Answered step by step

Verified Expert Solution

Question

1 Approved Answer

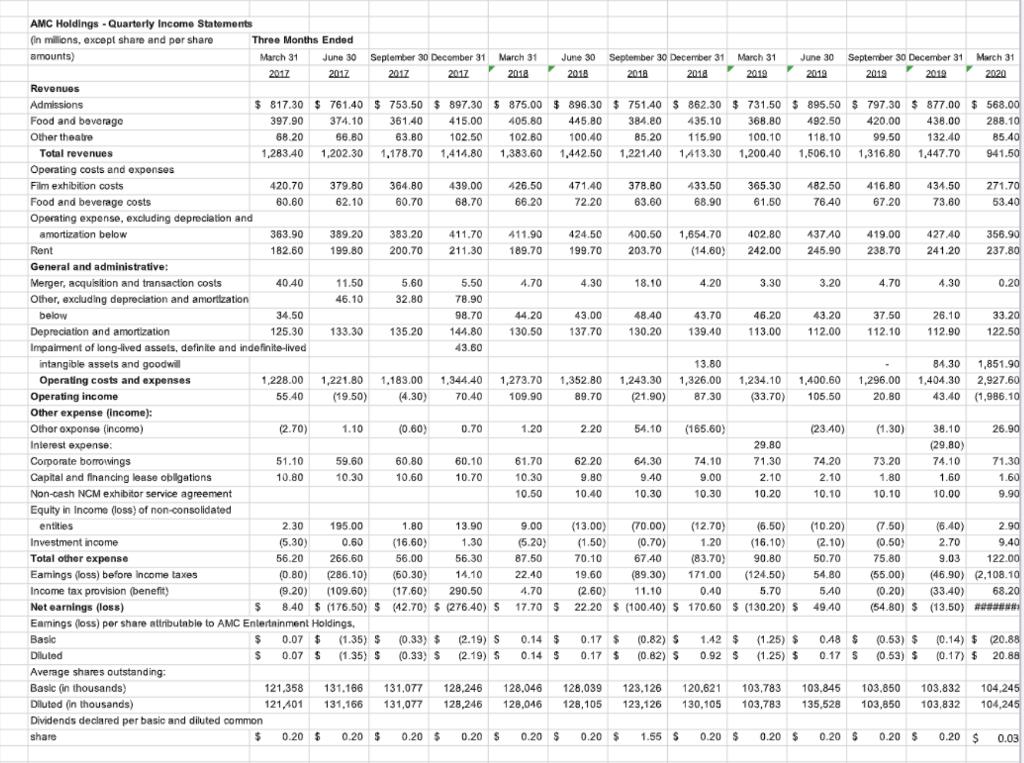

Discuss the patterns you see in the revenue streams. AMC Holdings -Quarterly Income Statements (in milions, except share and per share Three Months Ended amounts)

Discuss the patterns you see in the revenue streams.

AMC Holdings -Quarterly Income Statements (in milions, except share and per share Three Months Ended amounts) March 31 June 30 September 30 Decomber 31 March 31 June 30 September 30 December 31 March 31 June 30 September 30 December 31 March 31 2017 2012 2017 2017 2018 2018 2018 2018 2019 2019 2019 2019 2020 Revenues $ 896.30 $ 751.40 $ 862.30 $ 731.50$ 895.50 $ 797.30 $ 877.00 $ 568.00 $ 817.30 $ 761.40 $ 397.90 $ 753.50 $ 897.30 $ 875.00 Admissions Food and beverage 374.10 361.40 415.00 405.80 445.80 384.80 435.10 368.80 492.50 420.00 438.00 288.10 85.40 941.50 Other theatre 68.20 66.80 63.80 102.50 102.60 100.40 85.20 115.90 100.10 118.10 99.50 132.40 Total revenues 1,283.40 1,202.30 1,178.70 1,414.80 1,383.60 1,442.50 1,22140 1,413.30 1,200.40 1,506.10 1,316.80 1,447.70 Operating costs and expenses Film exhibition costs 420.70 379.80 364.80 439.00 426.50 471.40 378.80 433.50 365.30 482.50 416.80 434.50 271.70 Food and beverage costs 60.60 62.10 60.70 68.70 66.20 72.20 63.60 68.90 61.50 76.40 67.20 73.60 53.40 Operating expense, excluding depreciation and 363.90 411.90 1,654.70 402.80 437A0 427.40 356.90 237.80 amortization below 389.20 383.20 411.70 424.50 400.50 419.00 Rent 182.60 199.80 200.70 211.30 189.70 199.70 203.70 (14.60) 242.00 245.90 238.70 241.20 General and administrative: Merger, acquisition and transaction costs 40.40 11.50 5.60 5.50 4.70 4.30 18.10 4.20 3.30 3.20 4.70 4.30 0.20 Other, excluding depreciation and amortization 46.10 32.80 78.90 33.20 122.50 below 34.50 98.70 44.20 43.00 48.40 43.70 46.20 43.20 37.50 26.10 Depreciation and amortization 125.30 133.30 135.20 144.80 130.50 137,70 130.20 139.40 113.00 112.00 112.10 112.90 Impairment of long-lived assets, definite and indefinite-lived 43.60 1,851.90 2,927.60 intangible assets and goodwill 13.80 84.30 Operating costs and expenses 1,228.00 1,221.80 1,183.00 1,344.40 1,273.70 1,352.80 1,243.30 1,326.00 1,234.10 1,400.60 1,296.00 1,404.30 Operating income 55.40 (19.50) (4.30) 70.40 109.90 89.70 (21.90) 87.30 (33.70) 105.50 20.80 43.40 (1,986.10 Other expense (income): Othor oxponse (incomo) (2.70) 1.10 (0.60) 0.70 1.20 2.20 54.10 (165.60) (23.40) (1.30) 38.10 26.90 Interest expense: 29.80 (29.80) Corporate borrovings Capital and financing lease obllgations 71.30 1.60 51.10 59.60 60.80 60.10 61.70 62.20 64.30 74.10 71.30 74.20 73.20 74.10 10.80 10.30 10.60 10.70 10.30 9.80 9.40 9.00 2.10 2.10 1.80 1.60 Non-cash NCM exhibitor service agreement 10.50 10.40 10.30 10.30 10.20 10.10 10.10 10.00 9.90 Equity in Income (loss) of non-consolidated entities 195.00 (13.00) (70.00) (12.70) (6.50) (10.20) (7.50) (6.40) 2.90 9.40 2.30 1.80 13.90 9.00 Investment income (5.30) 0.60 (16.60) 1.30 (5.20) (1.50) (0.70) 1.20 (16.10) (2.10) (0.50) 2.70 Total other expense 56.20 266.60 56.00 56.30 87.50 70.10 67.40 (83.70) 90.80 50.70 75.80 9.03 122.00 Eamings (loss) before income taxes (0.80) (286.10) (60.30) 14.10 22.40 19.60 (89.30) 171.00 (124.50) 54.80 (55.00) (46.90) (2,108.10 (2.60) 22.20 $ (100.40) $ 170.60$ (130.20) $ (33.40) (54.80) $ (13.50) #### Income tax provision (benefit) (9.20) (109.60) (17.60) 290.50 4.70 11.10 0.40 5.70 540 (0.20) 68.20 Net earnings (loss) 8.40 $ (176.50) $ (42.70) $ (276.40) S 17.70 S 49.40 Eamings (loss) per share attributable to AMC Enlertninment Holdings, Basic $ 0.07 $ (1.35) $ $ 0.07 $ (1.35) S (0.33) $ (0.33) S (0.14) $ (20.88 (0.17) $ 20.88 (2.19) S 0.14 $ 0.17 $ (0.82) $ 1.42 $ (1.25) $ 048 $ (0.53) $ Diluted (2.19) S 0.14 $ 0.17 $ (0.82) $ 0.92 $ (1.25) $ 0.17 S (0.53) $ Average shares outstanding: Basic (in thousands) 121,358 131.166 131,077 128,246 128.046 128,039 123,126 120,621 103,783 103,845 103.850 103,832 104,245 Diluted (in thousands) 121,401 131,166 131,077 128,246 128,046 128,105 123,126 130,105 103,783 135,528 103,850 103,832 104,245 Dividends declared per basic and diluted common share 0.20 $ 0.20 $ 0.20 $ 0.20 $ 0.20 $ 0.20 $ 1.55 $ 0.20 $ 0.20 $ 0.20 $ 0.20 S 0.20 $ 0.03

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Revenue streams are the different ways in which a business earns money Revenue streams are us...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started