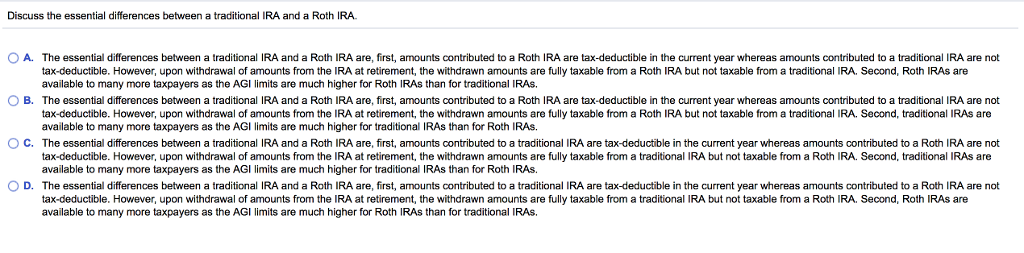

Discuss the essential difference between a traditional IRA and a Roth IRA The essential differences between a traditional IRA and a Roth IRA are, first, amounts contributed to a Roth IRA are tax-deductible in the current year whereas amounts contributed to a traditional IRA are not tax-deductible. However, upon withdrawal of amounts from the IRA at retirement, the withdrawn amounts are fully taxable from a Roth IRA but not taxable from a traditional IRA. Second, Roth IRAs are available to many more taxpayers as the AGI limits are much higher for Roth IRAs than for traditional IRAs. The essential differences between a traditional IRA and a Roth IRA are, first, amounts contributed to a Roth IRA are tax-deductible in the current year whereas amounts contributed to a traditional IRA are not tax-deductible. However, upon withdrawal of amounts from the IRA at retirement, the withdrawn amounts are fully taxable from a Roth IRA but not taxable from a traditional IRA. Second, traditional IRAs are available to many more taxpayers as the AGI limits are much higher for traditional IRAs than for Roth IRAs. The essential differences between a traditional IRA and a Roth IRA are first, amounts contributed to a traditional IRA are tax-deductible in the current year whereas amounts contributed to a Roth IRA are not tax-deductible. However, upon withdrawal of amounts from the IRA at retirement, the withdrawn amounts are fully taxable from a traditional IRA but not taxable from a Roth IRA. Second, traditional IRAs are available to many more taxpayers as the AGI limits are much higher for traditional IRAs than for Roth IRAs. The essential differences between a traditional IRA and a Roth IRA are, first, amounts contributed to a traditional IRA are tax-deductible in the current year whereas amounts contributed to a Roth IRA are not tax-deductible. However, upon withdrawal of amounts from the IRA at retirement, the withdrawn amounts are fully taxable from a traditional IRA but not taxable from a Roth IRA. Second, Roth IRAs are available to many more taxpayers as the AGI limits are much higher for Roth IRAs than for traditional IRAs