Discuss the characteristics of oligopolistic competition.

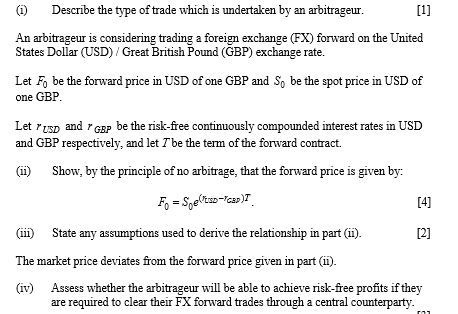

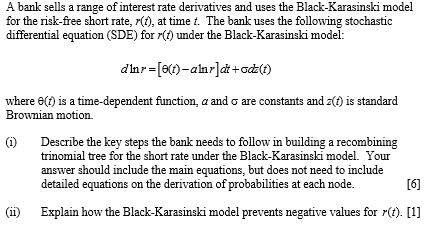

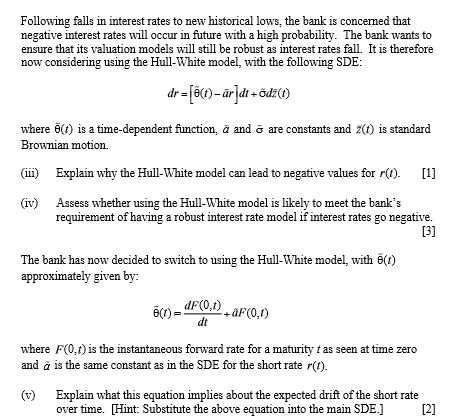

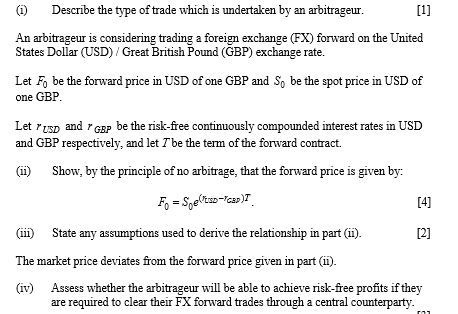

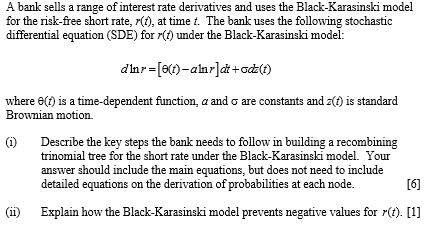

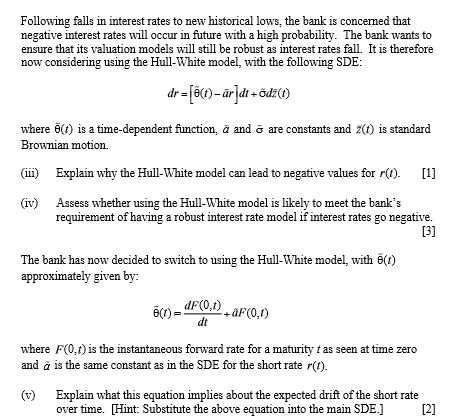

Explain how firm determine profit-maximizing output by comparing marginal revenue and marginal cost. Analyse the effects of government policies such as effective price ceiling, price floor or taxes in a market. Discuss the determinants of price elasticity of demand. Discuss the reason behind zero profits in the long run in perfectly competitive markets. Explain how economic profits or losses motivate firms to enter or exit perfectly competitive market in the long run. Discuss allocation efficiency. Discuss how firms in an oligopoly act interdependently and engage in strategic behaviour. Discuss the law of diminishing marginal utility and explain why it occurs.(1) Describe the type of trade which is undertaken by an arbitrageur. [1] An arbitrageur is considering trading a foreign exchange (FX) forward on the United States Dollar (USD) / Great British Pound (GBP) exchange rate. Let Fo be the forward price in USD of one GBP and So be the spot price in USD of one GBP. Let rasp and / cap be the risk-free continuously compounded interest rates in USD and GBP respectively, and let 7 be the term of the forward contract. (ii) Show, by the principle of no arbitrage, that the forward price is given by: Fo =SpellLD -FeED )T [4] (iii) State any assumptions used to derive the relationship in part (ii). [2] The market price deviates from the forward price given in part (1i). (iv) Assess whether the arbitrageur will be able to achieve risk-free profits if they are required to clear their FX forward trades through a central counterparty.A bank sells a range of interest rate derivatives and uses the Black-Karasinski model for the risk-free short rate, r(1), at time . The bank uses the following stochastic differential equation (SDE) for (?) under the Black-Karazinski model: dinr =(1)-alar]at + ock(1) where o(() is a time-dependent function, a and o are constants and z(() is standard Brownian motion. (i) Describe the key steps the bank needs to follow in building a recombining trinomial tree for the short rate under the Black-Karasinski model. Your answer should include the main equations, but does not need to include detailed equations on the derivation of probabilities at each node. [6] (ji) Explain how the Black-Karasinski model prevents negative values for r((). [1]Following falls in interest rates to new historical lows, the bank is concerned that negative interest rates will occur in future with a high probability. The bank wants to ensure that its valuation models will still be robust as interest rates fall. It is therefore now considering using the Hull-White model, with the following SDE: dr = (8(1)- ardi + odz(i) where o() is a time-dependent function, a and & are constants and Z() is standard Brownian motion. (iii) Explain why the Hull-White model can lead to negative values for r((). [1] (iv) Assess whether using the Hull-White model is likely to meet the bank's requirement of having a robust interest rate model if interest rates go negative. [3] The bank has now decided to switch to using the Hull-White model, with 6(() approximately given by: 8(0) = dF(0,() + GF(0,1) where F(0. () is the instantaneous forward rate for a maturity ? as seen at time zero and a is the same constant as in the SDE for the short rate r((). (v) Explain what this equation implies about the expected drift of the short rate over time. [Hint: Substitute the above equation into the main SDE.] [2]