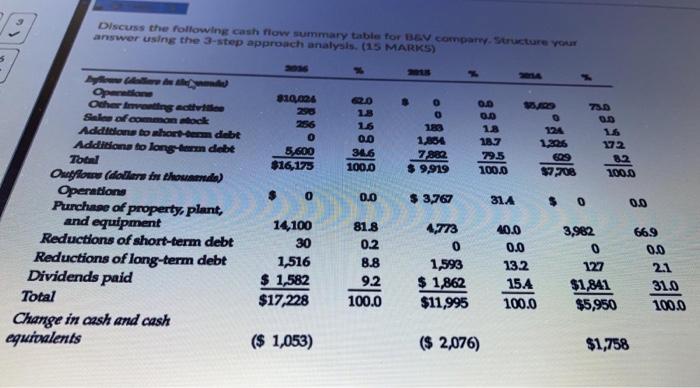

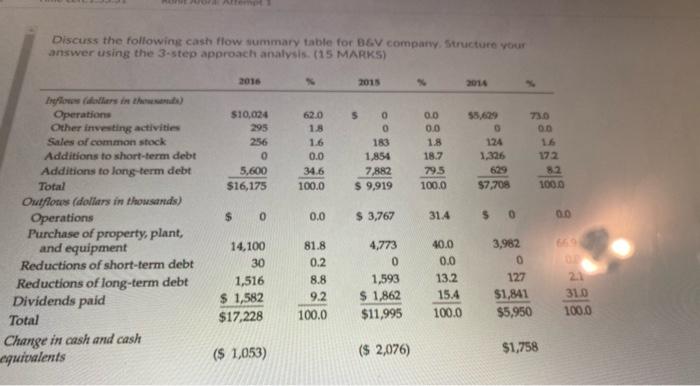

Discuss the following cash flow summary table for EV comparsaructure You answer using the 3-step approach analysis (15 MARKS) 310.024 78 1.8 16 0.0 3L6 100.0 o 5.600 $16,175 0 0 189 1.854 7 882 $ 9,919 0.0 0.0 18 187 79.5 100.0 WIRD 0 124 1.206 172 82 100.0 0 0.0 $ 3,767 31.A 0.0 Opera Other getti Selafcommodock Addison to whort-term debt Addition to long-term debe Tool Outilom (dalla thonda) Operatione Purchase of property, plant, and equipment Reductions of short-term debt Reductions of long-term debt Dividends paid Total Change in cash and cash equivalents 14,100 30 1,516 $ 1,582 $17,228 81.8 0.2 8.8 9.2 100.0 4,773 0 1,593 $ 1,862 $11,995 40.0 0.0 13.2 15.4 100.0 3,982 0 12 $1,841 $5,950 = 669 0.0 21 31.0 100.0 ($ 1,053) ($ 2,076) $1,758 Discuss the following cash flow summary table for 36V company Structure your answer using the 3-step approach analysis (15 MARKS) 2016 2015 2015 00 124 $10,024 295 256 0 5,600 $16,175 62.0 1.8 1.6 0.0 34.6 100.0 $ 0 0 183 1,854 7,882 $ 9,919 0.0 0.0 1.8 18.7 79.5 100.0 172 82 1000 $7,708 $ 0 0.0 $ 3,767 31.4 5 0 0.0 Bielowe daders in the Operations Other investing activities Sales of common stock Additions to short-term debt Additions to long-term debt Total Outflows (dollars in thousands) Operations Purchase of property, plant, and equipment Reductions of short-term debt Reductions of long-term debt Dividends paid Total Change in cash and cash equivalents 14,100 30 1,516 1,582 $17,228 81.8 0.2 8.8 9.2 100.0 4,773 0 1,593 $ 1,862 $11,995 40.0 0.0 13.2 15.4 100.0 3,982 0 127 $1,841 $5,950 21 310 100.0 ($ 1,053) ($ 2,076) $1,758 Discuss the following cash flow summary table for EV comparsaructure You answer using the 3-step approach analysis (15 MARKS) 310.024 78 1.8 16 0.0 3L6 100.0 o 5.600 $16,175 0 0 189 1.854 7 882 $ 9,919 0.0 0.0 18 187 79.5 100.0 WIRD 0 124 1.206 172 82 100.0 0 0.0 $ 3,767 31.A 0.0 Opera Other getti Selafcommodock Addison to whort-term debt Addition to long-term debe Tool Outilom (dalla thonda) Operatione Purchase of property, plant, and equipment Reductions of short-term debt Reductions of long-term debt Dividends paid Total Change in cash and cash equivalents 14,100 30 1,516 $ 1,582 $17,228 81.8 0.2 8.8 9.2 100.0 4,773 0 1,593 $ 1,862 $11,995 40.0 0.0 13.2 15.4 100.0 3,982 0 12 $1,841 $5,950 = 669 0.0 21 31.0 100.0 ($ 1,053) ($ 2,076) $1,758 Discuss the following cash flow summary table for 36V company Structure your answer using the 3-step approach analysis (15 MARKS) 2016 2015 2015 00 124 $10,024 295 256 0 5,600 $16,175 62.0 1.8 1.6 0.0 34.6 100.0 $ 0 0 183 1,854 7,882 $ 9,919 0.0 0.0 1.8 18.7 79.5 100.0 172 82 1000 $7,708 $ 0 0.0 $ 3,767 31.4 5 0 0.0 Bielowe daders in the Operations Other investing activities Sales of common stock Additions to short-term debt Additions to long-term debt Total Outflows (dollars in thousands) Operations Purchase of property, plant, and equipment Reductions of short-term debt Reductions of long-term debt Dividends paid Total Change in cash and cash equivalents 14,100 30 1,516 1,582 $17,228 81.8 0.2 8.8 9.2 100.0 4,773 0 1,593 $ 1,862 $11,995 40.0 0.0 13.2 15.4 100.0 3,982 0 127 $1,841 $5,950 21 310 100.0 ($ 1,053) ($ 2,076) $1,758