Answered step by step

Verified Expert Solution

Question

1 Approved Answer

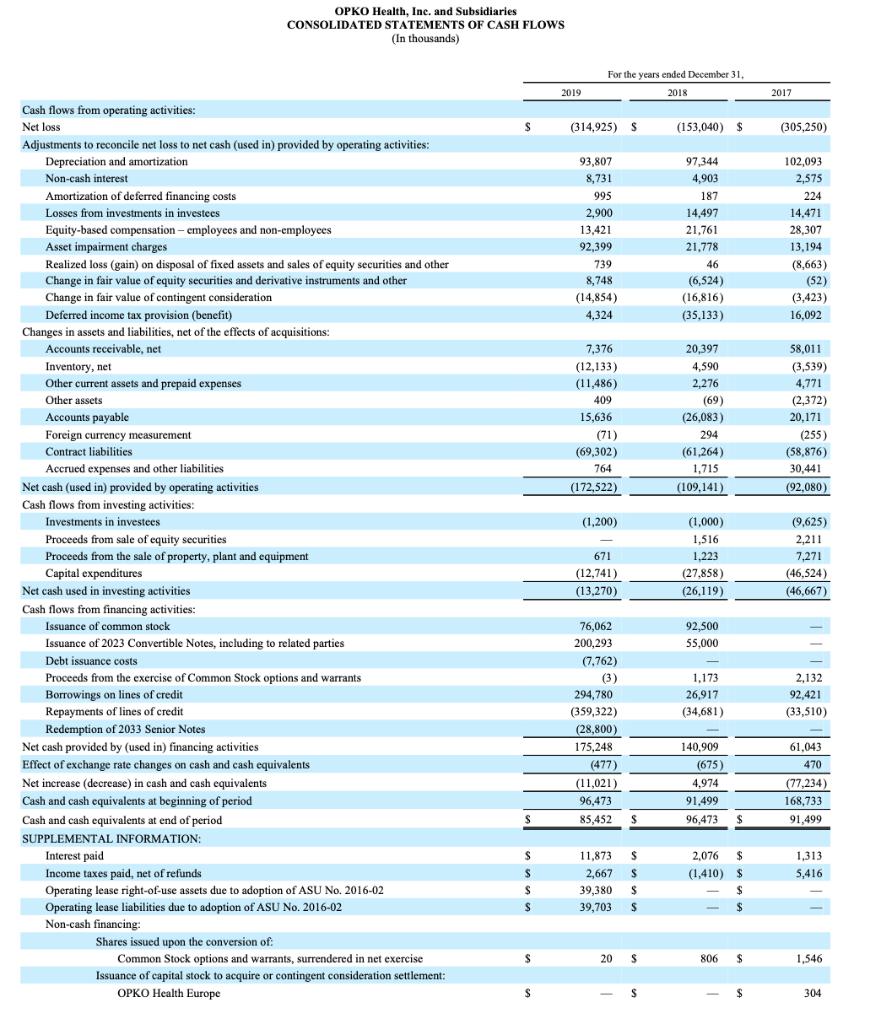

Discuss the statement of Cash Flow for a chosen company, including all three parts of the statement, explain what each section of the statement is

Discuss the statement of "Cash Flow" for a chosen company, including all three parts of the statement, explain what each section of the statement is and what it reports. Make sure and copy and paste an example of a cash flow statement from a 10k or 10Q.

I need to analyze the statement of cash flows and provide a brief explanation of each section of it and change each item from one year to another.

Around 3 and 4 paragraphs, but anything will help and will give good feedback

OPKO Health, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) For the years ended December 31, 2019 2018 2017 Cash flows from operating activities: Net loss (314,925) S (153,040) $ (305,250) Adjustments to reconcile net loss to net cash (used in) provided by operating activities: Depreciation and amortization 93,807 97,344 102,093 Non-cash interest 8,731 4,903 2,575 Amortization of deferred financing costs Losses from investments in investees 995 187 224 2,900 14,497 14,471 Equity-based compensation employees and non-employees 13,421 21,761 28,307 Asset impairment charges 92,399 21,778 13,194 (8,663) (52) Realized loss (gain) on disposal of fixed assets and sales of equity securities and other 739 46 Change in fair value of equity securities and derivative instruments and other 8,748 (6,524) Change in fair value of contingent consideration (14,854) (16,816) (3,423) Deferred income tax provision (benefit) Changes in assets and liabilities, net of the effects of acquisitions: 4,324 (35,133) 16,092 Accounts receivable, net 7,376 20,397 58,011 (3,539) Inventory, net Other current assets and prepaid expenses (12,133) 4,590 (11,486) 2,276 4,771 Other assets 409 (69) (2,372) Accounts payable 15.636 (26,083) 20,171 Foreign currency measurement Contract liabilities (71) 294 (255) (58,876) 30,441 (69,302) (61,264) Accrued expenses and other liabilities 764 1,715 Net cash (used in) provided by operating activities (172,522) (109,141) (92,080) Cash flows from investing activities: Investments in investees (1,200) (1,000) (9,625) Proceeds from sale of equity securities Proceeds from the sale of property, plant and equipment 1,516 2,211 671 1,223 7,271 Capital expenditures (12,741) (27,858) (46,524) Net cash used in investing activities (13,270) (26.119) (46,667) Cash flows from financing activities: Issuance of common stock 76,062 92,500 Issuance of 2023 Convertible Notes, including to related parties 200,293 55,000 (7,762) (3) Debt issuance costs Proceeds from the exercise of Common Stock options and warrants 1,173 2,132 Borrowings on lines of credit 294,780 26,917 92,421 Repayments of lines of credit (359,322) (34,681) (33,510) Redemption of 2033 Senior Notes (28,800) Net cash provided by (used in) financing activities 175,248 140,909 61,043 Effect of exchange rate changes on cash and cash equivalents (477) (675) 470 Net increase (decrease) in cash and cash equivalents (11,021) 4,974 (77,234) Cash and cash equivalents at beginning of period 96,473 91,499 168,733 Cash and cash equivalents at end of period 85,452 96,473 91,499 SUPPLEMENTAL INFORMATION: Interest paid Income taxes paid, net of refunds 11,873 2,076 $ 1,313 2,667 S (1,410) $ 5,416 Operating lease right-of-use assets due to adoption of ASU No. 2016-02 39,380 S 2$ Operating lease liabilities due to adoption of ASU No. 2016-02 Non-cash financing: %24 39,703 $ Shares issued upon the conversion of: Common Stock options and warrants, surrendered in net exercise 20 S 806 24 1,546 Issuance of capital stock to acquire or contingent consideration settlement: OPKO Health Europe $ 304

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Opko has Net loss for all the three years 2017 2018 and 2019 which is more in 2019 when compared to 2018 and 2019 Depreciation and ammortization a non cash expense has reduced from 102093 in 2017 to 9...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started