year. MGX's surprising 12:00 PM Thu 24 Mar ... 72% FM 2022_Coursework (Group).pdf 41 negative earnings guidance on January 12 quickly changed its outlook. MGX disclosed that the music industry and MGX's second half of the year releases had underperformed its expectations, While the publishing division was on track to achieve its goals, MGX's recorded music division revenues were now expected to decline by 6% to 10% from one year ago. The market and investment community reacted swiftly to the news. With trading volume nearly 10 times the previous day's volume, MGX's market capitalisation ended up down by more than 7%. MGX further shocked the investment community with another profit warning just one month later. On February 14, the company announced that the recorded music division's FY2020 revenues would actually decrease by about 15% year-over-year. MGX had based its new dismal forecast on worsening market conditions in Asia Pacific, where it was estimated that the physical music market had declined by 20% in 2020. The investment community punished MGX more severely after this second surprise profit warning and MGX's stock price dropped by another 12%. Malaysian newspapers reported shareholders were increasingly disgruntled with MGX's performance surprises. One shareholder allegedly said, "I think MGX is now very vulnerable to a takeover bid and Eric Neoh is not in any position to defend anything. I think the CFO, Martin Su, has also been tainted because it suggests they did not get to the bottom of the numbers". MGX analyst Ridzuan Ahmad of OMG Securities also decried MGX management's recent news: "It's disastrous. they give themselves a big 6% to 10% range and a month later say it's 15%. They have lost all credibility. I also think the dividend is going to get slashed to about 5 sen". Exhibit 4 contains information on MGX's shareholder profile. EXHIBIT 4 Analysis of Ordinary Sharcholdings on May 18, 2019 Categories of Shareholders Number Percentage Total Shares Held by Percentage this Category Small to 500 shares 9.720 500 1.921.601 0.2 sol to 1,000 shares 4.243 21.8 3,100,499 04 1.001 to 10.000 shares 4,648 23.9 10864,585 14 10,001 to 100.000 shows 434 22 15.502.961 2,0 100,001 to 1,000,000 shares 291 1.5 101,194.240 12.8 Large 1.000.0001 shares and over 123 0.6 660_319.675 83.3 Total 19,459 sharcholders 792.925364 shares Substantial Shareholders No. of Shares Percentage of Capital Held Employees Provident Fund Beard 114,065,999 14.19 Great Eastern Life Assurance (Malaysia) Berhad 74.460,205 9.39 Public blamic Dividend Fund 49,278,472 621 Social Society Organisation 40,609,739 5.12 Vanguard Emerging Markets Stock Index Fund 40,512.803 Vanguard Total International Stock Index Fund 37,310,271 4.71 Prolink Equity Fund 27.687.735 As its financial year came to a close, MGX's internal reports indicated that its February 14 forecast was close to the mark. The recorded music division's revenue was down and profits were negative. The publishing division revenue was essentially flat and its division's margin improved as a result of a smaller cost base. The company expected underlying group camings before interest, taxes, depreciation and amortisation (EBITDA), before extraordinary items to be RM174 million, which exceeded analysts' estimates. Digital revenue had grown by 59% and would represent 10% of revenue. MGX management planned to make a joint announcement with Apple in the next few days that it was going to offer its digital catalogue free from digital rights management and with improved sound quality. The new format would sell at a 30% premium. MGX management expected this move would drive increased digital sales. Management was pleased with the progress of the restructuring programme announced with the January profit warning. The plan was being implemented quicker than expected and, accordingly, more cost savings would be realised in FY2021. The programme was going to cost closer to RM125 million, as opposed to the RM150 million previously announced. Upon completion, the 5.11 12:00 PM Thu 24 Mar 72% FM 2022_Coursework (Group).pdf 41 programme was expected to remove RM110 million from MGX's annual cost base, with the majority of savings coming from the recorded music division. The plan reduced layers in the management structure encouraged the recorded music and publishing divisions to work more closely together for revenue and cost synergies. One headline-worthy change in the reorganisation was the surprise removal of the recorded music division head, Alan Lee, and Erie Neoh taking direct responsibility for the division The Dividend Decision Since the board had already declared an interim dividend of 2 sen per share in November 2019, the question was whether to maintain the past payout level by recommending that an additional 6 sen final MGX dividend be paid. Considering MGX's struggling financial situation, there was good reason to question the wisdom of paying a dividend. Exhibit 5 provides a forecast of the cash flow effects of maintaining the dividend, based on market-based forecasts of performance, Omitting the dividend, however, was likely to send a message that management had lost confidence, potentially accelerating the ongoing stock price decline - the last thing MGX needed to do. (Exhibit 6 depicts trends in the MGX share price from May 2013 to May 2019.) EXHIBIT 5 MGX Projected Statements of Cash Flows Assuming Annual 8 Sen Dividend is Maintained in RM million) For the Years Ended March 31 2020 2021 (Estimate) 2022 (Estimate) Assumptions Revenue growth 1.7 0.7 New equity issued Share repurchases 5.5 00 0.0 Dividends 632 2019 89 00 0.0 0.6 OS 62.0 63.2 2.0799 90.0 1,7813 1.7515 (287.0) 1.793.7 261 (804) 511 6546 Financial Statements Revenue Net income Non-current assets Current operating assets Cash Total assets Debt obligations Otherton-current liabilities Current liabilities Total equity 721 903 193 1,817 1.150 46 1.348 476 821.0 1910 1.488 1.49 1317 S2 1.280 (1151) 8570 1773 1.514 1.494 52 1.299 (1,332) 52 1.289 (726) (287.0) Cash Flow Statement Sources Net income New equity issued Other adjustments to quity Increase in debt obligaties Increase in other non-current liabilities Increase in current liabilities Total sources 90.0 0.6 425 (12.09 (726) $29 1014 (776) 1673 6.7 (681) 249.8) (804) 0.0 00 124.6 0,0 80 53.1 261 0.0 0.0 $22 0.0 100 &$ Uses Increase in non-currentes Increase in current operating at Increase in cash Sharc repurchases Dividends Tocales (19.99 1080 (50.00 0.5 629 1015 (21099 (2482) 140.6 5.5 632 249.8 (34.1) 166.4 (1424) 00 63.2 $3.1 2x 360 (135) 0.0 632 XX ... EXHIBIT 6 MGX Share Price Performance Sen 200 600-V 500+ 400+ 300+ 200+ 100+ 0 May 13 May 14 May-15 May 16 May-17 May-18 May.19 Many believed that music industry economics were on the verge of turning the corner. A decision to maintain the historical & sen dividend would emphasize management's expectation of business improvement despite the disappointing recent financial news. Forecasts for global economic growth continued to be strong (Exhibit 7) and reimbursements to shareholders through dividends and repurchases were on the upswing among media peers (Exhibit 8). EXHIBIT 7 Global Economic Indicators and Projections Annual Growth Rae Real GDP 2018 2019 20201 20211 2018 World 4.9 35 5.0 5.1 3.5 USA 3.2 33 2.6 3.3 3.4 Japan 3.2 15 2.0 2.5 101) Euro Zone 2.1 15 3.0 2.7 25 UK 1.9 2.7 2.7 2.1 21 Inflation 2019 20201 3.9 3.5 1.9 0.1 0.2 2.6 2.1 23 2011 33 23 05 2.4 20 Interest Rate Forecasts (5) 2018 2021E 2018 2019 USA Japan Euro Zone UK 3.51 0.05 2.18 4.80 1. Month Rates 2019 2020 avy 5.20 5.23 0.30 0.74 3.08 4.02 485 5.41 AVE 5.38 1.03 4.37 4.91 424 1.39 318 4.40 10-Year Bond Yields 2020 ave ave 4.29 4,49 1.76 1.62 3.78 3.86 4.50 4.58 2021E avy 5.24 1.98 4.53 5.18 USA Japan Euro Zone UK 2018 33 35 1.5 1.4 Real Economy Forecasts Consumption Expenditure 2019 2020 20211 2018 12 30 31 28 22 2.0 30 02 18 LA 2.2 NA 21 2.5 2.0 41 Wage Growth 2019 20201 39 3.8 08 07 NA NA 4.1 44 2021F 40 12 NA 7 12:01 PM Thu 24 Mar 72% 1 ... . X FM 2022_Coursework (Group).pdf 11 LT PE Katie Market Equity EXHIBIT 8 Comparative Global Media Data Financial Year 2019 Dura Resperating Ne LT Currency will) Marin Profile Margile Bo Equity CNP 2 13 XA Como Ch UND 707 98 0.91 Die USD 202 98 04 CAIC USD 6:27 15.7 1 6.10 Corp USD 2.21 13 10.6 08 Swy Corp JPY 5.436 L7 0.34 Time Tuner 116 Vertige USD 120 100 VIN FUR 2004 213 110 03 Wim Muc USD) 116 H4 11 MEX Cep USD NA NA NA 00 0.16 GON 0.17 NA 0:43 027 NA 22 17.1 49 231 NA 34 RS USD 22 20 NA Star Repurchases Bhd Pald) Curry FY2017 Awra INvidad Velas PY DOES FY2119 EGRE FY2017 FY2018 2019 0 FY2017 FYD FY2019 63 Camera Claugi 61 USD 48 34 1.841 1,00 1.31 56 23 NA 343 383 12 21 31 USD 3 2,420 24 410 CAICO 200 519 USD 09 0.0 1. 10 19 0 0 0 Net Cep 00 00 USD SA 00 2007 202 240 431 03 Sony Cory 8523 416 03 13 wou 22.106 22.97 34.110 Time Tunes 06 06 USD . 05 14 876 Vertigo 2,141 USD 00 06 NA NA 12 IN NA NA 0 TUR NA NA 00 NA 0 0 War Men USD LIS 16 NA 0 0 NA 0. 14 MX Cap UND NA 00 NA 0 00 00 Average vidend padid e collatod as dividende declaro per share Sora you divided by the wagonul pe af the stock en the same year BB D Payot toties led them fillede declared barnet mearly paid for a company ilye. divided by pred for that you FY2018 FY 2010 3 73 54 SS 15 16 0 0 16 30 20 16 17 NA 0 5 53 0 165 0 0 160 Viv As Martin Su navigated his way home, the radio played another hit from a well-known MGX artiste. Despite the current difficulties, he was convinced there was still a lot going for MGX COURSEWORK TASK: Assume that you are Martin Su, the chief financial officer of MGX Group Berhad. Discuss how you would address cache issue raised in the above case. Your report should be divided into both a group component and an individual component Part 1: Group Effort (0%) 1. Introduction etiba CASE STUDY: MGX GROUP BERHAD In early March 2020, Martin Su drove through the darkened streets of Jalan Dang Wangi in Kuala Lumpur. As chief financial officer (CFO) for music company MGX Group Berhad (MGX), Martin Su already knew most of the news that would break at the company's April 18 earnings announcement. Annual underlying revenue for the company was down 16% to RM1.8 billion. Earnings per share (EPS) had also dropped from 10.9 sen in 2019 to -36,3 sen in FY2020 (financial year). Those disappointing numbers were roughly in line with the guidance Martin Su had given investors in February. The performance reflected the global decline in music industry revenues as well as the extraordinary cost of the restructuring programme MGX was pursuing to realign its investment priorities and focus its resources to achieve the best returns in the future. The earnings announcement would include an announcement of the dividend amount, which had not yet been determined. The board would meet soon to review MGX's annual results and Martin Su was to recommend an appropriate final dividend for the financial year. On an annual basis, MGX had consistently paid an 8 sen per share dividend to ordinary shareholders since 2015 (Exhibit 1). Now in light of MGX's recent performance, Martin Su questioned whether MGX should continue to maintain what would represent a combined RM63 million annual dividend payment. Although omitting the dividend would preserve cash, Martin Su appreciated the negative effect the decision might have on MGX's share price, which was currently at RM2.27. Martin Su recognised that MGX faced considerable threat of a takeover. Although its board had recently been able to successfully reject an unsolicited RM2.60 per share merger offer from its rival Warner Music, there remained considerable outside interest in taking over MGX. It seemed that boosting MGX's share price was imperative if MGX was to maintain its independence. EXHIBIT I Financial and Stock Data per Share (in sen) Payout Ratio (%) Using Weighted Stock Price! Average Average Financial Basic Underlying Dividend Underlying Dividend Shares Year EPS Diluted per High Low Average Basic EPS Diluted Yield Outstanding End EPS Share EPS (millions) 2014 10,1 21.9 16,0 691.00 427,00 566,0 158 73 2.8 NA 2015 (25.5) 11.8 8.0 505.00 214.00 367.1 NA 68 22 7828 2016 29.3 15.7 80 363.00 80.00 1947 27 SI 4.1 784.0 2017 19.1) 15.5 80 27825 91.25 166.2 52 4.8 7844 2018 13.1 8.0 281.25 191.00 236.1 83 7856 2019 109 8.0 266,00 207.00 2442 73 51 33 7868 2020 5.8 2.0 + 313.75 210.75 263.5 TBD TBD TBD 794.8 TBD Stock price data is for the financial year period. For example, 2020 data is from April 1, 2019 to March 31, 2020. Stock price data was available from 2014 only from May is, 2013 to March 31, 2020 NA 9.6 61 15.7 MGX Recorded music and music publishing were the two main revenue drivers for the music industry. MGX divided its organisation into two corresponding divisions. MGX Music, the recorded music side, sought out artistes it believed would be long-term commercial recording successes. Each MGX record label marketed its artistes' recording to the public and sold the releases through a variety of retail outlets. Recorded music division sales came from both new and old recordings with existing catalogue albums constituting 30% to 35% of the division's unit sales. MGX Music Publishing focused not on recordings but on the songs themselves. Generally, there were three categories of publishing rights ownership in the music industry: the lyrics author, the music's composer and the publisher who acquired the right to exploit the song. These publishing rights owners were entitled to royalties whenever and however their music was used. Music Publishers categorised their revenue streams as mechanical royalties (sales of recorded music), performance royalties (performances of a song on TV, radio, at a live concert or in other public venues such as bars) and synchronisation royalties (use of a song in audiovisual works such as advertisements or computer games). MGX included a fourth category of royalties labelled "others", which included sales of sheet music and increasingly, mobile ring tones and ring backs. Similar to the recorded music division, the music publishing division identified songwriters with commercial potential and signed them to long-term contracts. The division then assisted the songwriters in marketing their works to record companies and other media firms. MGX's publishing business generated one-fourth of the total group revenue. Revenue in the publishing business was stable and operating profits were positive. In addition to secking out and signing flourishing recording artistes and songwriters to long- term agreements, both MGX divisions also expanded and enhanced their individual catalogues and artiste rosters by strategic transactions. Two key acquisitions for MGX's recorded music division were the 1968 acquisition of a leading record label, Cashmere Records, and the 2005 acquisition of Virgo Music Group. The music publishing division similarly targeted existing publishing assets with large, proven commercial potential. Since the company's founding in 1910, MGX's model had been that of "constantly seeking to expand their catalogue with the hits of today forming the classics of tomorrow". Both divisions pursued the goal of having the top- selling artistes and songwriters and the deepest, most-recognised catalogue assets. MGX welcomed technological innovations, which often drove increased music sales as consumers updated their music collections with the latest music medium (eg., replacing an LP or cassette with the same recording on compact disc). But the latest technology, digital audio on the Internet, was different and revolutionary. Digital audio on the Internet demanded rethinking the business model of all the major players in the music industry, including MGX Digital Audio and the Music Industry Digital audio had been around since the advent of the compact disc (CD) in the early 1980s, but the 1990s combination of digital audio, Internet and MP3 file format brought the music industry to a new crossroads. The MP3 format had nearly the same sound quality as CDs but its small file size allowed it to be casily downloaded from the Internet, stored on a computer hard drive and transferred to a digital audio player, generally referred to as an MP3 player. Peer-to-peer file-sharing Internet services emerged in the late 1990s, which facilitated the exchange of music files. The use of file-sharing programmes exploded and did not go unnoticed by the music industry. While some major players in the music industry managed to use the court system to force these peer-to-peer file-sharing Internet services to remove copyrighted materials, they could not stop peer-to-peer file sharing and prevent the illegal downloading of songs. MGX made an early presence on the Internet in 1992. None of the record labels were prepared, however, for how quickly peer-to-peer file sharing would change the dynamics of the music industry and become a seemingly permanent thorn in the music industry's side. Various music labels, including MGX, attempted various subscription services, but most failed due to reasons such as cost, CD-burning restrictions and incompatibility with available MP3 players. Only in early 2002, when Apple launched its user-friendly website, iTunes Music Store, did legitimate digital-audio sales really take off globally. Despite the rise of legally downloaded music, the global music market continued to shrink due to the rapid decline in physical sales, where total album units sold (excluding digital-track equivalents) declined by almost 25% from 1999 to 2005. However, several quarters have optimistically predicted that digital sales would compensate for the decrease in physical sales in 2 12:00 PM Thu 24 Mar ... 72% 1 . FM 2022_Coursework (Group).pdf 41 the near future, where the music industry's operating margins were expected to rise as digital sales became more significant and related production and distribution costs declined. At the same time, many in the industry feared that consumers' ability to unbundle their music purchases - to purchase two or three favourite songs from an album online versus the entire album at a physical retail store - would put negative pressure on music sales for the foreseeable future. Recent Developments at MGX The last few years had been incredibly difficult, particularly within MGX's recorded music division, where revenues had declined 27% from RM2,282 million in 2014 to RM1,660 million in 2019. (Exhibits 2 and 3 show MGX's financial statements through FY2020.) Fortunately, downloadable digital audio did not have a similar ruinous effect on the publishing division MGX's publishing sales were a small buffer for the company's performance and hovered in a tight range of RM420 million to RM391 million during that period. CEO Eric Neoh's address at the July 2019 annual general meeting indicated good things were in store for MGX in both the short-term and the long-term Eric Neoh stressed MGX's exciting upcoming release schedules, growth in digital sales and success with restructuring plans. EXHIBIT 2 Income Statements (in RM million, except per share data) For the Years Ended March 31 2016 2017 2018 2019 2020 Underlying revenue 2,175 2.121 2,001 2,080 1,752 Group profit from operations before extraordinary items and amortisatice 255 249 225 251 151 Extraordinary items (138) (18) 3 (107) Amortisation and impairment (SI) (48) (30) (53) Share of protit from associates and joint ventures 10 1 1 Profit (Loss) from operations 191 60 161 204 (207) Extraordinary items: Losses on disposal or closure of business (25) (40) Gains on disposal of plant property & equipment and investments 235 24 2 50 Protit/Loss) before finance charges 401 43 161 206 (157) Finance charges 07 (96) (62) (88) (107) Profit/(Less) before taxation 124 (53) (264) Taxation (83) (20) (24) (28) (23) Profiteatter taxation 241 (73) 75 90 (287) Underlying EBITDA 297 284 250 276 174 Underlying PBT 179 163 141 159 63 Earnings per ordinary share Basic 29. sen 19.1 sen) 9.6 sen 10.9 sen (36 3 sen Underlying diluted 15.7 sen 13.1 sen 15.7 sem 5.8 Dividend per ordinary share 80 sen 80 sen 8.0 sen 20 sen TBD Net borrowings 80 749 880 904 Interest cover 1.9 3.3 2.9 3.0 1.9% Dividende 2. 1.6 2.0 TRD Underlying EBITDA is group profit from operations before depreciation, operating extraordinary items and amortisation Underlying profit before takes IPBT) is before extraordinary items and amortisation Net borrowings is the sum of long-term and short-term borrowings including finance leases less cash, cash equivalents and liquid funds investments Interest cover is underlying EBITDA (before extraordinary items) divided by finance charges (excluding nonstandard charges) Dividend cover is underlying diluted camins per ordinary share divided by dividend declared per dinary share. MGX noted the company targeted on ongoing dividend cover of 2.x in its 2017 annual report 118 1999agra 15.5 80 sen 19 3 ... EXHIBIT 3 Statements of Financial Position (in RM million) As at March 31 2019 2020 306 29 132 & 405 35 200 9 57 30 7 741 389 41 197 9 56 23 4 721 12 4 SII 28 336 300 21 110 Assets Non-current assets Music copyrights and intangibles Goodwill Property, plant and equipment Investments in associates Financial assets Deferred taxation Other receivables Current assets Inventories Advances Trade receivables Corporation tax recoverable Other receivables Financial assets Investments: liquid funds Cash and cash equivalents Total assets Liabilities Non-current liabilities Financial liabilities Other payables Deferred taxation Pension provisies Current liabilities Financial abilities Other payables Current tax liability Other provision for liabilities and charges Total liabilities 37 330 409 12 110 0 2 191 1,096 1817 10 218 290 16 101 0 2 330 988 1.49 2 241 1.08 1.779 11 10 8 100 20 1.150 10 5 31 1.195 1.317 7 4 42 1.380 31 1.000 100 4 1.295 2575 23 1.149 143 34 1.14 2.544 12 1.045 112 111 1.280 2.650 Equity Capital and reserves Share capital Share premium account Capital redemption reserve Foreign exchange reserve Other reserves Retained earnings Equity attributable to equity holders of the parent Minority Interests (equity) Totalcquity 111 447 496 4 204 2,107) (846) 111 468 496 (17) 206 (2,019) (775) 49 (727) 112 455 496 20 215 2.451) (1.154) 7961 (1.150) MGX's digital sales were growing and represented an increasingly large percentage of total revenues. In 2017, MGX generated group digital revenues of RMIS million, which represented just less than 1% of total group revenues. By 2019, MGX had grown the digital revenue to RM112 million, which represented 5.4% of total group revenues. The expected 2020 digital sales for MGX were close to 10% of group revenues. Given the positive expectations for its 2020 financial year, financial analysts had expected MGX's recorded music division to see positive sales growth during the year. MGX's surprising 12:00 PM Thu 24 Mar ... 72% FM 2022_Coursework (Group).pdf 41 negative earnings guidance on January 12 quickly changed its outlook. MGX disclosed that the music industry and MGX's second half of the year releases had underperformed its expectations, While the publishing division was on track to achieve its goals, MGX's recorded music division revenues were now expected to decline by 6% to 10% from one year ago. The market and investment community reacted swiftly to the news. With trading volume nearly 10 times the previous day's volume, MGX's market capitalisation ended up down by more than 7%. MGX further shocked the investment community with another profit warning just one month later. On February 14, the company announced that the recorded music division's FY2020 revenues would actually decrease by about 15% year-over-year. MGX had based its new dismal forecast on worsening market conditions in Asia Pacific, where it was estimated that the physical music market had declined by 20% in 2020. The investment community punished MGX more severely after this second surprise profit warning and MGX's stock price dropped by another 12%. Malaysian newspapers reported shareholders were increasingly disgruntled with MGX's performance surprises. One shareholder allegedly said, "I think MGX is now very vulnerable to a takeover bid and Eric Neoh is not in any position to defend anything. I think the CFO, Martin Su, has also been tainted because it suggests they did not get to the bottom of the numbers". MGX analyst Ridzuan Ahmad of OMG Securities also decried MGX management's recent news: "It's disastrous. they give themselves a big 6% to 10% range and a month later say it's 15%. They have lost all credibility. I also think the dividend is going to get slashed to about 5 sen". Exhibit 4 contains information on MGX's shareholder profile. EXHIBIT 4 Analysis of Ordinary Sharcholdings on May 18, 2019 Categories of Shareholders Number Percentage Total Shares Held by Percentage this Category Small to 500 shares 9.720 500 1.921.601 0.2 sol to 1,000 shares 4.243 21.8 3,100,499 04 1.001 to 10.000 shares 4,648 23.9 10864,585 14 10,001 to 100.000 shows 434 22 15.502.961 2,0 100,001 to 1,000,000 shares 291 1.5 101,194.240 12.8 Large 1.000.0001 shares and over 123 0.6 660_319.675 83.3 Total 19,459 sharcholders 792.925364 shares Substantial Shareholders No. of Shares Percentage of Capital Held Employees Provident Fund Beard 114,065,999 14.19 Great Eastern Life Assurance (Malaysia) Berhad 74.460,205 9.39 Public blamic Dividend Fund 49,278,472 621 Social Society Organisation 40,609,739 5.12 Vanguard Emerging Markets Stock Index Fund 40,512.803 Vanguard Total International Stock Index Fund 37,310,271 4.71 Prolink Equity Fund 27.687.735 As its financial year came to a close, MGX's internal reports indicated that its February 14 forecast was close to the mark. The recorded music division's revenue was down and profits were negative. The publishing division revenue was essentially flat and its division's margin improved as a result of a smaller cost base. The company expected underlying group camings before interest, taxes, depreciation and amortisation (EBITDA), before extraordinary items to be RM174 million, which exceeded analysts' estimates. Digital revenue had grown by 59% and would represent 10% of revenue. MGX management planned to make a joint announcement with Apple in the next few days that it was going to offer its digital catalogue free from digital rights management and with improved sound quality. The new format would sell at a 30% premium. MGX management expected this move would drive increased digital sales. Management was pleased with the progress of the restructuring programme announced with the January profit warning. The plan was being implemented quicker than expected and, accordingly, more cost savings would be realised in FY2021. The programme was going to cost closer to RM125 million, as opposed to the RM150 million previously announced. Upon completion, the 5.11 12:00 PM Thu 24 Mar 72% FM 2022_Coursework (Group).pdf 41 programme was expected to remove RM110 million from MGX's annual cost base, with the majority of savings coming from the recorded music division. The plan reduced layers in the management structure encouraged the recorded music and publishing divisions to work more closely together for revenue and cost synergies. One headline-worthy change in the reorganisation was the surprise removal of the recorded music division head, Alan Lee, and Erie Neoh taking direct responsibility for the division The Dividend Decision Since the board had already declared an interim dividend of 2 sen per share in November 2019, the question was whether to maintain the past payout level by recommending that an additional 6 sen final MGX dividend be paid. Considering MGX's struggling financial situation, there was good reason to question the wisdom of paying a dividend. Exhibit 5 provides a forecast of the cash flow effects of maintaining the dividend, based on market-based forecasts of performance, Omitting the dividend, however, was likely to send a message that management had lost confidence, potentially accelerating the ongoing stock price decline - the last thing MGX needed to do. (Exhibit 6 depicts trends in the MGX share price from May 2013 to May 2019.) EXHIBIT 5 MGX Projected Statements of Cash Flows Assuming Annual 8 Sen Dividend is Maintained in RM million) For the Years Ended March 31 2020 2021 (Estimate) 2022 (Estimate) Assumptions Revenue growth 1.7 0.7 New equity issued Share repurchases 5.5 00 0.0 Dividends 632 2019 89 00 0.0 0.6 OS 62.0 63.2 2.0799 90.0 1,7813 1.7515 (287.0) 1.793.7 261 (804) 511 6546 Financial Statements Revenue Net income Non-current assets Current operating assets Cash Total assets Debt obligations Otherton-current liabilities Current liabilities Total equity 721 903 193 1,817 1.150 46 1.348 476 821.0 1910 1.488 1.49 1317 S2 1.280 (1151) 8570 1773 1.514 1.494 52 1.299 (1,332) 52 1.289 (726) (287.0) Cash Flow Statement Sources Net income New equity issued Other adjustments to quity Increase in debt obligaties Increase in other non-current liabilities Increase in current liabilities Total sources 90.0 0.6 425 (12.09 (726) $29 1014 (776) 1673 6.7 (681) 249.8) (804) 0.0 00 124.6 0,0 80 53.1 261 0.0 0.0 $22 0.0 100 &$ Uses Increase in non-currentes Increase in current operating at Increase in cash Sharc repurchases Dividends Tocales (19.99 1080 (50.00 0.5 629 1015 (21099 (2482) 140.6 5.5 632 249.8 (34.1) 166.4 (1424) 00 63.2 $3.1 2x 360 (135) 0.0 632 XX ... EXHIBIT 6 MGX Share Price Performance Sen 200 600-V 500+ 400+ 300+ 200+ 100+ 0 May 13 May 14 May-15 May 16 May-17 May-18 May.19 Many believed that music industry economics were on the verge of turning the corner. A decision to maintain the historical & sen dividend would emphasize management's expectation of business improvement despite the disappointing recent financial news. Forecasts for global economic growth continued to be strong (Exhibit 7) and reimbursements to shareholders through dividends and repurchases were on the upswing among media peers (Exhibit 8). EXHIBIT 7 Global Economic Indicators and Projections Annual Growth Rae Real GDP 2018 2019 20201 20211 2018 World 4.9 35 5.0 5.1 3.5 USA 3.2 33 2.6 3.3 3.4 Japan 3.2 15 2.0 2.5 101) Euro Zone 2.1 15 3.0 2.7 25 UK 1.9 2.7 2.7 2.1 21 Inflation 2019 20201 3.9 3.5 1.9 0.1 0.2 2.6 2.1 23 2011 33 23 05 2.4 20 Interest Rate Forecasts (5) 2018 2021E 2018 2019 USA Japan Euro Zone UK 3.51 0.05 2.18 4.80 1. Month Rates 2019 2020 avy 5.20 5.23 0.30 0.74 3.08 4.02 485 5.41 AVE 5.38 1.03 4.37 4.91 424 1.39 318 4.40 10-Year Bond Yields 2020 ave ave 4.29 4,49 1.76 1.62 3.78 3.86 4.50 4.58 2021E avy 5.24 1.98 4.53 5.18 USA Japan Euro Zone UK 2018 33 35 1.5 1.4 Real Economy Forecasts Consumption Expenditure 2019 2020 20211 2018 12 30 31 28 22 2.0 30 02 18 LA 2.2 NA 21 2.5 2.0 41 Wage Growth 2019 20201 39 3.8 08 07 NA NA 4.1 44 2021F 40 12 NA 7 12:01 PM Thu 24 Mar 72% 1 ... . X FM 2022_Coursework (Group).pdf 11 LT PE Katie Market Equity EXHIBIT 8 Comparative Global Media Data Financial Year 2019 Dura Resperating Ne LT Currency will) Marin Profile Margile Bo Equity CNP 2 13 XA Como Ch UND 707 98 0.91 Die USD 202 98 04 CAIC USD 6:27 15.7 1 6.10 Corp USD 2.21 13 10.6 08 Swy Corp JPY 5.436 L7 0.34 Time Tuner 116 Vertige USD 120 100 VIN FUR 2004 213 110 03 Wim Muc USD) 116 H4 11 MEX Cep USD NA NA NA 00 0.16 GON 0.17 NA 0:43 027 NA 22 17.1 49 231 NA 34 RS USD 22 20 NA Star Repurchases Bhd Pald) Curry FY2017 Awra INvidad Velas PY DOES FY2119 EGRE FY2017 FY2018 2019 0 FY2017 FYD FY2019 63 Camera Claugi 61 USD 48 34 1.841 1,00 1.31 56 23 NA 343 383 12 21 31 USD 3 2,420 24 410 CAICO 200 519 USD 09 0.0 1. 10 19 0 0 0 Net Cep 00 00 USD SA 00 2007 202 240 431 03 Sony Cory 8523 416 03 13 wou 22.106 22.97 34.110 Time Tunes 06 06 USD . 05 14 876 Vertigo 2,141 USD 00 06 NA NA 12 IN NA NA 0 TUR NA NA 00 NA 0 0 War Men USD LIS 16 NA 0 0 NA 0. 14 MX Cap UND NA 00 NA 0 00 00 Average vidend padid e collatod as dividende declaro per share Sora you divided by the wagonul pe af the stock en the same year BB D Payot toties led them fillede declared barnet mearly paid for a company ilye. divided by pred for that you FY2018 FY 2010 3 73 54 SS 15 16 0 0 16 30 20 16 17 NA 0 5 53 0 165 0 0 160 Viv As Martin Su navigated his way home, the radio played another hit from a well-known MGX artiste. Despite the current difficulties, he was convinced there was still a lot going for MGX COURSEWORK TASK: Assume that you are Martin Su, the chief financial officer of MGX Group Berhad. Discuss how you would address cache issue raised in the above case. Your report should be divided into both a group component and an individual component Part 1: Group Effort (0%) 1. Introduction etiba